Dassault Systèmes Reports First QuarterRevenue and EPS Growth Up Double-digits,Reaffirms 2019 Financial Objectives and Updates for Currency VÉLIZY-VILLACOUBLAY, France, April 24 (Bernama-GLOBE NEWSWIRE) -- Dassault Systèmes (Euronext Paris: #13065, DSY.PA), announces IFRS unaudited financial results for the first quarter ended March 31, 2019. These results were reviewed by the Company’s Board of Directors on April 23, 2019. This press release also includes financial information on a non-IFRS basis with reconciliations included in the Appendix to this communication. All IFRS and non-IFRS figures are presented in compliance with IFRS 15 and IFRS 16 standards.

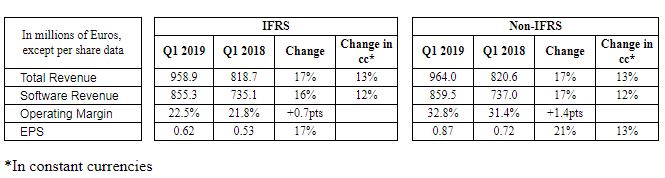

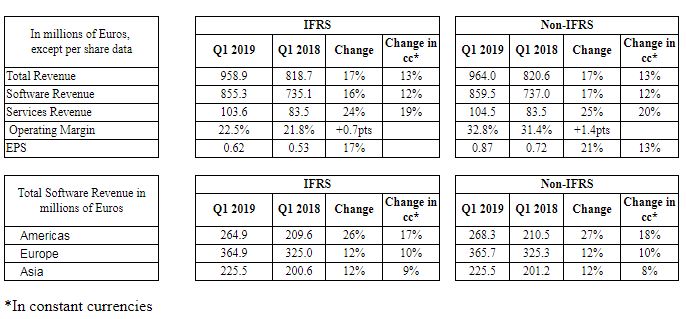

First Quarter Highlights and Financial Summary(Unaudited, all revenue growth at constant currency)

• On an organic basis, Q1 non-IFRS total revenue, software revenue and recurring software revenue up 8%; licenses & other software up 9%, all at constant currency

•

3DEXPERIENCE software revenue up 26% at constant currency

• Cash flow from operations up 20% to €489 million

• Reaffirms FY Objectives & updates for currency: non-IFRS EPS €3.40-3.45, up 9%-11%

• Board of Directors proposes 12% increase in annual dividend to €0.65 for the 2018 FY

• BHP and Dassault Systèmes sign long-term partnership, with BHP adopting the

3DEXPERIENCE platform

Bernard Charlès, Dassault Systèmes’ Vice Chairman and Chief Executive Officer commented, “With the purpose of imagining sustainable innovations capable of harmonizing product, nature and life, the 3DEXPERIENCE platform makes us a partner of choice for the world’s largest businesses and for small and medium-sized firms in all sectors as they transform themselves in the Industry Renaissance underway.“BHP, a world leading resources company and the largest mining company in the world, has decided to establish a long-term partnership with Dassault Systèmes to digitally transform the mining industry, a world first in the sector, using the 3DEXPERIENCE twin to improve sustainability and predictability, and empower the workforce of the future. “In Life Sciences, the largest pharmaceutical companies in the world as well as small innovative research labs, are adopting our solutions, led by BIOVIA, to transform their industry, and drive improved patient outcomes through end to end innovation.“For the mainstream market, we introduced 3DEXPERIENCE.WORKS, a new business applications family that brings the platform advantages to small and mid-sized companies -improved collaboration, manufacturing efficiency, business agility and an empowered workforce. 3DEXPERIENCE.WORKS will leverage our POWER’BY strategy, which is proving very effective in enabling companies to connect their existing software investments to the 3DEXPERIENCE platform, and benefit from the platform’s full innovation capabilities in terms of business operations and business model.”First Quarter Financial Summary

