KUALA LUMPUR, Nov 14 (Bernama) -- KLCCP Stapled Group recorded a stronger performance in the third quarter ended 30 September 2018, registering its best performance for the year thus far. Despite the challenges in the market, YTD Revenue rose 2.5% underpinned by the higher contribution from the retail and hotel segments whilst Profit Before Tax (PBT) increased 1.2%.

In the quarter ended 30 September 2018, KLCCP Stapled Group recorded positive revenue growth of 2.6% year-on-year (y-o-y) compared to the corresponding quarter in the preceding year with a marginal PBT increase to RM234.5 million, partially offset by higher operating expenses.

KLCCP Stapled Group declared a distribution per stapled security of 8.70 sen, an increase of 1.2% compared to the corresponding quarter in the preceding year, payable on 28 December 2018. This brings the distribution per stapled security to 26.10 sen for the cumulative nine-month period in the year. Based on KLCCP Stapled Group’s last traded share price of RM7.60 as at 30 September 2018, the proposed and declared dividend per Stapled Security translates into a distribution yield of 4.6%, a premium of 51 bps to the 10-year Malaysian Government Securities.

The office segment remained stable, recording a marginal increase in revenue reflecting the full occupancy of Menara ExxonMobil compared to 2017. Enhancement initiatives for all office buildings continue with the “Workplace For Tomorrow” (WFT) project where our tenants can elevate their workspace experience through greater collaboration, connectivity and security. The project is currently 45% completed with full completion targeted for April 2020.

Under the retail segment, Suria KLCC and the retail podium of Menara 3 PETRONAS saw a resilient performance for the third quarter of 2018 as it continued its efforts in reinventing in-store experience to deliver value for retailers and responding to the evolving customer expectations. Suria KLCC welcomed seven new tenants onboard including four new F&B concepts namely, Acme Bar & Coffee, Delirium, Dotty’s and B& by Boost in the third quarter, refreshing its tenants mix, offering unique and bespoke customisation to enhance customer experience and lifestyle. Fashion and lifestyle store, Michael Kors made a grand entry into Suria KLCC to become the third duplex store after Fendi and Bally. Gucci, Puma, Furla and Mothercare also underwent major upgrading and expansion exercise to create a fresher and more appealing store layout to provide premium shopping experience.

The retail segment recorded a YTD revenue increase of 2.1% with PBT growth of 1.2% arising from improved occupancy and higher rental rates from new and renewed leases becoming effective during the period. The Moving Annual Turnover of tenant sales sustained at RM2.6 billion supported by a 6% increase in footfall during the holiday tax period.

The hotel segment recorded YTD revenue growth of 6.5% driven by higher occupancy and average room rate from the newly refurbished rooms, supported by improved demand in the leisure segment. The quarter also saw the hotel registering a lower PBT due to higher depreciation arising from the fully refurbished rooms. During the quarter, Mandarin Oriental, Kuala Lumpur (MOKL) fully completed its guestroom renovation with all guestrooms returned to inventory.

The management services segment comprising facilities management and car parking management services recorded a solid growth in revenue and PBT, registering an increase of 4.4% and 1.4% respectively, attributed to new contracts under facilities management operations and higher car park income from the new operating lots at KLCC Precinct. This segment continues to complement the property portfolio of KLCCP Stapled Group in delivering premium asset management services.

The overall performance of KLCCP Stapled Group for the remainder of 2018 is expected to remain stable as the office segment will continue to be backed by its long-term tenancies. Despite the challenging market conditions, the retail segment is likely to remain resilient while the hotel segment, with the newly completed refurbished rooms is expected to continue to operate in a competitive environment. The Group will continue to focus on strengthening its competitive advantage to sustain growth and generate stable returns to the holders of Stapled Securities.

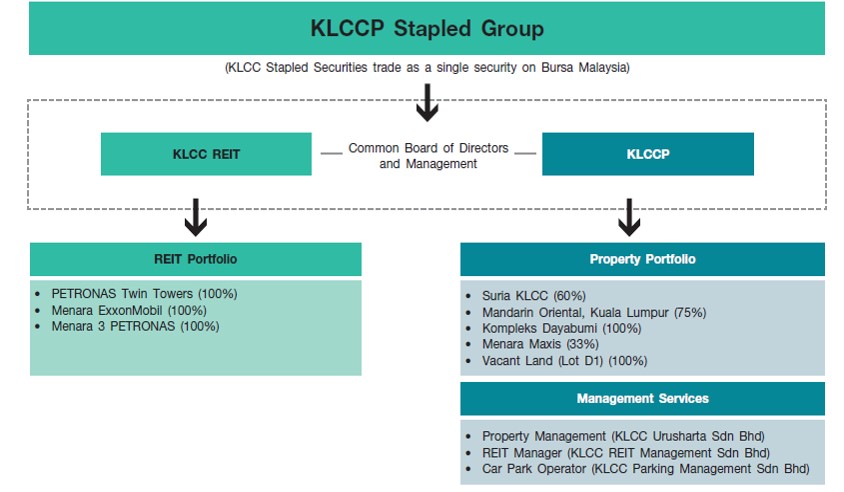

About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013. As a constituent of the FBM KLCI Index, KLCCSS trades under the REIT sector of the Index as a single price quotation.

With a market capitalisation of RM13.7 billion as at September 2018, KLCCP Stapled Group constitutes 33% of the market capitalisation of the Malaysian REIT segment.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly-owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly-owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCC Stapled Group is continuously recognised for its excellence in the industry and remains a constituent of the FTSE4Good Bursa Malaysia Index and the FTSE4Good Emerging Index for demonstrating strong environmental, social and governance practices.

Issued by:

Corporate Communications

Investor Relations and Business Development Department

13 November 2018

SOURCE: KLCC Property Holdings BerhadFOR MORE INFORMATION, PLEASE CONTACT:Name: Ms Bindu MenonHead, Investor Relations and Business Development KLCC Property Holdings BerhadTel: +603 2783 7391Email: bindu@klcc.com.my Name: Ms Yasmin AbdullahCorporate CommunicationsInvestor Relations and Business Development DepartmentKLCC Property Holdings BerhadTel: +603 2783 7584Email: yasmina@klcc.com.my Website: www.klcc.com.my --BERNAMA