· 14.5% YoY growth in net profit to RM2.70 billion with annualised ROE of 9.7%

· RM1.51 billion 2Q19 net profit representing 26.6% QoQ growth

· Improved performance driven by stronger operating income (up 4.8% YoY) and reduced loan loss provisions (down 15.7% YoY)

· Lower loan loss charge of 0.35% in 1H19 compared to 0.45% in 1H18

· Steady loan growth of 6.9% YoY driven by above-industry growth in Malaysia

· Group CET1 ratio stood at 12.9% as at 30 June 2019

· Proposed first interim dividend of 14.0 sen or 50.4% payout ratio

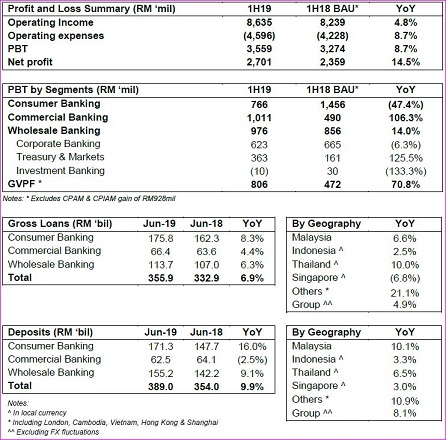

KUALA LUMPUR, Aug 30 (Bernama) -- 1) SummaryCIMB Group Holdings Berhad (“CIMB Group” or the “Group”) on 29 August 2019 reported a Profit Before Tax (“PBT”) of RM3.56 billion for the first half of 2019 (“1H19”). The 8.7% year-on-year (“YoY”) increase was underpinned by stronger operating income and a 15.7% YoY decline in loan loss provisions, with an 8.7% YoY increase in operating expenses. The Group’s 1H19 net profit was 14.5% higher YoY at RM2.70 billion, translating to a net Earnings Per Share (“EPS”) of 28.1 sen and an annualised Return On average Equity (“ROE”) of 9.7%. The Group declared a first interim net dividend of 14.0 sen per share to be paid via cash or an optional Dividend Reinvestment Scheme (“DRS”). The total interim dividend amounts to a payment of approximately RM1.36 billion, translating to a dividend payout ratio of 50.4% of 1H19 profits.

“We are pleased with the 14.5% YoY increase in our net profit to RM2.70 billion underpinned by our above-industry loan growth in Malaysia and better Treasury and Markets income. Malaysia’s PBT improved 5.3% YoY, contributing 67% to the Group’s PBT. Indonesia also posted an encouraging 20.2% YoY growth, supported by its strong Consumer business. Overall, the Group remained resilient with lower loan loss provisions despite challenging external headwinds,” said Tengku Dato’ Sri Zafrul Aziz, Group CEO, CIMB Group.

2) CIMB Group 1H19 YoY PerformanceCIMB Group’s 1H19 operating income was 4.8% higher YoY at RM8.64 billion. Net interest income (“NII”) grew 3.3% YoY from the 6.9% loans growth, while the 8.5% improvement in non-interest income (“NOII”) came largely on the back of better capital market activity in the second quarter of 2019 (“2Q19”). Operating expenses rose 8.7% YoY from incremental investments and Forward23-related expenses, bringing about a Cost-to-Income Ratio (“CIR”) of 53.2% for 1H19. Loan loss provisions declined by 15.7% to RM629 million resulting in an 8.7% growth in the Group’s PBT to RM3.56 billion.

The Group’s Consumer Banking PBT declined 47.4% YoY in 1H19 from a combination of lower operating income, higher operating expenses, increased seasonal provisions and MFRS9 related effects. Commercial Banking PBT rose by 106.3% YoY to RM1.01 billion underpinned by better NII as gross loans grew 4.4%, while provisions were significantly lower. PBT at the Group’s Wholesale Banking division increased by 14.0% YoY to RM976 million as improved capital market activity brought about a 33.7% growth in NOII, partially offset by higher operating expenses and loan provisions. Group Ventures & Partnerships and Funding (“GVPF”) PBT was 70.8% higher YoY from an improved performance in the Group’s fixed income portfolio.

