• 1Q19 net profit of RM1.19 billion with annualised ROE of 9.2%

• YoY PBT declined from lower operating income due to absence of the RM152 million gain from the CSI sale, and higher operating cost, offset by a reduction in loan loss provisions

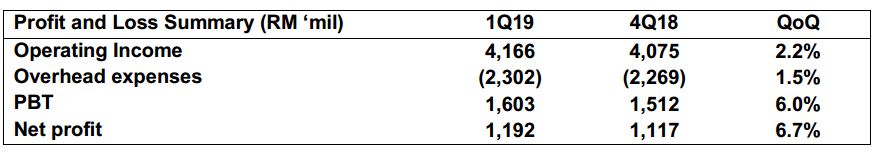

• Better performance QoQ, as PBT grew 6.0% while net profit increased by 6.7% on the back of 2.2% growth in operating income

• Lower loan loss charge of 0.34% in 1Q19 compared to 0.49% in 1Q18

• Robust 7.6% YoY loan growth supported by a 7.7% YoY growth in Malaysia

• Strengthened Group CET1 ratio to 12.8% as at 31 March 2019

KUALA LUMPUR, May 29 (Bernama) --

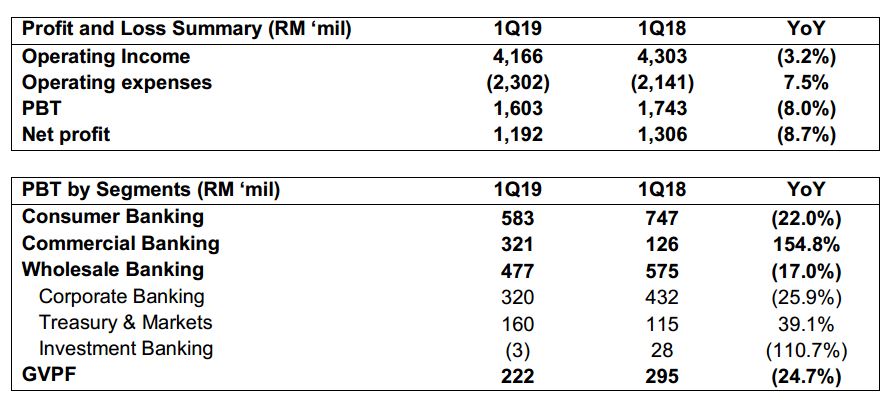

1) Summary CIMB Group Holdings Berhad (“CIMB Group” or the “Group”) today reported a Profit Before Tax (“PBT”) of RM1.60 billion for the first quarter of 2019 (“1Q19”). The 8.0% year-on-year (“YoY”) decline was attributed to a lower operating income and a 7.5% increase in operating expenses, partially offset by a 25.2% YoY decline in loan loss provisions. Operating income was 3.2% lower YoY due to a decline in fee income and the RM152 million gain from the sale of CIMB Securities International (“CSI”) in the prior year’s corresponding period. The Group’s 1Q19 net profit was 8.7% lower YoY at RM1.19 billion, translating to a net Earnings Per Share (“EPS”) of 12.5 sen and an annualised Return On average Equity (“ROE”) of 9.2%.

“Although our PBT declined by 8.0% YoY to RM1.60 billion, the QoQ performance improved by 6.0%. This was achieved amid a challenging operating landscape in our key markets. The QoQ performance was supported by better operating income in 1Q19, driven by stronger performances in Thailand and Singapore. Our ROE came in at 9.2%, and we are pleased that our CET1 strengthened to 12.8% while loan loss charge improved to 0.34%,” said Tengku Dato’ Sri Zafrul Aziz, Group CEO, CIMB Group.

