|

|

|

|

November 23, 2024 -Saturday |

|

|

|

|

|

|

|

|

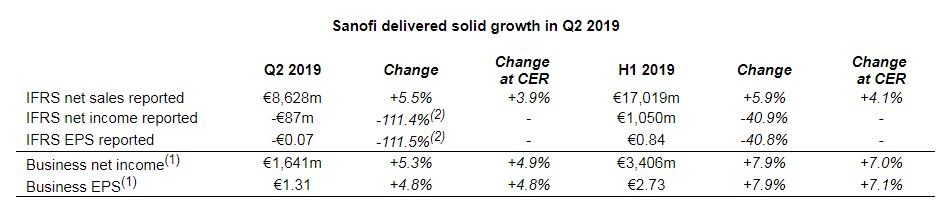

SANOFI DELIVERED SOLID GROWTH IN Q2 2019

Monday 29/07/2019

Paris, July 29 (Bernama-GLOBE NEWSWIRE) --

Sanofi delivered solid growth in Q2 2019  Second-quarter 2019 sales growth(3) driven by Sanofi Genzyme, Sanofi Pasteur and Emerging Markets Second-quarter 2019 sales growth(3) driven by Sanofi Genzyme, Sanofi Pasteur and Emerging Markets- Net sales were €8,628 million, up 5.5% on a reported basis, up 3.9%(3) at CER and up 5.8% at CER/CS(4).

- Sanofi Genzyme sales up 21.8% due to strong launch performance of Dupixent®.

- Vaccines sales increased 24.7% mainly reflecting the recovery and growth of Pentaxim® in China and low basis for comparison.

- CHC sales up 1.1%, as U.S. growth more than offset lower sales in Europe impacted by non-strategic brand divestments.

- Primary Care GBU sales declined 10.4% at CER/CS mainly as a result of lower Diabetes sales.

- Emerging Markets sales(5) grew double-digits (up 10.0%) supported by higher Vaccines and Rare Disease sales.

2019 business EPS guidance revised upward - Q2 2019 business net income increased 5.3% to €1,641 million and 4.9% at CER.

- Q2 2019 business EPS(1) up 4.8% at CER to €1.31.

- Q2 2019 IFRS EPS was -€0.07 (-115.5%) reflecting a €1.8 billion impairment charge mainly related to Eloctate®.

- Business EPS(1) in 2019 is now expected to grow approximately 5% at CER(6) barring unforeseen major adverse events. Applying the average July 2019 exchange rates, the currency impact on 2019 business EPS is estimated to be between 1% and 2%.

Key regulatory milestones achieved in R&D - Isatuximab accepted for review by the FDA and EMA for approval in relapsed/refractory multiple myeloma.

- Libtayo® approved for advanced cutaneous squamous cell carcinoma in the EU.

- Dupixent® recommended by CHMP for atopic dermatitis in adolescents.

- Dupixent® approved in the U.S. for chronic rhinosinusitis with nasal polyposis.

- FDA accepted for review MenQuadfiTM, a meningococcal vaccine candidate.

|

Sanofi Chief Executive Officer, Olivier Brandicourt, commented:

“Sanofi continued its growth phase with a solid business performance in the second quarter, led by the strong launch of Dupixent® driven by the accelerated uptake in atopic dermatitis and asthma in the U.S. Specialty Care and Vaccines were significant contributors across all geographies. Our increased focus in R&D delivered important results with several positive data read-outs and the achievement of regulatory milestones. We are confident in the growth outlook for the year. Consequently, we have revised upward our guidance for full-year business EPS growth to approximately 5%.”

|

(1) In order to facilitate an understanding of operational performance, Sanofi comments on the business net income statement. Business net income is a non-GAAP financial measure (see Appendix 10 for definitions). The consolidated income statement for Q2 2019 is provided in Appendix 3 and a reconciliation of reported IFRS net income to business net income is set forth in Appendix 4;(2) including a €1.8 billion impairment charge mainly related to Eloctate® – see page 12; (3) Changes in net sales are expressed at constant exchange rates (CER) unless otherwise indicated (see Appendix 10); (4) Constant Structure: Adjusted for divestment of European Generics business and sales of Bioverativ products to SOBI; (5) See definition page 9; (6) 2018 business EPS was €5.47.

