KUALA LUMPUR, Aug 21 (Bernama) -- KLCCP Stapled Group reported a stronger overall performance for the second quarter ended 30 June 2019, demonstrating continued sustained growth across the office, retail and hotel segments. The Group’s revenue grew 1.8% Year-on-Year (YoY) to RM351.1 million and Profit Before Tax (PBT) increased to RM234.0 million.

With resilient growth in its distributable income, KLCCP Stapled Group proposed a distribution per Stapled Security of 8.80 sen. This brings the distribution per stapled security to 17.60 sen for the first half of 2019, a 1.1% increase YoY.

Stable earnings boosted by retail and hotel segments in Quarter 2, 2019

The office segment comprising PETRONAS Twin Towers, Menara 3 PETRONAS, Menara Dayabumi and Menara ExxonMobil continued to provide a stable income stream to the Group. The growth in PBT by 1.5% is mainly due to higher recovery of utility charges coupled with lower operating expenditure.

During the quarter, PETRONAS Twin Towers and Menara 3 PETRONAS successfully attained the Green Building Index (GBI) Certified Gold Rating and GBI Certified Silver Rating respectively. These achievements are testament to the Group’s efforts and commitment in promoting sustainable development across its operations.

The retail segment represented by Suria KLCC and the retail podium of Menara 3 PETRONAS recorded an impressive growth in revenue of 3.8% YoY and an increase in footfall of 6.3% YoY in spite of 12% of its net lettable area going through an anchor-to-specialty space reconfiguration. Higher rental rates from new and renewed leases and increased revenue from internal digital advertising contributed to the top-line growth. PBT of RM94.9 million was however offset marginally by maintenance works and security upgrades.

During the quarter, Suria KLCC welcomed five new tenants onboard and successfully launched the dedicated luxury Men’s Precinct at level 1, the first of its kind in the country and a one-stop centre for men’s fashion, featuring renowned international brands.

Mandarin Oriental, Kuala Lumpur (MOKL) recorded a significant growth in revenue of 12.5% despite the softer market conditions affecting the hospitality industry. The improved occupancy and increased revenue from banqueting boosted the performance in the hotel segment. The completion of the guestroom renovation since June 2018 has been fueling healthy Revenue Per Available Room (Rev Par) growth for the hotel with a solid increase in Rev Par of 6.0%, strengthening the hotel’s positioning in the luxury hospitality market. However, PBT is still impacted by the higher depreciation cost post refurbishment.

The management services segment which comprises facilities management and car parking management saw a decrease in revenue and PBT of 6.7% and 10.3% respectively. This was mainly due to the higher revenue recorded from one-off projects under the facilities management operations in quarter 2, 2018.

Resilient half year result - on a strong footing to deliver improved performance and growth

The Group’s overall performance for the cumulative six-month period from 1 January to 30 June 2019 saw an increase in revenue of 2.1% to RM704.5 million compared to the first half of 2018 while PBT rose 1.5% YoY to RM473.6 million. This is mainly contributed by the resilience of the retail segment and anchored by the office segment which provides the Group’s stability in performance.

Suria KLCC continues its resilience as a true landmark mall and will see its next boost coming from the anchor-to-specialty reconfiguration of space with the first phase scheduled opening in December 2019. The new retail concept and offerings is expected to enhance yields and customer experience, contributing positively to earnings.

With headwinds in the hospitality industry persisting, the hotel segment will continue to face stiff competition. Nevertheless, MOKL is aggressively strengthening its positioning in the market, leveraging its brand expressions with new improved experiences for its guests.

KLCCP Stapled Group expects the overall performance of the Group for the year to remain stable, underpinned by the long-term office tenancy agreements. The retail segment will continue to be resilient though will be marginally affected by the space reconfiguration exercise whilst the hotel segment is expected to continue to operate in a competitive and challenging market condition.

Chief Executive Officer, KLCC Property Holdings Berhad, Datuk Hashim Wahir said, “We are encouraged by this improved performance in the first half of 2019. Despite the tough operating market conditions, our office, retail and hotel segments remain resilient and we are optimistic that we will be able to sustain this momentum in the coming quarters. Given the strategic plans we have in place, in particular with the transformation in store at Suria KLCC into a new shopping experience, we aim to continue to deliver value and sustainable growth to our stakeholders.”

About KLCCP Stapled Group

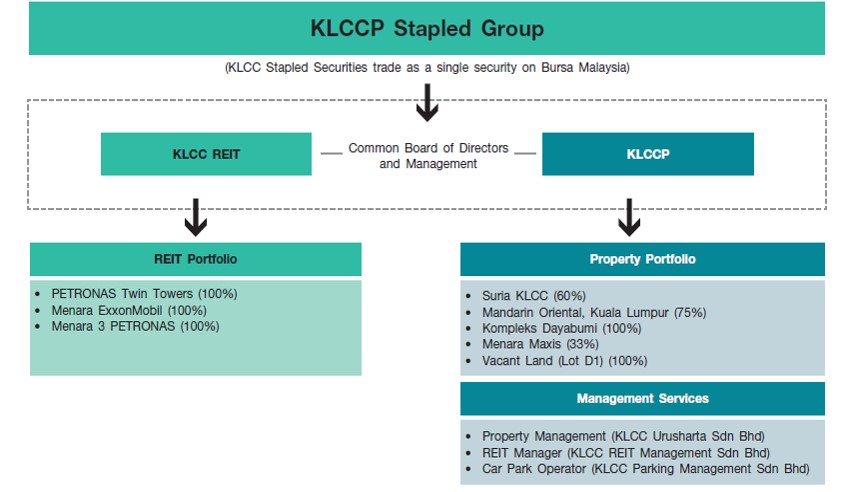

KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013. KLCCSS trades as a single price quotation under the REIT sector on Bursa Malaysia.

With a market capitalisation of RM14.0 billion as at June 2019, KLCCP Stapled Group constitutes 34% of the market capitalisation of the Malaysian REIT segment.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly-owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly-owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCC Stapled Group is continuously recognised for its excellence in the industry and remains a constituent of the FTSE4Good Emerging Index for demonstrating strong environmental, social and governance practices.

Issued by:

Corporate Communications

Investor Relations and Business Development Department

20 August 2019

| Source: KLCC Property Holdings Berhad |

FOR MORE INFORMATION, PLEASE CONTACT:

Head, Investor Relations and

Business Development

Email: bindu@klcc.com.my

Name: Ms. Yasmin Abdullah

Corporate Communications

Investor Relations and Business

Development Department

Tel: +603 2783 7584

Email: yasmina@klcc.com.my--BERNAMA