Bernard Charlès, Dassault Systèmes’ Vice Chairman and Chief Executive Officer commented, “With the purpose of imagining sustainable innovations capable of harmonizing product, nature and life, the 3DEXPERIENCE platform makes us a partner of choice for the world’s largest businesses and for small and medium-sized firms in all sectors as they transform themselves in the Industry Renaissance underway.“BHP, a world leading resources company and the largest mining company in the world, has decided to establish a long-term partnership with Dassault Systèmes to digitally transform the mining industry, a world first in the sector, using the 3DEXPERIENCE twin to improve sustainability and predictability, and empower the workforce of the future. “In Life Sciences, the largest pharmaceutical companies in the world as well as small innovative research labs, are adopting our solutions, led by BIOVIA, to transform their industry, and drive improved patient outcomes through end to end innovation.“For the mainstream market, we introduced 3DEXPERIENCE.WORKS, a new business applications family that brings the platform advantages to small and mid-sized companies -improved collaboration, manufacturing efficiency, business agility and an empowered workforce. 3DEXPERIENCE.WORKS will leverage our POWER’BY strategy, which is proving very effective in enabling companies to connect their existing software investments to the 3DEXPERIENCE platform, and benefit from the platform’s full innovation capabilities in terms of business operations and business model.”First Quarter Financial Summary(Unaudited)

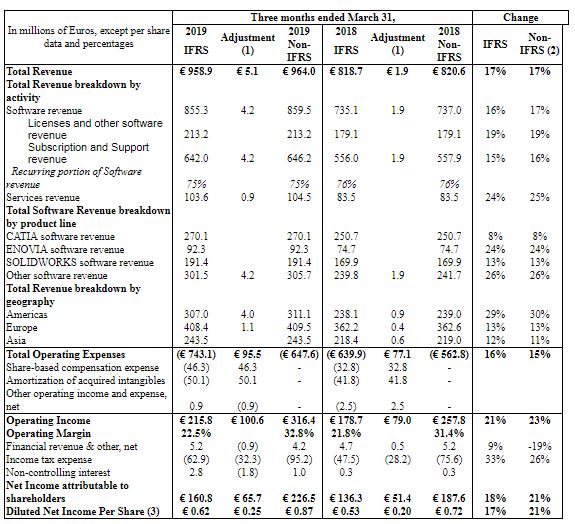

First Quarter 2019 versus 2018 Financial Comparisons

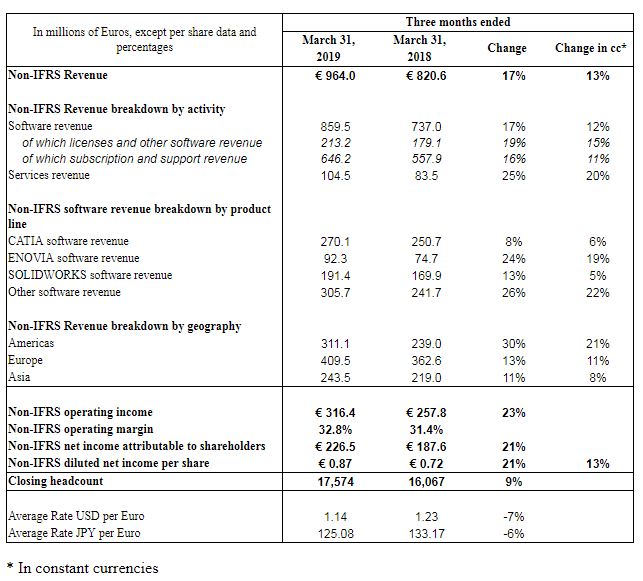

Revenue Review• In constant currencies: Total revenue increased 13% (IFRS and non-IFRS). On an organic basis, non-IFRS total revenue increased 8%.

• Total software revenue increased 12% (IFRS and non-IFRS). Licenses and other software revenue increased 15% (IFRS and non-IFRS). Non-IFRS recurring revenue increased 11% reflecting double-digit growth for both support as well as subscription revenue. On an organic basis, total software revenue increased 8% with licenses and other software revenue growing 9% and recurring software revenue higher by 8%. Services revenue increased 20% in total, 9% on an organic basis and represented about 11% of total revenue (IFRS). (All growth rates at constant currencies.)

• From an industry perspective and in constant currencies: Non-IFRS software revenue increased double-digits in seven of the Company’s eleven industries (regrouped as of January 1, 2019, see Appendix for details): Transportation & Mobility, Aerospace & Defense, Industrial Equipment, Marine & Offshore, High Tech, Life Sciences and Home & Lifestyle.

