(Issued by the President Life Insurance Association of Malaysia, Ms Loh Guat Lan in conjunction with the tabling of Budget 2021 by the Minister of Finance Malaysia scheduled on Friday, 6 November 2020)KUALA LUMPUR, Nov 4 (Bernama) -- In conjunction with the tabling of the 2021 Budget by the Minister of Finance Malaysia, YB Tengku Dato’ Sri Zafrul Aziz, LIAM wishes to reiterate our wish list in promoting financial inclusion and increasing awareness on the importance of financial protection among the Rakyat.

Encouraging Malaysians to plan for their needs for protection, medical and health needs and education of their children The life insurance industry has played a key role in encouraging Malaysians to plan for their needs for protection, medical and health needs and education of their children although there is scope for even greater participation. Based on LIAM’s statistics, in 2019, the life insurance industry paid out a total of RM11.9 billion in benefit payout. A significant part of this payout, totalling RM4.9 billion or 41% in 2019, is for medical insurance.

Recognising the importance of medical insurance in the management of healthcare cost, currently there is a combined tax relief of RM3,000 for medical and education insurance premiums. This amount is actually insufficient in most circumstances as illustrated below:

The cost of medical insurance itself for an average family (2 adults, 3 children) is around RM2,500 per annum at the lower end. This leaves only about RM500 per annum premium for savings towards the education of the 3 children in this typical family.

In order to encourage Malaysians to plan for their needs for protection, medical and health needs and education of their children, we propose the following:

1. To increase the current limit of RM3,000 Tax Relief for Life Insurance premium to RM5,000.

2. To increase the current limit of RM3,000 Tax Relief for Education and Medical insurance premium to RM6,000.

The increase in tax relief would put more money back into the pocket of the Rakyat to relieve them of their financial burden and also to encourage them to have a better financial plan for the future.

Enhancing Long-term Protection and Security for the Rakyat by allowing the utilization of EPF Account 2 for Life Insurance and Medical Insurance As part of the Government’s stimulus package to combat the economic impact of COVID-19, the i-Lestari programme was introduced, allowing withdrawals from the EPF Account 2. EPF members aged 55 years and below and have savings in Account 2 can withdraw up to RM500 a month for a maximum duration of 12 months (April 2020 to March 2021). The objective is to help reduce their financial burden caused by the pandemic.

In these uncertain times, financial well-being should go beyond a strong retirement fund or immediate cash needs.

In the long run, to provide better long-term protection and security to EPF contributors, we propose to allow EPF members to utilise the EPF Account 2 to purchase Life Insurance and Medical and Health Insurance (MHI).

Life insurance provides financial coverage for the family in the event of a death or illness of the family breadwinner. By allowing members to purchase life insurance from Account 2, it will help the members to augment their EPF savings to provide for themselves and their family in times of need.

Extending insurance coverage to B40 through Perlindungan Tenang by providing a 1-to-1 subsidy for the premiums paid by this group. The industry together with its stakeholders have been embarking on various educational and awareness programmes for the Rakyat to encourage the take up of insurance and takaful products among the B40.

On 24 November 2017, Bank Negara Malaysia together with the insurance and takaful industry launched

Perlindungan Tenang - Mampu & Mudah initiative to expand insurance and takaful solutions targeted at the B40 segment. These products are also intended to be suitable for the general public who are not currently covered by any form of insurance or takaful protection. The guiding principles for these products are that they are affordable, easily accessible and provide a simple claims process.

The support from the Government is important to empower the B40 group to take the first step to introduce financial planning in their families.

This support could be in the form of a subsidy for the premium of a

Perlindungan Tenang – Mampu & Mudah plan for a limited period of time, say 2 years. This will provide an opportunity for the B40 group to appreciate the importance of life insurance protection (particularly if the insured member or family receives a claim) and to continue with the insurance after the 2-year period.

Recognising that premium affordability is key, we further propose that the Government provides a 1-to-1 subsidy for the premiums paid by this group of Rakyat therefore bringing down the effective cost to them to below RM0.50 per day. This can be introduced on a phased in approach. For a start, the 1-to-1 subsidy could be given to 10% of the lowest poverty household in Malaysia or those who receive subsidy under the Bantuan Sara Hidup scheme.