Non-Malaysia PBT contribution to the Group rose to 33% in 1H19 compared to 31% in 1H18. Indonesia’s PBT was 20.2% higher YoY at RM701 million in 1H19 driven by stronger operating income from improved NIM. Thailand's PBT contribution of RM199 million was 16.4% lower YoY from weaker trading income and higher overheads. Total PBT contribution from Singapore was 2.8% higher YoY at RM224 million from better NIM.

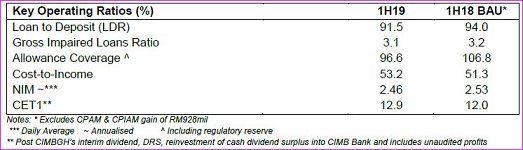

The Group’s total gross loans grew by 6.9% YoY while total deposits were 9.9% higher YoY. The Loan to Deposit Ratio (“LDR”) stood at 91.5%, compared to 94.0% as at end-June 2018. The Group’s gross impairment ratio stood at 3.1% as at end-June 2019, with an allowance coverage of 96.6%. The Group’s CIR stood at 53.2% compared with 51.3% in 1H18 from higher operating expenses. The Group’s NIM was lower at 2.46% mainly from the spread compression in Malaysia.

As at 30 June 2019, CIMB Group’s total capital ratio stood at 16.6% while the Common Equity Tier 1 (“CET1”) capital ratio stood at 12.9%.

3) CIMB Group 2Q19 QoQ Performance

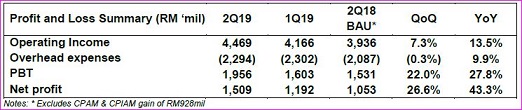

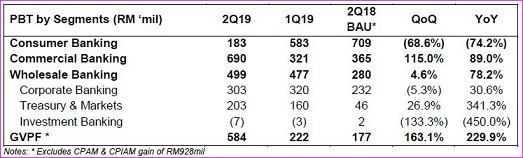

On a quarter-on-quarter (“QoQ”) basis, 2Q19 operating income increased by 7.3% to RM4.47 billion from a 33.3% improvement in NOII. Consumer Banking PBT declined 68.6% QoQ attributed to lower NII and higher seasonal provisions. The 115.0% QoQ improvement in Commercial Banking PBT was underpinned by operating income growth coupled with sharply improved provisions. Wholesale Banking PBT increased by 4.6% QoQ as the 6.0% operating income growth was partially offset by higher provisions. GVPF PBT rose by 163.1% largely driven by the improved performance in the Group’s fixed income portfolio. As a result, the Group’s 2Q19 net profit was 26.6% higher QoQ.

On a YoY basis, the 13.5% growth in Group operating income emanated from the stronger capital market-driven NOII, reflected in the 78.2% YoY jump in Wholesale Banking PBT. Consumer Banking PBT was 74.2% lower YoY from reduced NII, higher operating expenses and provisions. Commercial Banking improved 89.0% YoY from reduced provisions. GVPF improved 229.9% YoY from the improved performance in the Group’s fixed income portfolio in 2Q19, which contributed to the Group’s 43.3% YoY growth in 2Q19 net profit.

4) CIMB Islamic

4) CIMB IslamicCIMB Islamic 1H19 PBT increased by 12.2% YoY to RM557 million, driven by strong 17.1% operating income growth and 19.1% lower provisions. CIMB Islamic’s gross financing assets rose 14.2% YoY to RM76.4 billion, accounting for 21.5% of the Group’s total gross loans. Total deposits (including investment account) increased by 18.0% YoY to RM84.7 billion.

5) Outlook“Our main focus for 2H19 will be on loan growth, revenue generation and asset quality management. Key financial targets are on track as our main markets continue to grow despite the challenging operating environment driven by continued trade tensions. CIMB will continue to invest in its people and technology, particularly in the next two years, to achieve our Forward23 objectives,” said Tengku Zafrul.

Click here for AppendixSource: CIMB Group

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Suria Zainal

Head - Group Corporate Communications

CIMB Group Holdings Berhad

Tel: +603 - 2261 0638

Email: suriawati.zainal@cimb.com

--BERNAMA