• On a regional basis and at constant currencies: Americas non-IFRS software revenue increased 18%, reflecting the contribution from acquisitions, large deal activity and strong recurring software growth. Europe non-IFRS software revenue increased 10%, on large deal activity in multiple geographies, most notably Central and Southern Europe. Asia non-IFRS software revenue increased 8% led by China and Asia Pacific, and to a lesser extent by India and Japan. On an organic basis, all three regions reported high single-digit software revenue growth.

•

3DEXPERIENCE software revenue increased 26% at constant currency and represented 23% of related software revenue, led by large

3DEXPERIENCE transactions, both new and expansions, with clients in Industrial Equipment, Transportation & Mobility, Aerospace & Defense and High Tech, among others.

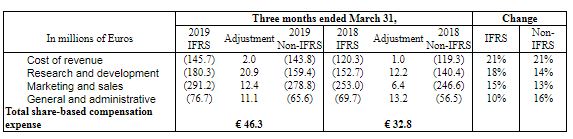

Operating Review• IFRS operating income increased 21%. Non-IFRS operating income increased 23% to €316.4 million. The non-IFRS operating margin was 32.8% in the first quarter, compared to 31.4% in the year-ago quarter, reflecting underlying organic improvement of 210 basis points, currency favorable effect of 50 basis points and estimated acquisition dilution of 120 basis points.

• IFRS effective tax rate was 28.5%, compared to 25.9% in the prior year quarter. On a non-IFRS basis, the first quarter 2019 effective tax rate was 29.7%, compared to 28.8% in the year-ago quarter.

• IFRS diluted net income per share increased 17%. Non-IFRS diluted net income per share increased 21% as reported to €0.87 per share, and increased about 13% at constant currency.

CFO Commentary(In the discussion below figures are on a non-IFRS basis, with revenue growth rates in constant currencies.)

Pascal Daloz, Dassault Systèmes’ Executive Vice President, CFO and Corporate Strategy Officer, commented,

“We checked a number of boxes in the first quarter, leading to double-digit revenue and earnings per share growth exclusive of any currency benefits.•

It was a dynamic quarter with important customers’ business decisions, most notably in Transportation & Mobility, High Tech, Industrial Equipment, Life Sciences and Energy & Materials.•

We had strong momentum with 3DEXPERIENCE, where software revenue increased 26%, on core industries large clients’ adoption.•

Our organic growth continued to strengthen, with recurring software, representing 75% of our total software, up 8% organically.•

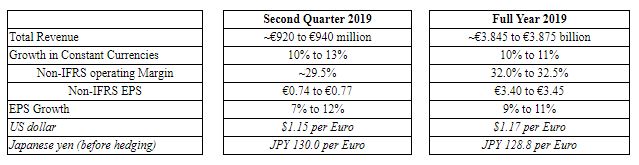

Finally, cash flow from operations set a strong performance, at €489 million, up 20%. “We are reaffirming our constant currency non-IFRS revenue growth range of 10% to 11% for 2019. Our growth outlook for software revenue is similar to 2018, and importantly as we stated at the outset of this year, we see a stronger contribution coming from recurring software revenue.“Based upon this visibility, we are updating our 2019 reported non-IFRS revenue and earnings per share guidance ranges for the better than expected currency upside we saw in the first quarter and updated second quarter currency rate assumptions, leading us to add €35 million at the mid-point to our revenue range, now €3.845 billion to €3.875 billion and 5 cents per share to our earnings per share range, now €3.40 to €3.45.” 2019 Second Quarter and Full Year Financial ObjectivesThe Company’s second quarter and full year 2019 financial objectives presented below are given on an IFRS 15 and IFRS 16, non-IFRS basis and reflect the principal 2019 currency exchange rate assumptions below for the US dollar and Japanese yen as well as the potential impact from additional non-Euro currencies representing about 18% of the Company’s total revenue in 2018:

These objectives are prepared and communicated only on a non-IFRS basis and are subject to the cautionary statement set forth below.