Investor Relations: (+) 33 1 53 77 45 45 - E-mail: IR@sanofi.com - Media Relations: (+) 33 1 53 77 46 46 - E-mail: MR@sanofi.com

Website: www.sanofi.com Mobile app: SANOFI IR available on the App Store and Google Play

2019 Second-quarter and first-half Sanofi sales Unless otherwise indicated, all percentage changes in sales in this press release are stated at CER(7).

|

In the second quarter of 2019, Company sales were €8,628 million, up 5.5% on a reported basis. Exchange rate movements had a positive effect of 1.6 percentage points mainly driven by the U.S. dollar which largely offset the negative impact from the Argentine Peso and Turkish Lira. At CER, Company sales increased 3.9%. First-half Company sales reached €17,019 million, up 5.9% on a reported basis. Exchange rate movements had a favorable effect of 1.8 percentage points. At CER, Company sales were up 4.1%. Please click here for more details R&D updateConsult Appendix 6 for full overview of Sanofi’s R&D pipelineRegulatory update Regulatory updates since April 26, 2019 include the following: - In July, the U.S. Food and Drug Administration (FDA) accepted for review the Biologics License Application (BLA) for isatuximab for the treatment of patients with relapsed/refractory multiple myeloma (RRMM). The target action date for the FDA decision is April 30, 2020.

- In June, Libtayo® (cemiplimab, collaboration with Regeneron) was approved in the European Union (EU) for the treatment of adults with metastatic or locally advanced cutaneous squamous cell carcinoma (CSCC) who are not candidates for curative surgery or curative radiation.

- In June, the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion for Dupixent® (dupilumab, collaboration with Regeneron) recommending extending its approval in the EU to include adolescents 12 to 17 years of age with moderate-to-severe atopic dermatitis who are candidates for systemic therapy.

- The FDA accepted for review the BLA for Sanofi’s MenQuadfiTM Meningococcal Polysaccharide Tetanus Toxoid Conjugate Vaccine candidate to help prevent meningococcal meningitis. The target action date for the FDA decision is April 25, 2020.

- In June, the FDA approved Dupixent® for the treatment of chronic rhinosinusitis with nasal polyposis (CRSwNP) in adults whose disease is not adequately controlled.

- In May, the European Commission approved Dupixent® for use in adults and adolescents 12 years and older as an add-on maintenance treatment for severe asthma with type 2 inflammation characterized by raised blood eosinophils and/or raised fractional exhaled nitric oxide (FeNO), who are inadequately controlled with high dose inhaled corticosteroid (ICS) plus another medicinal product for maintenance treatment.

- In May, SAR341402 (insulin aspart), a rapid acting insulin, was submitted to the EMA for the treatment of Type I and II diabetes.

- In April, the FDA approved Praluent® (collaboration with Regeneron) to reduce the risk of heart attack, stroke, and unstable angina requiring hospitalization in adults with established cardiovascular disease.

At the end of July 2019, the R&D pipeline contained 83 projects, including 34 new molecular entities in clinical development. 35 projects are in phase 3 or have been submitted to the regulatory authorities for approval.

Portfolio update

Phase 3: - Topline results from three Phase 3 trials of ZynquistaTM (sotagliflozin) in adults with type 2 diabetes from the InSynchrony clinical program were announced on July 26. Given the primary endpoint results of blood sugar control (HbA1c) reduction in the SOTA-CKD3 and SOTA-CKD4 studies, Sanofi provided notice to Lexicon that it is terminating the collaboration to develop, manufacture, and commercialize ZynquistaTM in all ongoing global type 1 and type 2 diabetes programs. At this time, the ongoing Phase 3 clinical trials will continue and there will be no immediate changes. Sanofi has expressed willingness to work with Lexicon to ensure a smooth transition of the studies. Sanofi remains committed to working and supporting the investigators and patients enrolled in the studies while next steps are discussed with Lexicon.

