KUALA LUMPUR, April 30 (Bernama) -- KLCC Property Holdings Berhad (KLCCP) and KLCC REIT Management Sdn Bhd (KLCCRM) wish to announce the appointment of Encik Md Shah Mahmood as the new Chief Executive Officer, replacing Datuk Hashim Wahir, who retires on 30 April 2021 after almost 14 years serving the Group. The appointment of Encik Md Shah Mahmood as the new CEO is effective 1 May 2021.

Encik Md Shah previously served as Head of Strategy and Business Development, Gas and New Energy (GNE) Business in Petroliam Nasional Bhd (PETRONAS). Prior to that, he was Head of Commercial and Business Development, PETRONAS LNG Sdn. Bhd.

Encik Md Shah has over 27 years of experience in PETRONAS and has held numerous management positions including Corporate Planning and Development Divisions where he led various merger and acquisition transactions and evaluations of PETRONAS’ new investment and green field projects. With his vast exposure in techno-commercial areas, he has also successfully led the completion of major projects such as LNG Regasification Facilities (RGT-2 Terminal) Project in Pengerang, Johor and three Solar Projects - Suria KLCC, PETRONAS Dagangan Berhad (PDB) Solaris Station and Solar Independent Power Producer in Gebeng. He has also orchestrated the development of GNE Strategy Blueprint and formulation for an integrated new business solution.

He was a Company Director of PETRONAS Gas and Trading Sdn. Bhd. and Amplus Energy Solutions (Singapore) Pte. Ltd. He also served as PETRONAS Corporate Investment Committee Member and PETRONAS Sustainability Development and Health Safety and Security Executive Council.

We would like to thank Datuk Hashim Wahir for his immense contribution during his long tenure with the Group and wish him all the best in his future undertakings and we welcome Encik Md Shah Mahmood as the new CEO of KLCCP and KLCCRM.

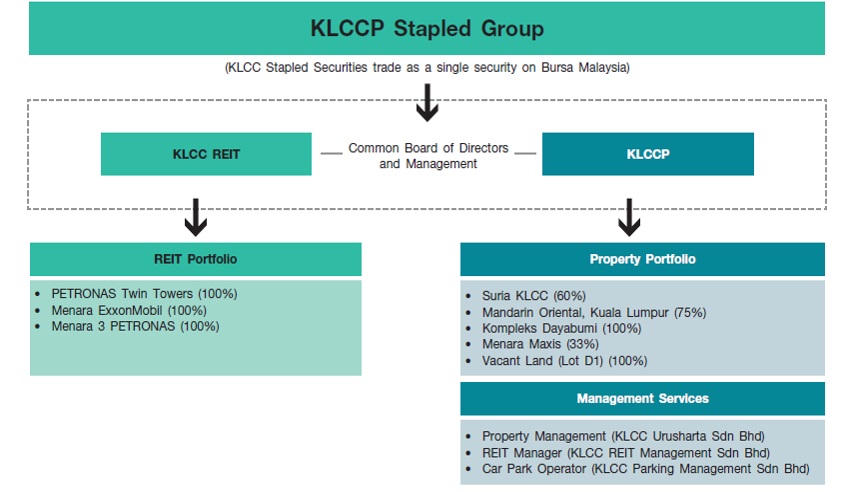

About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013. As a constituent of the FBM KLCI Index, KLCCSS trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly-owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly-owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCCP Stapled Group is a proud constituent of the FTSE4Good Bursa Malaysia Index. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation’s 2030 Agenda across five critical dimensions - Prosperity, Planet, People, Partnership and Peace, in line with its commitment to contribute towards five prioritised United Nation’s Sustainable Development Goals. For a better insights into the Group’s ESG profile and disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.php.

Issued by:

Corporate CommunicationsInvestor Relations and Business Development Department 30 April 2021

SOURCE: KLCC PROPERTY HOLDINGS BERHAD

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Ms. Bindu Menon

Head, Investor Relations and

Business Development

KLCC Property Holdings Berhad

Tel: +603 2783 7291

Email: bindu@klcc.com.my

Ms. Yasmin Abdullah

Corporate Communications

Investor Relations and

Business Development Department

KLCC Property Holdings Berhad

Tel: +603 2783 7584

Email: yasmina@klcc.com.my --BERNAMA