This subsidy could be granted on a voluntary basis. For instance, an individual under the Bantuan Sara Hidup scheme can select whether or not he/she wishes to purchase

Perlindungan Tenang – Mampu & Mudah.

If the premium for this individual (and his household) is RM100 per annum; the insurance premium payable by this family will be RM50, and the RM50 could be deducted from the

Bantuan Sara Hidup disbursement. The balance of RM50 will be supported by the Government.

Ultimately, it is hoped that through the Government’s support in pushing the B40 segment to take up

Perlindungan Tenang – Mampu & Mudah protection plans for themselves and their families, it would help to materialize the nation’s aspiration of insuring 75% of the population.

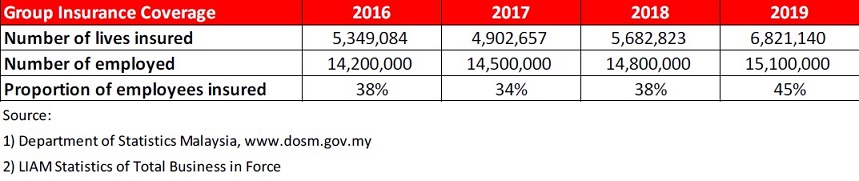

To waive the Service Tax for group insurance schemes by encouraging higher take-up rates by the employers, for the benefit of their employeesBased on published statistics, less than half of employees is being covered by any form of group insurance.

This leaves a significant insurance gap that needs to be closed, in order to extend the insurance safety net to as many Malaysians as possible. This is especially true for the B40 group. Studies have shown that the B40 group is under-protected. In urban areas such as Kuala Lumpur, 88% of non-B40 working age population have insurance and takaful coverage, compared to 30% among the B40. In the less urban states such as Sabah, a similar pattern is observed, with 30% of non-B40 having insurance and takaful relative to 19% among the B40

1.

Typically, group insurance is a cheaper form of insurance compared to individual insurance, due to the associated large underlying volume, and it comes with simpler (or no) underwriting. This is an ideal form of safety net to be extended to the B40 group. Under the existing tax regime, the premiums for group insurance schemes are subject to the Service Tax of 6%. This results in costlier premiums which may not be affordable for some employers, especially the SMEs.

1 “Expanding Insurance and Takaful Solutions for the Underserved Segment” by Bank Negara Malaysia (March 2018)

By having more Malaysians covered under private group medical insurance, this will help to lessen the burden of the public healthcare system, from both financial and capacity angles.

The insurance industry is well-positioned and in full alignment to support the government in providing an insurance safety net for all Malaysians, especially the B40 group. This is in line with the national agenda of increasing insurance penetration rate. To be more effective in playing our part, we seek the government’s agreement to waive the Service Tax on the group insurance scheme. This is critical in encouraging higher take-up rates by the employers, for the benefit of their employees, and in return, help to reduce the burden on the public healthcare system.

Conclusion Moving forward, the life insurance industry continues to play an important role in financial protection, financial accumulation and healthcare funding for the nation. With proper advanced planning and the right tax structure, the private sector and the Rakyat can be incentivised to play a bigger role and form a public-private sector partnership with the Government in sharing the cost of various social economic benefits associated with a developed nation.

About LIAMFormed in 1974, the Life Insurance Association of Malaysia (LIAM) is a trade association registered under the Societies Act 1966. LIAM has a total of 16 members, of which 14 are life insurance companies and 2 life reinsurance companies.

LIAM’s objectives are to promote a progressive life insurance industry; to enhance public understanding and appreciation for life insurance; to upgrade the image and professionalism of the life insurance industry and to support the regulatory authorities in developing a strong industry.

SOURCE: Life Insurance Association of Malaysia

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Ms Nancy Tan

Executive Secretary

Life Insurance Association of Malaysia

Tel: 03 –2691 6628/ 6168

Fax: 03 –2691 7978

Email: liaminfo@liam.org.my

Website: www.liam.org.my

--BERNAMA