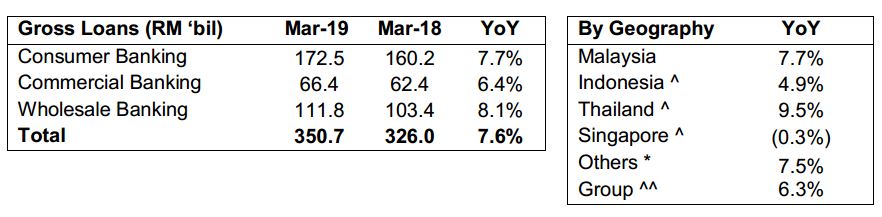

2) CIMB Group 1Q19 YoY Performance CIMB Group’s 1Q19 operating income was 3.2% lower YoY at RM4.17 billion due to a 19.3% decline in non-interest income. This was attributed to the absence of the RM152 million one-off gain from the sale of 50% of CSI in 1Q18 as well as lower bancassurance and wealth management fees, partially offset by a 4.3% YoY growth in net interest income on the back of a 7.6% loans growth. Operating expenses rose 7.5% YoY from incremental investments and Forward23-related expenses, resulting in the Group’s Cost-to-Income Ratio (“CIR”) registering at 55.3% in 1Q19. With a 25.2% YoY decline in loan loss provisions, the Group’s PBT was 8.0% lower YoY at RM1.60 billion.

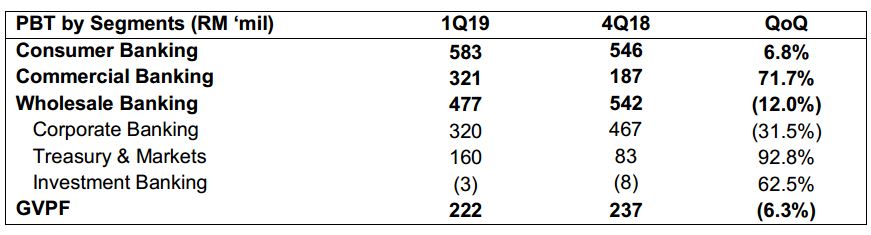

The Group’s Consumer Banking PBT declined 22.0% YoY in 1Q19 to RM583 million from weaker non-interest income attributed to lower bancassurance and wealth management fee income, and higher operating expenses. Commercial Banking PBT rose by 154.8% YoY to RM321 million as a result of its regional recalibration, which brought about a 6.4% YoY loan growth and 82.4% decline in provisions. PBT at the Group’s Wholesale Banking division declined 17.0% YoY to RM477 million as the improved capital market revenue was offset by increased operating expenses and higher loan provisions. Group Ventures & Partnerships and Funding (“GVPF”) is a new segment incorporating mandates for strategic platform partnerships, investments, management of digital assets and markets as well as management of the Group’s shareholders’ funds, previously known as Group Funding. GVPF PBT was 24.7% lower YoY from higher investment expenses and the absence of the RM152 million one-off gain from the sale of 50% of CSI recognised in 1Q18.

Non-Malaysia PBT contribution to the Group rose to 45% in 1Q19 compared to 28% in 1Q18 from stronger performances in Indonesia and Thailand. Indonesia’s PBT increased by 47.0% YoY to RM397 million in 1Q19 due to a 4.9% loan growth, better Net Interest Margin (“NIM”) and lower provisions. Thailand's PBT contribution of RM159 million was 62.2% higher YoY from business improvements and lower provisions. Total PBT contribution from Singapore was 4.2% lower YoY at RM113 million mainly from the deconsolidation of the asset management business.