The 2019 non-IFRS financial objectives set forth above do not take into account the following accounting elements and are estimated based upon the 2019 principal currency exchange rates above: contract liabilities write-downs estimated at approximately €12 million; share-based compensation expense, including related social charges, estimated at approximately €121 million and amortization of acquired intangibles estimated at approximately €196 million. The above objectives also do not include any impact from other operating income and expense, net principally comprised of acquisition, integration and restructuring expenses, and impairment of goodwill and acquired intangible assets; from one-time items included in financial revenue; from one-time tax effects; and from the income tax effects of these non-IFRS adjustments. Finally, these estimates do not include any new stock option or share grants, or any new acquisitions or restructurings completed after April 24, 2019.

Implementation of IFRS 16 Leases SummaryAs of January 1

st 2019, Dassault Systèmes adopted the new accounting standard IFRS 16

Leases, under the modified retrospective method. Under this method, the transition effect is accounted for within the consolidated equity at the date of initial application, therefore, there is no adjustment to prior year comparative information.

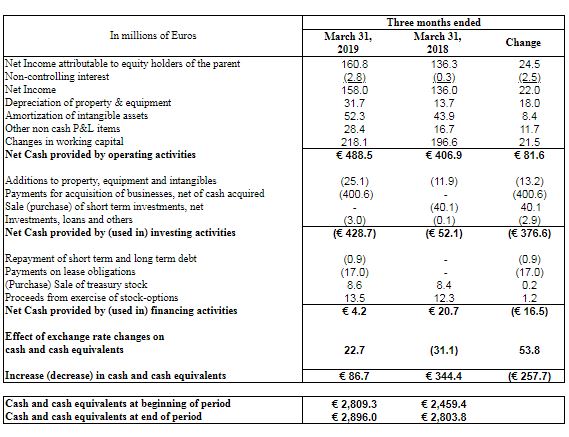

Cash Flow and Other Financial HighlightsNet operating cash flow increased 20% to €488.5 million for the 2019 first quarter compared to €406.9 million in the prior year period principally reflecting growth in net income and working capital improvement.

Dassault Systèmes’ net financial position increased to €1.90 billion at March 31, 2019, compared to €1.81 billion at December 31, 2018, with cash, cash equivalents and short-term investments of €2.9 billion and debt related to credit lines of €1.0 billion.

Cash Dividend Recommendation, Annual Shareholders’ Meeting Date and Filing of Regulatory Annual ReportThe Board of Directors has scheduled the Annual Shareholders’ Meeting for May 23, 2019 and is recommending a dividend per share equivalent to €0.65 per share for the fiscal year ended December 31, 2018, representing an increase of approximately 12% compared to the prior year €0.58 per share. Shares will be traded ex-dividend as of May 29, 2019. Dividends will be made payable on May 31, 2019. These recommendations are subject to approval by shareholders at the Annual Shareholders’ Meeting. For further information, see the Company’s 2018

Document de Référence filed with the French

Autorité des Marchés Financiers (AMF) on March 26, 2019

. The 2018

Document de Référence and an English language translation of this document are available on the Company’s website.

Summary of Recent Business, Technology and Customer Announcements•

BHP and Dassault Systèmes sign long-term partnership, with BHP adopting the 3DEXPERIENCE platform. Dassault Systèmes and BHP have engaged in a long-term strategic partnership to leverage the application of digital technologies to mining. Combining the experience and resources of each company, the ambition is to unlock value by applying technologies proven in other industries to the core mining fundamentals of geoscience and resource engineering. The partnership intends to create a new level of understanding of resource and operational potential, underpinned by both company’s commitments to safety and sustainability.

•

On March 26, 2019, Dassault Systèmes announced that Eurostar has chosen DELMIA Quintiq applications powered by the 3DEXPERIENCE platform to optimize its resource and maintenance planning.

•

On March 12, 2019, Dassault Systèmes announced that it will supply Alstom with its 3DEXPERIENCE platform to accelerate the delivery of 150 tailored trains to its customer, Trenitalia, the Italian national rail operator and part of Ferrovie dello Stato, introducing a new virtual product experience in the rail industry.

•

On March 5, 2019, Dassault Systèmes announced that it had acquired the startup Argosim to leverage proven artificial intelligence technology as the backbone of model-based systems engineering and architecture for embedded systems.