- Results from a phase 3 study evaluating Soliqua®/Suliqua® (insulin glargine 100 Units/mL and lixisenatide) in adults with type 2 diabetes inadequately controlled by GLP-1 receptor agonist (GLP-1 RA) treatments were presented at the American Diabetes Association (ADA) Scientific Sessions in June. The study met the primary objective by demonstrating a statistically superior reduction of average blood sugar level (HbA1c) after 26 weeks, compared with continuing GLP-1 RA treatment.

- Pivotal phase 3 ICARIA-MM trial results were presented at the 2019 American Society of Clinical Oncology (ASCO) Annual Meeting in June and demonstrated that isatuximab added to pomalidomide and dexamethasone (isatuximab combination therapy) showed statistically significant improvements compared to pomalidomide and dexamethasone (pom-dex) alone in patients with relapsed/refractory multiple myeloma (RRMM).

- A phase 3 study evaluating cemiplimab, a PD-1 inhibitor, in adjuvant treatment for Cutaneous Squamous Cell Carcinoma (CSCC) started.

- Dupilumab, moved into phase 3 in Chronic Obstructive Pulmonary Disease (COPD).

- Fitusiran, a siRNA inhibitor targeting AT3, entered phase 3 for pediatric hemophilia.

- Nirsevimab (SP0232, collaboration with Medimmune), a monoclonal antibody, entered phase 3 for respiratory syncytial virus (RSV)

Phase 2: - SAR440340/REGN3500 (collaboration with Regeneron), an investigational IL-33 antibody, met the primary endpoint of improvement in loss of asthma control when comparing monotherapy to placebo in a phase 2 proof-of-concept trial The trial also met a key secondary endpoint, demonstrating SAR440340 monotherapy significantly improved lung function compared to placebo. Patients treated with Dupixent® monotherapy did numerically better than SAR440340 across all endpoints, although the trial was not powered to show differences between active treatment arms. The combination of SAR440340 and Dupixent® did not demonstrate increased benefit compared to Dupixent® monotherapy in this trial.

Phase 1: - A phase 1 trial evaluating SAR441255, a trigonal GLP1R/GIPR/GCGR agonist was initiated.

- SAR441236, a tri-specific neutralizing anti-HIV mAb, entered into phase 1.

An additional seven research projects have been discontinued to enhance the company’s focus on delivering first and best in class medicines

Collaboration

In June, Sanofi and Google announced that they will establish a new virtual Innovation Lab with the ambition to transform how future medicines and health services are delivered by tapping into the power of emerging data technologies. The collaboration aims to change how Sanofi develops new treatments and will focus on three key objectives: to better understand patients and diseases, to increase Sanofi’s operational efficiency, and to improve the experience of Sanofi’s patients and customers.

2019 Second-quarter and first-half financial results(10)

Business Net Income(10)

In the second quarter of 2019, Sanofi generated net sales of €8,628 million, an increase of 5.5% (up 3.9% at CER). First-half sales were €17,019 million, up 5.9% on a reported basis (up 4.1% at CER).

Second-quarter other revenues increased 15.4% (up 9.2% at CER) to €352 million, reflecting the VaxServe sales contribution of non-Sanofi products (€302 million, up 25.0% at CER). First-half other revenues increased 26.5% (up 18.8% at CER) to €674 million driven by the VaxServe sales contribution of non-Sanofi products (€543 million, up 28.0% at CER) and the consolidation of collaboration revenues from Swedish Orphan Biovitrum AB (SOBI).

Second-quarter Gross Profit increased 6.5% to €6,211 million (up 4.7% at CER). The gross margin ratio was 72.0% (71.8% at CER) versus 71.3% in the second quarter of 2018 and benefited from the strong performance of Dupixent®, Vaccines and the divestment of the Generics business in Europe as well as the end of royalty payments to Bristol-Myers Squibb on Plavix® and Avapro® sales. These positive drivers more than offset the negative impact from U.S. Diabetes net price evolution and the decline in Established Rx Products sales in mature markets. In the second quarter of 2019, the gross margin ratio of segments were 75.1% for Pharmaceuticals (up 0.2 percentage points), 67.1% for CHC (down 0.3 percentage points) and 62.3% for Vaccines (up 7.2 percentage points). First-half Gross Profit increased 7.6% to €12,308 million (up 5.5% at CER). In the first half of 2019, the gross margin ratio increased 1.1 percentage point to 72.3% (72.1% at CER) versus the first half of 2018. Sanofi now expects its full-year 2019 gross margin ratio to be between 70% and 71% at CER.