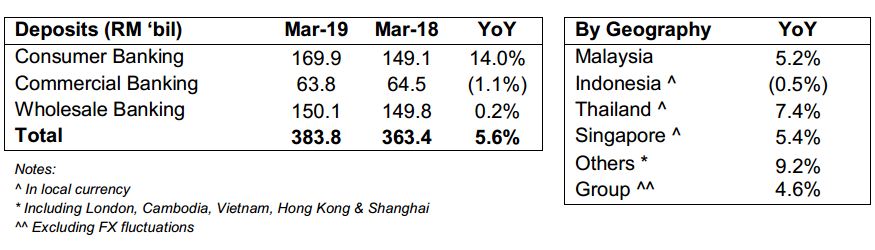

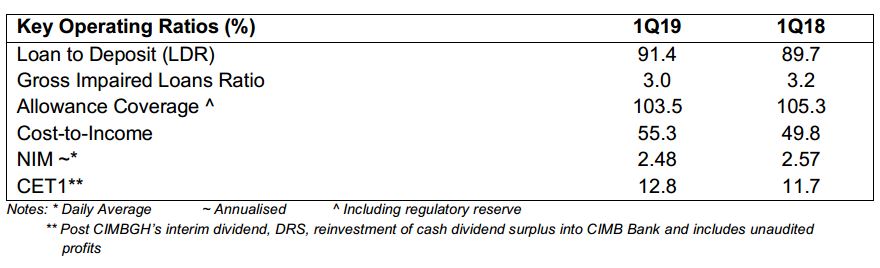

The Group’s total gross loans grew by 7.6% YoY while total deposits were 5.6% higher YoY. The Loan to Deposit Ratio (“LDR”) stood at 91.4%, compared to 89.7% as at end-March 2018. The Group’s gross impairment ratio stood at 3.0% as at end-March 2019, with an allowance coverage of 103.5%. The Group’s CIR stood at 55.3% compared with 49.8% in 1Q18 from higher operating expenses and lower revenues. The Group’s NIM was lower at 2.48% due to spread compression in Malaysia and Thailand.

As at 31 March 2019, CIMB Group’s total capital ratio stood at 16.2% while the Common Equity Tier 1 (“CET1”) capital ratio stood at 12.8%.

3) CIMB Group 1Q19 QoQ Performance

On a quarter-on-quarter (“QoQ”) basis, 1Q19 operating income increased by 2.2% to RM4.17 billion from the 1.0% growth in net interest income and 6.0% improvement in non-interest income. Consumer Banking PBT rose 6.8% QoQ largely due to lower provisions. The 71.7% QoQ improvement in Commercial Banking PBT was attributed to operating income growth coupled with lower costs and provisions. Wholesale Banking PBT declined 12.0% QoQ as the 5.5% operating income growth was offset by higher provisions. GVPF PBT fell 6.3% as operating expenses increased 31.2%. The Group’s 1Q19 net profit was 6.7% higher QoQ mainly from better Commercial and Wholesale operating income and 11.6% lower provisions.

4) CIMB Islamic

4) CIMB Islamic CIMB Islamic’s 1Q19 PBT increased by 19.8% YoY to RM248 million, driven by strong 16.4% operating income growth and 57.6% lower provisions. CIMB Islamic’s gross financing assets rose 16.2% YoY to RM74.0 billion, accounting for 21.1% of the Group’s total gross loans. Total deposits (including investment account) increased by 13.3% YoY to RM81.8 billion.

5) Outlook “We expect the rest of 2019 to remain challenging, amidst fresh trade tensions and other macroeconomic headwinds, coupled with tougher operating conditions in our major markets. However, we are confident that Forward23, our newly launched strategic growth plan, will accelerate growth and future-proof CIMB, particularly through investments in customer experience, our people and technology,” said Tengku Zafrul.

APPENDIX Significant Corporate Developments in 2019 1) Capital Management • On 24 April 2019, CIMB Group issued and allotted 162,964,518 new CIMB Group shares pursuant to the DRS arising from the Second Interim Dividend announcement for FY18. The new shares were listed and quoted on the Main Market of Bursa Securities on 25 April 2019.

• On 15 May 2019, CIMB Bank PLC completed a Tier 2 Subordinated Loan issuance of USD15 million, at 4.5% per annum with a maturity of 10 years callable at the end year 5. The entire Subordinated Loan was subscribed by CIMB Bank via its offshore Labuan branch.