•

On February 28, 2019, ABB and Dassault Systèmes jointly announced a wide spanning global partnership to offer customers in digital industries a unique software solutions portfolio ranging from product life cycle management to asset health solutions. The companies will focus, in a staged approach, on factory automation and robotics, process industry automation, as well as electrification solutions for smart buildings.

•

On February 11, 2019, Dassault Systèmes announced the signing of a definitive agreement to acquire the elecworks electrical and automation design software product line from Trace Software International. Through the agreement, a team of 21 skilled professionals will join Dassault Systèmes. The acquisition of the elecworks assets will streamline and boost Dassault Systèmes’ development of an integrated mechatronics solution on the

3DEXPERIENCE platform to help its SOLIDWORKS customers address electrical design challenges in the development of smart products.

•

On February 7, 2019, Dassault Systèmes announced that Naval Energies, a leader in marine renewables, is using the 3DEXPERIENCE platform to develop new offshore floating wind turbines and Ocean Thermal Energy Conversion (OTEC) turnkey solutions, and drive its leadership in marine renewable energies.

•

On February 6, 2019, Airbus and Dassault Systèmes announced the signing of a five-year Memorandum of Agreement to cooperate on the implementation of collaborative 3D design, engineering, manufacturing, simulation and intelligence applications. Under the agreement, Airbus will deploy Dassault Systèmes’

3DEXPERIENCE platform, which delivers digital continuity, from design to operations, in a single data model for a unified user experience, making digital design, manufacturing and services (DDMS) a company-wide reality for all Airbus divisions and product lines.

•

In February, 2019 Dassault Systèmes unveiled the creation of 3DEXPERIENCE.WORKS, a new portfolio of industry-aware applications on the 3DEXPERIENCE platform that is tailored to the needs of SOLIDWORKS customers and small and midsized companies. 3DEXPERIENCE.WORKS uniquely combines social collaboration with design, simulation and manufacturing ERP capabilities in a single digital environment to help growing businesses become more inventive, efficient and responsive in today’s Industry Renaissance.

•

On January 8, 2019, Dassault Systèmes and Cognata, Ltd. announced that they are partnering to embed Cognata’s Autonomous Vehicle Simulation Suite into Dassault Systèmes’ 3DEXPERIENCE platform. The partnership will provide a first-of-its-kind solution for autonomous vehicle makers to define, test and experience autonomous driving throughout the development cycle within the

3DEXPERIENCE platform. This will make a fully integrated autonomous vehicle development process resulting in faster, more accurate and safer autonomous vehicles on the road.

Today’s Webcast and Conference Call InformationToday, Wednesday, April 24, 2019, Dassault Systèmes will first host from London a webcasted meeting at 8:30 AM London time/9:30 AM Paris Time and will then host a conference call at 9:00 AM New York time/ 3:00 PM Paris time/ 2:00 PM London time. The webcasted meeting and conference call will be available via the Internet by accessing

http://www.3ds.com/investors/. Please go to the website at least 15 minutes prior to the webcast or conference call to register, download and install any necessary software.

Additional investor information can be accessed at

http://www.3ds.com/investors/ or by calling Dassault Systèmes’ Investor Relations at 33.1.61.62.69.24.

Key Investor Relations EventsAnnual Meeting of Shareholders: May 23, 2019

Second Quarter 2019 Earnings Release: July 24, 2019

Third Quarter 2019 Earnings Release: October 24, 2019

Fourth Quarter 2019 Earnings Release: February 6, 2020

Forward-looking InformationStatements herein that are not historical facts but express expectations or objectives for the future, including but not limited to statements regarding the Company’s non-IFRS financial performance objectives, are forward-looking statements. Such forward-looking statements are based on Dassault Systèmes management's current views and assumptions and involve known and unknown risks and uncertainties. Actual results or performances may differ materially from those in such statements due to a range of factors. The Company’s current outlook for 2019 takes into consideration, among other things, an uncertain global economic environment. In light of the continuing uncertainties regarding economic, business, social and geopolitical conditions at the global level, the Company’s revenue, net earnings and cash flows may grow more slowly, whether on an annual or quarterly basis. While the Company makes every effort to take into consideration this uncertain macroeconomic outlook, the Company’s business results, however, may not develop as anticipated. Further, there may be a substantial time lag between an improvement in global economic and business conditions and an upswing in the Company’s business results. The Company’s actual results or performance may also be materially negatively affected by numerous risks and uncertainties, as described in the “Risk Factors” section of the 2018

Document de Référence (Annual Report) filed with the AMF (French Financial Markets Authority) on March 26, 2019 and also available on the Company’s website www.3ds.com.

