KUALA LUMPUR, May 7 (Bernama) -- Revenue for 1Q 2019 increased 2.4% Year-on-Year (YoY) to RM353.4 million. Correspondingly, Profit Before Tax (PBT) saw a 2.4% rise from RM233.9 million to RM239.6 million. The results reflect stronger contribution by the retail and management services segments.

KLCCP Stapled Group’s distribution to the holders of Stapled Securities rose 1.1% to 8.80sen, reflecting a total dividend payment of RM158.9 million.

OfficeThe office segment with full occupancy at PETRONAS Twin Towers, Menara 3 PETRONAS, Menara ExxonMobil and Menara Dayabumi continued to provide a steady income stream to the Group. The portfolio recorded PBT of RM121.4 million on the back of revenue of RM149.3 million. The increase in PBT was mainly due to the lower expenses and higher recovery of utility charges at Menara ExxonMobil.

RetailSuria KLCC and the retail podium of Menara 3 PETRONAS representing the retail segment of the Group recorded a commendable growth in revenue and PBT of 5.1% and 4.7% respectively. This was attributable to the higher rental rates and improved occupancy during the quarter. This was also contributed by higher income from the mall’s internal digital advertising through its media and advertising screens and panels.

Suria KLCC is currently embarking on a reconfiguration exercise of the 124,000 sq. ft. of space recently vacated by an anchor tenant. The space will be transformed into a new shopping experience in the city with diversified tenant mix including fashion, cosmetics and food and beverage. This transformation is expected to boost income and yield for the retail segment upon completion.

HotelThe hotel segment represented by Mandarin Oriental, Kuala Lumpur saw a significant rise in occupancy as at March 2019 supported by growth in the leisure segment through solid online conversions. However, the decline in revenue of 3.4% is mainly attributable to the lower demand in banqueting, further impacted by the slower meeting activities in the city’s MICE calendar. In addition, the higher depreciation on the fully refurbished rooms impacted PBT, resulting in a marginal loss.

Management ServicesThe management services segment comprising facilities management and car parking management saw an increase in revenue and PBT of 5.2% and 6.9% respectively, contributed by additional revenue from one-off projects under the facilities management operations during the first quarter. KLCC Parking Management Sdn. Bhd. is actively pursuing cashless initiatives to improve customers’ convenience whilst keeping pace with the advancement in technology.

Prospects KLCCP Stapled Group expects the overall performance of the Group to remain stable on the back of long-term office tenancy agreements. The retail segment is expected to improve its competitiveness in the longer term with the tenant reconfiguration exercise whilst the hotel segment will continue to operate under challenging market condition.

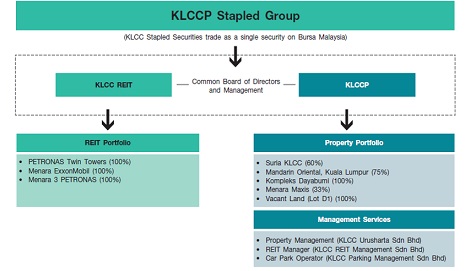

About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013. KLCCSS trades as a single price quotation under the REIT sector on Bursa Malaysia.

With a market capitalisation of RM14.0 billion as at March 2019, KLCCP Stapled Group constitutes 34% of the market capitalisation of the Malaysian REIT segment.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly-owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly-owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCC Stapled Group is continuously recognised for its excellence in the industry and remains a constituent of the FTSE4Good Emerging Index for demonstrating strong environmental, social and governance practices.

Issued by:Corporate CommunicationsInvestor Relations and Business Development Department