Research and Development (R&D) expenses increased 7.7% to €1,588 million in the second quarter of 2019. At CER, R&D expenses increased 5.4%, due to expansion of phase 3 clinical programs together with investments in Vaccines and Emerging Markets. These increased expenditures were partly offset by lower research costs resulting from the end of the Immuno-oncology agreement with Regeneron. First-half R&D expenses increased 7.9% to €2,973 million (up 5.2% at CER).

Second-quarter selling general and administrative expenses (SG&A) decreased 1.5% to €2,462 million. At CER, SG&A expenses were down 3.1%, reflecting investments in Specialty Care offset by cost efficiency measures notably in Primary Care in Mature Markets and support functions. In the second quarter, the ratio of SG&A to sales decreased 2.1 percentage points to 28.5% compared to the second quarter of 2018. First-half SG&A expenses increased 0.7% to €4,842 million (down 1.3% at CER). In the first half of 2019, the ratio of SG&A to sales was 1.4 percentage points lower at 28.5% compared to the same period of 2018.

Second-quarter operating expenses were €4,050 million, an increase of 1.9% and 0.1% at CER. First-half operating expenses were €7,815 million, an increase of 3.3% and 1.0% at CER.

Second-quarter other current operating income net of expenses was -€91 million versus €189 million in the second quarter of 2018 and included the share of profit to Regeneron of the monoclonal antibodies Alliance. In the second quarter of 2018, this line also included €123 million of capital gains on disposals of some small products and income from a data share agreement. First-half other current operating income net of expenses was -€193 million versus €158 million in the first half of 2018.

The share of profits from associates was €98 million in the second quarter versus €75 million for the same period of 2018, partly driven by the increased contribution of the share of profits in Regeneron. In the first half, the share of profits from associates was €169 million versus €149 million for the same period of 2018.

In the second quarter, non-controlling interests were -€5 million versus -€28 million in the second quarter of 2018, reflecting the end of non-controlling interests related to the Alliance with Bristol-Myers Squibb on Plavix® and Avapro®. First-half non-controlling interests were -€15 million versus -€58 million for the same period of 2018.

(10) See Appendix 3 for 2019 second-quarter consolidated income statement; see Appendix 10 for definitions of financial indicators, and Appendix 4 for reconciliation of IFRS net income reported to business net income.

Second-quarter business operating income increased 3.4% to €2,163 million. At CER, business operating income increased 3.0%. The ratio of business operating income to net sales decreased 0.5 percentage points to 25.1% versus the second quarter of 2018. Over the period, the business operating income ratio of segments were 33.8% for Pharmaceuticals (down 3.7 percentage points), 38.6% for CHC (up 3.0 percentage points) and 27.0% for Vaccines (up 11.0 percentage points). First-half business operating income was €4,454 million, up 7.9% (up 7.1% at CER). In the first half of 2019, the ratio of business operating income to net sales increased 0.5 percentage point to 26.2%.

Net financial expenses were -€85 million in the second quarter versus -€107 million in the same period of 2018, reflecting lower cost of net debt. First-half net financial expenses were -€130 million versus -€105 million in the first half of 2018.

Second-quarter and first-half effective tax rate was stable at 22.0%.

Second-quarter business net income(10) increased 5.3% to €1,641 million and increased 4.9% at CER. The ratio of business net income to net sales decreased 0.1 percentage points to 19.0% versus the second quarter of 2018. First-half 2019 business net income(10) increased 7.9% to €3,406 million and increased 7.0% at CER. The ratio of business net income to net sales increased 0.4 percentage points to 20.0% versus the first half of 2018.

In the second quarter of 2019, business earnings per share(10) (EPS) increased 4.8% to €1.31 on a reported basis and at CER. The average number of shares outstanding was 1,248.5 million versus 1,247.4 million in the second quarter of 2018.