In preparing such forward-looking statements, the Company has in particular assumed an average US dollar to euro exchange rate of US$1.15 per €1.00 for the 2019 second quarter and US$1.20 per €1.00 for the 2019 second half as well as an average Japanese yen to euro exchange rate of JPY130 to €1.00 for the 2019 second quarter and second half before hedging; however, currency values fluctuate, and the Company’s results of operations may be significantly affected by changes in exchange rates.

Non-IFRS Financial InformationReaders are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. Further specific limitations for individual non-IFRS measures, and the reasons for presenting non-IFRS financial information, are set forth in the Company’s 2018

Document de Référence filed with the AMF on March 26, 2019.

In the tables accompanying this press release the Company sets forth its supplemental non-IFRS figures for revenue, operating income, operating margin, net income and diluted earnings per share, which exclude the effect of adjusting the carrying value of acquired companies’ deferred revenue, share-based compensation expense and related social charges, the amortization of acquired intangible assets, other operating income and expense, net, including impairment of goodwill and acquired intangibles, certain one-time items included in financial revenue and other, net, and the income tax effect of the non-IFRS adjustments and certain one-time tax effects. The tables also set forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information.

This press release constitutes the quarterly financial information required by article L.451-1-2 IV of the French Monetary and Financial Code (Code Monétaire et Financier).

About Dassault SystèmesDassault Systèmes, the

3DEXPERIENCE Company, provides business and people with virtual universes to imagine sustainable innovations. Its world-leading solutions transform the way products are designed, produced, and supported. Dassault Systèmes’ collaborative solutions foster social innovation, expanding possibilities for the virtual world to improve the real world. The Group brings value to over 250,000 customers of all sizes, in all industries, in more than 140 countries. For more information, visit

www.3ds.com.

3DEXPERIENCE, the Compass logo and the 3DS logo, CATIA, SOLIDWORKS, ENOVIA, DELMIA, SIMULIA, GEOVIA, EXALEAD, 3DVIA, BIOVIA, NETVIBES and 3DEXCITE are registered trademarks of Dassault Systèmes or its subsidiaries in the US and/or other countries.(Tables to Follow)

Contacts:

Dassault Systèmes IR Team

François-José Bordonado/Béatrix Martinez

+33.1.61.62.69.24

United States and Canada:

Michele.Katz@3ds.com

Dassault Systèmes Press Contact

Arnaud Malherbe

+33.1.61.62.87.73

arnaud.malherbe@3ds.com

FTI Consulting

Jamie Ricketts

+44.20.3727.1000

Arnaud de Cheffontaines

+33.1.47.03.69.48

APPENDIX TABLE OF CONTENTS(Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.)

Glossary of Definitions

Non-IFRS Financial Information

Condensed consolidated statements of income

Condensed consolidated balance sheets

Condensed consolidated cash flow statements

IFRS – non-IFRS reconciliation

DASSAULT SYSTEMES - Glossary of DefinitionsInformation in Constant CurrenciesWe have followed a long-standing policy of measuring our revenue performance and setting our revenue objectives exclusive of currency in order to measure in a transparent manner the underlying level of improvement in our total revenue and software revenue by type, industry, region and product lines. We believe it is helpful to evaluate our growth exclusive of currency impacts, particularly to help understand revenue trends in our business. Therefore, we provide percentage increases or decreases in our revenue and EPS (in both IFRS as well as non-IFRS) to eliminate the effect of changes in currency values, particularly the U.S. dollar and the Japanese yen, relative to the euro. When trend information is expressed by us "in constant currencies", the results of the "prior" period have first been recalculated using the average exchange rates of the comparable period in the current year, and then compared with the results of the comparable period in the current year.

