KUALA LUMPUR, April 22 (Bernama) -- KLCCP Stapled Group held the KLCC Property Holdings Berhad’s 18

th Annual General Meeting (AGM) and KLCC Real Estate Investment Trust 8

th Annual General Meeting today, presenting to its shareholders the Group’s performance for the financial year ended 31 December 2020. The Meeting was held in a fully virtual mode to ensure the health and safety of all parties in the context of the Covid-19 pandemic. Votes were cast remotely, and the Meeting was broadcasted live to the shareholders.

Highlights of 2020 • Sustained stable performance, recording a revenue of RM1.2 billion and Profit Before Tax* (PBT) of RM772.0 million, on the back of a stable office segment and negatively impacted retail and hotel segments • KLCC REIT proactively secured the extension of the Triple Net lease agreement for PETRONAS Twin Towers and Menara 3 PETRONAS for a further term of 15 years up to 2042 and 2041 respectively, strengthening the stability of the office segment and visibility of future cashflows • Suria KLCC fully completed the 108,000 sq. ft. anchor-to-specialty space reconfiguration and brought on board 40 new tenants during the year, which are first stand-alone stores and exclusive to the mall • KLCC Parking Management successfully transitioned the North West Development car park to fully ticketless and cashless, embracing multiple e-wallet and cashless payment options, creating a safe space for its customers • KLCC Urusharta established the new Integrated Building Command Centre (IBCC) to manage operations and facilities of the assets in real-time, leveraging the power of data • The Group delivered on its commitment to the holders of Stapled Securities with the highest pay-out ratio of 98%, since becoming a stapled security with four interim dividends totaling 30.0 sen per stapled security *excluding fair value adjustment and impairmentA “Reset” Year 2020 was a reset of the whole business ecosystem for KLCCP Stapled Group as we managed risk holistically and embedded controls into our business operations in pivoting to the new normal. The Group focused on its business resilience, prioritising health and safety of its stakeholders and restoring confidence and trust in its tenants, shoppers and hotel guests to return to work, shop and stay. The Group accelerated its digital transformation journey with five identified focused areas to create a delightful experience for stakeholders, improve operational efficiency and spur innovative solutions for market needs. During the year, the Group successfully adopted and transformed its operations towards IoT based communications, enhanced supply chains and new technologies.

Despite the tumultuous year marred by the COVID-19 pandemic, KLCCP Stapled Group sustained a stable performance for the financial year ended 31 December 2020. The Group recorded a revenue of RM1.2 billion, a decrease of 12.9% from 2019 on the back of a resilient office segment. Profit Before Tax (PBT) excluding fair value adjustment and impairment, declined 19.1% to RM772.0 million from RM943.5 million in the previous year.

Notwithstanding the adverse impact on the business, the Group continued to deliver on its commitment to the holders of Stapled Securities, and distributed 98% of its distributable income, bringing the total distribution to 30.0 sen per stapled security for the year. This translates to a full year dividend payment of RM541.6 million.

Office Driven by its solid occupancy with long-term tenancies, the office segment comprising PETRONAS Twin Towers, Menara 3 PETRONAS, Menara ExxonMobil and Menara Dayabumi remained the major revenue driver, contributing 48% of the Group’s total revenue. The segment recorded a PBT of RM396.5 million for the financial year ended on the back of RM591.6 million in revenue. During the year, the office segment retained its full occupancy and continued to drive strength and provide strong asset stability against the backdrop of soft market conditions.

The Group successfully executed the agreements on the extension of Triple Net Lease (TNL) for PETRONAS Twin Towers and Menara 3 PETRONAS for a further 15 years from the expiry in 2027 and 2026 respectively. The TNL extension, involving office spaces of over four million sq. ft. demonstrates our lessee’s commitment, reflecting their requirement of office spaces in the future. This lease extension will reinforce the Group’s stability and further strengthen its positioning in the market, delivering value to the stakeholders in the long-term.

The office segment also saw ExxonMobil Exploration and Production Malaysia Inc. and PETRONAS renew their leases for the next three-year term of the 18-year lease tenure for Menara ExxonMobil.

Retail Suria KLCC and the retail podium of Menara 3 PETRONAS which represent the retail segment, saw revenue contracting 19.6% to RM413.8 million while PBT decreased 26.0% to RM290.4 million attributable to the RM90 million in assistance packages to its affected tenants from quarter two, 2020. Despite the challenging retail landscape, Suria KLCC maintained its resilient occupancy at 97%, owing to the support and collaboration of its tenants.

Suria KLCC successfully completed the anchor-to-specialty reconfiguration exercise, covering an area of 108,000 sq. ft. during the year which houses 72 new tenants, ranging from international and local fashion to F&B and cosmetic brands, comprising first stand-alone stores in Malaysia and exclusive to Suria KLCC

The mall saw an encouraging recovery when it embarked on its experiential reward-driven shopper engagements such as the “The Golden Ticket” and “Unlock A Christmas Surprise” campaigns to encourage shoppers spending and boost footfall. Coupled with the increased customer confidence and relaxation in movement restrictions, December 2020 recorded the highest tenant sales, which saw a recovery of over 80% of sales compared to the preceding year.

Hotel Mandarin Oriental, Kuala Lumpur’s (MOKL Hotel) performance was severely affected by the mandatory closure and prolonged pandemic restrictions between March and December 2020, resulting in a 70.2% decline in revenue compared to the previous year. This was mainly due to reduced occupancy and F&B covers from event postponements and cancelations. However, the hotel capitalised on the domestic leisure business with its “Staycations at MO”, generating revenues and occupancy, driving 65% of total bookings which resulted in weekend occupancy, hitting a high of 44% in December 2020.

