|

|

|

|

December 25, 2024 -Wednesday |

|

|

|

|

|

|

|

|

MASH GROUP PLC REPORTS INTERIM UNAUDITED FINANCIALS, H1 2018 ENDED 30TH JUNE 2018

Monday 13/08/2018

Mash Group reports record H1/18 revenue, up 99% from H1/17. With H1/18 lending volumes surpassing full year 2017 and a strong EBIT of EUR 5.5 million achieved, Mash Group is extremely well positioned to continue executing on its growth plan, comments CEO Hickson.

FINLAND, Aug 13 (Bernama-GLOBE NEWSWIRE) -- Mash continued to grow rapidly in all markets during the second quarter, achieving record lending volumes and maintaining strong momentum.

Strategic Highlights

- Mash increases the size of its structured financing facility with funds managed by affiliates of Fortress Investment Group LLC (NYSE:FIG), from EUR 120 million to EUR 200 million.

- Mash was recognized as one of the Fintech50, Europe’s leading list of FinTech companies.

- AI Global Media, award CEO Hickson ‘Most Influential FinTech CEO of the year 2018’.

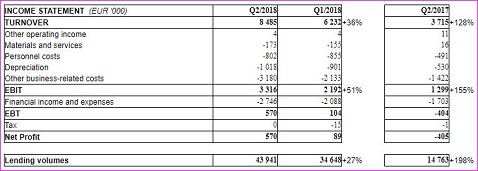

Operational Highlights- Mash continued to grow rapidly in all markets during the second quarter, achieving a record Q2 2018 in terms of lending volumes (+27%) and revenues (+36%) compared to Q1 2018.

- Registered merchants for Mash’s pay later point of sale solution grew 733% in H1 2018.

- The number of new customers grew by 265% compared to H1 2017.

- The group initiated lending in Spain and saw stronger than anticipated demand for Group products.

Financial Highlights- Lending volumes for H1/18 were 77% higher than H2/17 and 170% higher than H1/17.

- Revenues grew by 99% year-on-year and 63% compared to H2/17 to EUR 14.7 million, while EBIT increased 134% and 266%, correspondingly, to EUR 5.5 million.

- The Group’s solidity remains excellent, with equity increasing by 46% in 2018, maintaining a strong equity ratio at 27%, while the total loan portfolio increased by 55%.

- Total assets grew by 55% in 2018 and 84% year-on-year to EUR 205 million.

Values based on pro-forma consolidated figures. For equivalent FAS values see below.

James Hickson, CEO of Mash Group is pleased with the Group’s performance for the first half of 2018: “Our strong momentum has continued in the first half of 2018 thanks to the commitment of our team and partners. During the second quarter, we saw our lending volumes continue to grow as planned, being three times the level compared to the same period last year. We also saw the positive impact of our decision to move to interest-based pricing, with our revenue growing faster than our lending volumes in the second quarter compared to the first”, said Group CEO James Hickson. “This demonstrates the strong competitive position of our lending business model. We anticipate this strong growth to continue in H2 2018, supported by our new customer acquisition channels and going live in the Spanish market in Q2/18.”

“We are also very pleased with our continued focus and investment on in-store pay-later solutions, having grown our merchant base significantly this year and reached record lending volumes at point of sale. Notably, payment channels generated 40% of our new customer base in the first half of the year, underscoring the validity of our strategic decision. We continue to make investments for the long term in this acquisition channel and explore new opportunities to enhance our capability, identify new partners and expand our merchant and consumer offering”

Tommi Lindfors, Chairman of Mash Group added, “The rapid growth trajectory and financial performance during the first half shows the scalability of our business model. The Group set new records not only in terms of business growth (lending volumes and revenues) but also in terms of equity raised and new funding capabilities to support the high growth of our loan portfolio. The fact that we managed to secure EUR 25 million in equity and over EUR 100 million in funding underscores the belief from our new and existing investors in our go-forward business and strategy, which continues to be ratified by our results.”

The Group confirmed that they will communicate Q3 2018 figures on Monday 12th of November.

.jpg)

.jpg)

* The interim pro-forma consolidated figures and comparison figures have been prepared by consolidating Mash Group figures prepared in compliance with Finnish Accounting Standards ("FAS") and Pausa Capital S.à.r.l. prepared in conformity with Luxembourg legal and regulatory requirements and according to generally accepted accounting principles applicable in Luxembourg ("Lux GAAP"). The following transactions between Mash Group and Pausa Capital S.à.r.l. have been eliminated in the pro-forma consolidated figures:- Subordinated Notes issued by Pausa Capital S.à.r.l. and held by Mash Group

- Variable interest recognised by Mash Group related to the Subordinated Notes

- Servicing fees from Mash Group to Pausa Capital S.à.r.l., Mash Finance Oyj being the servicer of the funding facility.

- Debt Collection fees charged by Mash Group to Pausa Capital S.à.r.l., Credito Cobro Oy being one of the collection agencies of the funding facility.

Pausa Capital S.à.r.l is a special purpose vehicle supporting the funding facility provided to Mash Group. According to Group Management, the pro-forma consolidated figures that include Pausa Capital S.à.r.l. provide a more comprehensive view of the financial position and performance of Mash Group, compared to FAS consolidated figures, which can be found below. These figures are unaudited. The reader is advised to refer to the 2017 annual review and financial statements for the latest audited figures and more information about the Group.

Financial Highlights (FAS)- Lending volumes for H1/18 were 77% higher than H2/17 and 170% higher than H1/17.

- Revenues grew by 112% year-on-year and 65% compared to H2/17 to EUR 12.2 million, while EBIT increased 223% and 334%, correspondingly, to EUR 3.4 million.

- The Group’s solidity remains excellent, with equity increasing by 46% in 2018, maintaining a strong equity ratio at 38%, while the total loan portfolio increased by 40%.

- Total assets grew by 47% in 2018 and 70% year-on-year to EUR 144 million.

.jpg)

.jpg) For more information please contact: For more information please contact:

Jonas Lindholm

Mash Group Plc

Tel +358 10 217 1003

investor@mash.com

press@mash.com

Attachments Source : Mash Group Oyj

--BERNAMA |

|

|

|

|

|