While constant currency calculations are not considered to be an IFRS measure, we do believe these measures are critical to understanding our global revenue results and to compare with many of our competitors who report their financial results in U.S. dollars. Therefore, we are including this calculation for comparing IFRS revenue figures for comparable periods as well as for comparing non-IFRS revenue figures for comparable periods. All constant currency information is provided on an approximate basis. Unless otherwise indicated, the impact of exchange rate fluctuations is approximately the same for both the Company’s IFRS and supplemental non-IFRS financial data.

Information on Growth excluding acquisitions (“organic growth”)In addition to discussing total growth, we also provide financial information where we discuss growth excluding acquisitions or growth on an organic basis as used alternatively. In both cases, growth excluding acquisitions have been calculated using the following restatements of the scope of consolidation: for entities entering the consolidation scope in the current year, subtracting the contribution of the acquisition from the aggregates of the current year, and for entities entering the consolidation scope in the previous year, subtracting the contribution of the acquisition from January 1st of the current year, until the last day of the month of the current year when the acquisition was made the previous year.

Information on Industrial SectorsOur global customer base includes companies in 11 industrial sectors as of January 1, 2019: with “Core Industries” comprised of Transportation & Mobility; Industrial Equipment; Aerospace & Defense; and a portion of Business Services. “Diversification Industries” includes companies in High-Tech; Life Sciences; Energy & Materials; Home & Lifestyle, Construction, Cities & Territories; Consumer Packaged Goods & Retail, Marine & Offshore and a portion of Business Services.

3DEXPERIENCE Licenses and Software ContributionTo measure the progressive penetration of

3DEXPERIENCE software, we utilize the following ratios: a) for Licenses revenue, we calculate the percentage contribution by comparing total

3DEXPERIENCE Licenses revenue to Licenses revenue for all product lines except SOLIDWORKS and acquisitions (“related Licenses revenue”); and, b) for software revenue, the Company calculates the percentage contribution by comparing total

3DEXPERIENCE software revenue to software revenue for all product lines except SOLIDWORKS and acquisitions (“related software revenue”).

DASSAULT SYSTEMESNON-IFRS FINANCIAL INFORMATION (unaudited; in millions of Euros, except per share data, headcount and exchange rates)

Non-IFRS key figures exclude the effects of adjusting the carrying value of acquired companies’ deferred revenue, share-based compensation expense and related social charges, amortization of acquired intangible assets, other operating income and expense, net, certain one-time financial revenue items and the income tax effects of these non-IFRS adjustments.

Comparable IFRS financial information and a reconciliation of the IFRS and non-IFRS measures are set forth in the separate tables within this Attachment.