In the first half of 2019, business earnings per share(10) was €2.73, up 7.9% on a reported basis and up 7.1% at CER. The average number of shares outstanding was 1,247.2 million in the first half of 2019 versus 1,247.8 million in the first half of 2018.

Reconciliation of IFRS net income reported to business net income (see Appendix 4)

In the first half of 2019, the IFRS net income was €1,050 million. The main items excluded from the business net income were: - An amortization charge of €1,116 million related to fair value remeasurement on intangible assets of acquired companies (primarily Genzyme: €368 million, Bioverativ: €272 million, Boehringer Ingelheim CHC business: €122 million, Aventis: €107 million) and to acquired intangible assets (licenses/products: €56 million). An amortization charge of €559 million related to fair value remeasurement on intangible assets of acquired companies (primarily Genzyme: €182 million, Bioverativ: €137 million, Boehringer Ingelheim CHC business: €61 million, Aventis: €53 million), and to acquired intangible assets (licenses/products: €26 million) was recorded in the second quarter. These items have no cash impact on the Company.

- An impairment of intangible assets of €1,840 million (of which €1,835 million in the second quarter) mainly related to Eloctate® based on actual sales performance in the U.S. and revision of sales projections.

- Restructuring costs and similar items of €747 million (of which €426 million in the second quarter) mainly related to streamlining initiatives in Europe and the U.S.

- An income of €190 million (of which €130 million in the second quarter) mainly reflecting a decrease of Bayer contingent considerations linked to Lemtrada® (income of €140 million, of which €143 million in second quarter).

- A €905 million tax effect arising from the items listed above, mainly comprising €711 million of deferred taxes generated by amortization and impairments of intangible assets, and €197 million associated with restructuring costs and similar items. The second quarter tax effect was €678 million, including €573 million of deferred taxes generated by amortization and impairments of intangible assets and €102 million associated with restructuring costs and similar items (see Appendix 4).

- A net gain of €317 million mainly related to litigation.

- An income of €53 million net of tax (of which €28 million in the second quarter) related to restructuring costs of associates and joint ventures, and expenses arising from the impact of acquisitions on associates and joint ventures.

(10) See Appendix 3 for 2019 second-quarter consolidated income statement; see Appendix 10 for definitions of financial indicators, and Appendix 4 for reconciliation of IFRS net income reported to business net income. Capital Allocation In the first half of 2019, net cash generated by operating activities was €2,850 million after capital expenditures of €684 million and an increase in working capital of €833 million. Over the period, the dividend paid by Sanofi was €3,834 million, restructuring costs and similar items were €705 million and acquisitions and partnerships net of disposals were €631 million. As a consequence, net debt increased from €17,628 million at December 31, 2018, to €18,705 million at June 30, 2019 (amount net of €6,742 million cash and cash equivalents). Forward-Looking StatementsThis press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are statements that are not historical facts. These statements include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans” and similar expressions. Although Sanofi’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, the uncertainties inherent in research and development, future clinical data and analysis, including post marketing, decisions by regulatory authorities, such as the FDA or the EMA, regarding whether and when to approve any drug, device or biological application that may be filed for any such product candidates as well as their decisions regarding labelling and other matters that could affect the availability or commercial potential of such product candidates, the absence of guarantee that the product candidates if approved will be commercially successful, the future approval and commercial success of therapeutic alternatives, Sanofi’s ability to benefit from external growth opportunities, to complete related transactions and/or obtain regulatory clearances, risks associated with intellectual property and any related pending or future litigation and the ultimate outcome of such litigation, trends in exchange rates and prevailing interest rates, volatile economic conditions, the impact of cost containment initiatives and subsequent changes thereto, the average number of shares outstanding as well as those discussed or identified in the public filings with the SEC and the AMF made by Sanofi, including those listed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in Sanofi’s annual report on Form 20-F for the year ended December 31, 2018. Other than as required by applicable law, Sanofi does not undertake any obligation to update or revise any forward-looking information or statements. Please Click here AppendicesSource: Sanofi

--BERNAMA |

|

|

|

|

|