In paving the way for the new normal of hotel buffets, Mosaic restaurant became the first in the city to introduce the assisted buffet arrangement concept. This unique concept allowed guests to window-shop their preferred meals and saw great success for its F&B revenues. The hotel’s innovativeness and strong focus saw its online MO-shop significantly multiply its F&B revenue when it extended its signature food offerings to be delivered directly to the doorstep of guests.

Management Services The management services segment, which comprises facility management and car parking management services recorded a 22% year-on-year increase in revenue from the new business approach in facilities management services. However, PBT registered a decline from lower carpark income as a result of reduced transient parking due to the varying stages of COVID-19 movement restrictions.

In elevating the quality of services to our tenants and operational efficiency of our assets, our facility management company, KLCC Urusharta Sdn Bhd successfully executed the pilot launch of the new IBCC which enables the operations and management of multiple buildings and services on a real-time dashboard. With the cloud based IoT platform, leveraging data analytics, the Group will be able to improve energy efficiency and proactively manage the comfort levels of our tenants.

KLCC Parking Management Sdn Bhd (KPM) successfully transitioned the 5,092 car park bays at the KLCC Northwest Development car park to fully ticketless and cashless, using smart parking system solutions. KPM also recently launched its Premium Parking area comprising 49 bays, equipped with 20 electric vehicle chargers, CCTV surveillance, emergency call points and security patrolling for the added convenience and safety of its customers, further elevating the parking experience.

Sustainability at the Forefront With the growing awareness and greater emphasis on sustainability, the Group stayed focused on its efforts to pursue its sustainability agenda, embedding sustainability in all aspects of its business. In striving for improved environmental practices and operational sustainability, MOKL Hotel successfully eliminated 68% of single-use plastic throughout its operations while Suria KLCC recycled over 90 metric tonnes of food waste during the year from its food courts.

In line with the objective to create, deliver and share value with stakeholders, the Group supported various Covid-19 humanitarian efforts during the year and spent RM95.3 million in community investment and various retail tenant assistance. The Group also partnered with the Ministry of Domestic Trade and Consumer Affairs to launch the “Buy Malaysian Product” campaign to provide some relief to local entrepreneurs during the difficult period and help revive the domestic economy.

The Group made significant achievement in reinforcing its commitment to zero tolerance to bribery and corruption when KLCC Property Holdings Berhad, KLCC REIT Management Sdn Bhd, KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd successfully attained the Anti-Bribery Management System, ISO 37001:2016 certifications. The Group was among the top 80 companies and the first real estate investment and management company in Malaysia to have received this certification.

Together, Looking Beyond Despite the challenges and the uncertainties, the Group remains hopeful for a better year in 2021, given the roll-out of vaccines which will help boost consumer and business sentiment. However, due to the prolonged Covid-19 pandemic, the retail and hotel segment will continue to operate in a challenging environment, whilst the office segment is expected to remain stable backed by its long-term, locked-in leases.

The Group will continue to rebuild trust and stakeholder confidence through its strong focus on health and wellbeing of tenants and customers, ensuring long-term sustainability as it continues to streamline its operations, embracing digitalisation through its 4-year Digital Roadmap, focused on delivering customer experiences as a value proposition.

“I hope that 2021 will be a better year and as the vaccine rollout will offer great hope to turn the tide of the pandemic and get us back to some level of normalcy in our daily lives.” “We at KLCCP Stapled Group will remain committed in positioning KLCC as The Place, progressively adapting to the new norm and reimagining the experiential customer lifestyle while embracing digital in meeting the future needs. The Group will also continue to explore opportunities and flexibilities in responding to changes in our operational and business landscape in strengthening our resilience and long-term sustainability.” Datuk Hashim Wahir, Chief Executive Officer About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013. As a constituent of the FBM KLCI Index, KLCCSS trades under the REIT sector of the Index as a single price quotation.

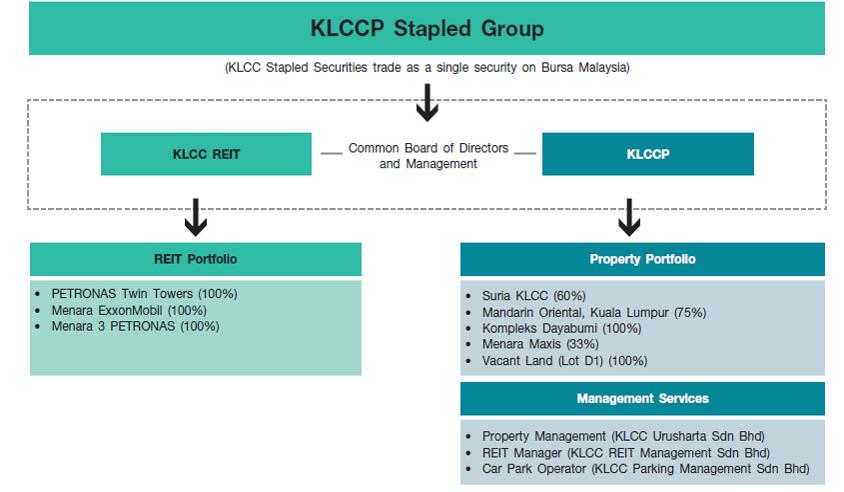

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

Issued by:

Corporate CommunicationsInvestor Relations and Business Development Department 22 April 2021

Source: KLCC Property Holdings Berhad (KLCCP)

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Ms. Bindu Menon

Head, Investor Relations and

Business Development

KLCC Property Holdings Berhad

Tel: +603 2783 7291

Email: bindu@klcc.com.my