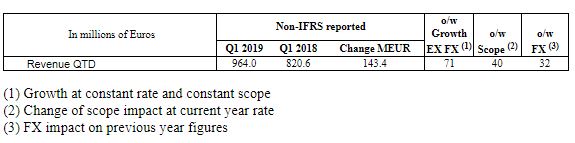

DASSAULT SYSTEMES ACQUISITIONS AND FOREIGN EXCHANGE IMPACT

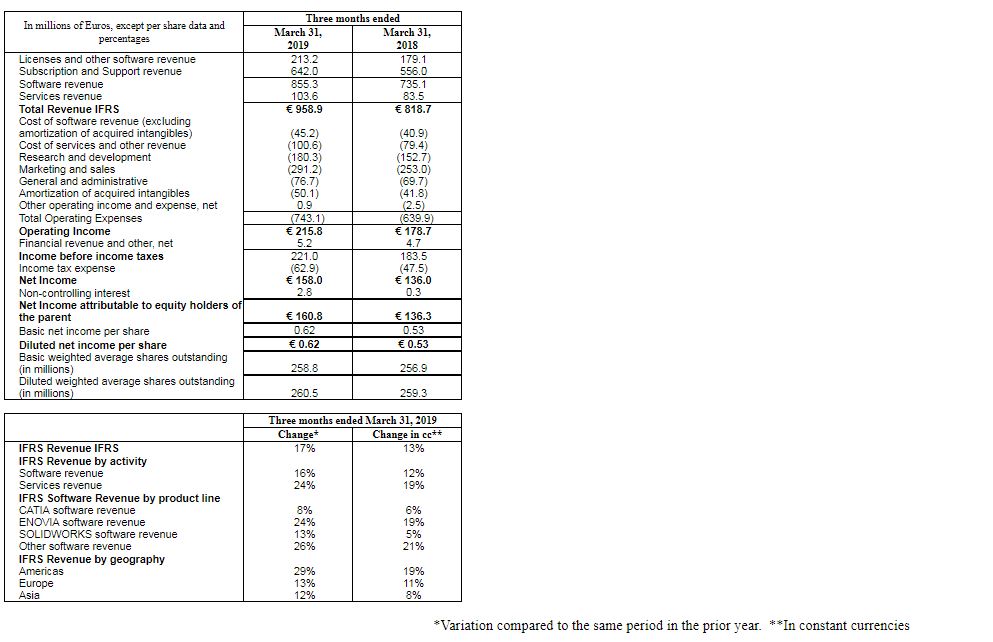

DASSAULT SYSTEMES ACQUISITIONS AND FOREIGN EXCHANGE IMPACT DASSAULT SYSTEMESCONDENSED CONSOLIDATED STATEMENTS OF INCOME (IFRS)

DASSAULT SYSTEMESCONDENSED CONSOLIDATED STATEMENTS OF INCOME (IFRS)(unaudited; in millions of Euros, except per share data)

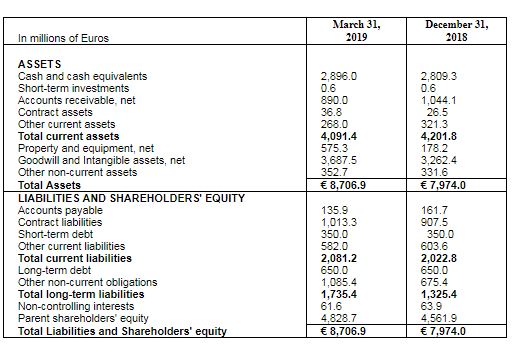

DASSAULT SYSTEMESCONDENSED CONSOLIDATED BALANCE SHEETS (IFRS)(unaudited; in millions of Euros)

DASSAULT SYSTEMESCONDENSED CONSOLIDATED CASH FLOW STATEMENTS (IFRS)

DASSAULT SYSTEMESCONDENSED CONSOLIDATED CASH FLOW STATEMENTS (IFRS)(unaudited; in millions of Euros)

DASSAULT SYSTEMESSUPPLEMENTAL NON-IFRS FINANCIAL INFORMATIONIFRS – NON-IFRS RECONCILIATION

DASSAULT SYSTEMESSUPPLEMENTAL NON-IFRS FINANCIAL INFORMATIONIFRS – NON-IFRS RECONCILIATION(unaudited; in millions of Euros, except per share data)

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. Further specific limitations for individual non-IFRS measures, and the reasons for presenting non-IFRS financial information, are set forth in the Company’s

Document de référence for the year ended December 31, 2018 filed with the AMF on March 26, 2019. To compensate for these limitations, the supplemental non-IFRS financial information should be read not in isolation, but only in conjunction with the Company’s consolidated financial statements prepared in accordance with IFRS.

(1) In the reconciliation schedule above, (i) all adjustments to IFRS revenue data reflect the exclusion of the deferred revenue adjustment of acquired companies; (ii) adjustments to IFRS operating expense data reflect the exclusion of the amortization of acquired intangibles, share-based compensation expense and related social charges, and other operating income and expense, (iii) adjustments to IFRS financial revenue and other, net reflect the exclusion of certain one-time items included in financial revenue and other, net, and (iv) all adjustments to IFRS income data reflect the combined effect of these adjustments, plus for net income and diluted net income per share, certain one-time tax effects and the income tax effect of the non-IFRS adjustments.

(2) The non-IFRS percentage increase (decrease) compares non-IFRS measures for the two different periods. In the event there is non-IFRS adjustment to the relevant measure for only one of the periods under comparison, the non-IFRS increase (decrease) compares the non-IFRS measure to the relevant IFRS measure.

(3) Based on a weighted average 260.5 million diluted shares for Q1 2019 and 259.3 million diluted shares for Q1 2018.

Attachment

Attachment Source: Dassault Systemes SE

Source: Dassault Systemes SE

--BERNAMA