2) Mergers and Acquisitions • On 6 June 2017, CIMB Group Sdn Bhd signed a conditional Share Purchase Agreement with China Galaxy International Financial Holdings Limited (“CGI”) for the sale of 50% interest in CIMB Securities International Pte Ltd (“CSI”). On 6 September 2017, CIMB Group Sdn Bhd signed a conditional Share Purchase Agreement to acquire 100% equity interest in Jupiter Securities for RM55 million cash. On 18 January 2018, the CSI disposal was completed for approximately SGD167 million (approximately RM500 million). On 28 September 2018, the proposed acquisition of Jupiter Securities was completed. On 18 December 2018, CIMB Group Sdn Bhd and CGI subscribed to new shares in CGS-CIMB Holdings, which will be the holding company for the Malaysia stockbroking business of the CGS-CIMB joint venture. On 9 May 2019, High Court of Malaya granted the court orders for the Proposed Business Transfer, effective 1 July 2019.

• On 23 January 2019, CIMB Group Sdn Bhd received approval from the Securities and Exchange Commission of the Philippines to establish its investment banking business via a 60:40 JV (CIMB Bancom Capital Corporation) with Bancom II Consultants, Inc. and PLP Group Holdings, Inc.

• On 23 January 2019, CIMB Group’s wholly-owned indirect subsidiary, CIG Berhad, entered into a Share Purchase Agreement to divest its entire 51% interest in CIMB Howden Insurance Brokers to HBG Malaysia Sdn Bhd for RM59.6 million. On 31 January 2019, the divestment was completed.

3) Others• On 16 January 2019, CIMB Group announced that the President/CEO of CIMB Thai, Kittiphun Anutarasoti would take voluntary personal leave until 31 March 2019 due to personal reasons. On 4 February 2019, the Group Chief Operating Officer of CIMB Group, Omar Siddiq was appointed Acting President and CEO of CIMB Thai effective 30 January 2019. On 29 March 2019, CIMB Group announced the extension of Kittiphun Anutarasoti’s voluntary personal leave until 31 May 2019. On 2 May 2019, Adisorn Sermchaiwong was appointed Acting President and CEO of CIMB Thai, replacing Omar Siddiq from 1 May 2019 to 31 May 2019. On 27 May 2019, the Group announced a further extension of Kittiphun Anutarasoti’s term of voluntary personal leave until further notice.

• On 24 January 2019, CIMB Group announced the retirement of Watanan Petersik and Glenn Muhammad Surya Yusuf from the Board of Directors. On 31 January 2019, Afzal bin Abdul Rahim was appointed as Independent Director and a member of the Group’s Nomination & Remuneration Committee. On 7 May 2019, Didi Syafruddin Yahya and Tongurai Limpiti were appointed as Independent Directors on the Board of Directors. On 9 May 2019, Didi Syafruddin Yahya was appointed as a member of the Nomination & Remuneration Committee.

• On 29 January 2019, Moody’s reaffirmed CIMB Investment Bank’s long term and short term issuer ratings at A3 and P-2 respectively. The outlook is stable.

• On 21 February 2019, CIMB Group announced the appointment of Jefferi M. Hashim as CEO of CIMB Investment Bank effective 1 March 2019, and retirement of Dato’ Kong Sooi Lin effective 1 April 2019.

• On 23 April 2019, Fitch Ratings reaffirmed CIMB Niaga’s long term and short term issuer default rating at BBB- and F3, long term and short term national ratings at AA+ (idn) and F1+(idn) respectively. The outlook is stable.

• On 15 May 2019, CIMB Niaga completed a Cash Dividend distribution of IDR 696,485,584,153 to all its shareholders for FY2018.

Source: CIMB Group

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Suria Zainal

Group Corporate Communications

CIMB Group Holdings Berhad

Tel: +603 - 2261 0638

Email: suriawati.zainal@cimb.com

--BERNAMA