KUALA LUMPUR, Nov 9 (Bernama) -- KLCCP Stapled Group on 8 November 2021 announced its financial results for third quarter 2021, showing a revenue decline of 17% from RM312.6 million to RM260.3 million compared to third quarter, 2020 amid prolonged restrictions and movement control order due to the exponential increase in Covid-19 cases. Profit Before Tax (PBT) was down 21% to RM154.1 million from RM195.5 million last year.

Under the backdrop of a very challenging environment, the office segment remained the major contributor to the Group’s revenue showing strong momentum backed by long term leases. The decline in revenue and PBT was mainly attributed to the weak performance of the hotel and retail segments which was significantly impacted by the restrictions imposed due to the escalating health crisis which further dampened recovery in both the retail and hotel markets.

Despite the tough performance, the Group declared a dividend of 7.00 sen per stapled security for the quarter, bringing the total dividend to 21.00 sen for the cumulative nine months ended September 2021.

The office segment, comprising the PETRONAS Twin Towers, Menara 3 PETRONAS, Menara ExxonMobil and Menara Dayabumi remained stable backed by its locked-in long-term tenancies and the Triple Net Lease (TNL) of the PETRONAS Twin Towers and Menara 3 PETRONAS. However, the revenue and PBT decreased marginally as compared to third quarter 2020, mainly due to the accounting adjustments following the extension of the TNL agreement for PETRONAS Twin Towers and Menara 3 PETRONAS for another 15 years up to 2042 and 2041 respectively.

Suria KLCC and the retail podium of Menara 3 PETRONAS which represent the retail segment, saw revenue and PBT decline by 36.0% and 47.0% respectively. The subdued performance was mainly due to the pandemic lockdown restrictions coupled with higher provision of tenant assistance and lower advertising income. The situation improved tremendously following the transition to Phase 2 of the National Recovery Plan (NRP) in September when Suria KLCC recorded an increase in footfall, reaching 86% compared to the previous month. The gradual relaxation of restrictions also saw tenant sales more than doubled compared to August, led by Fashion, Leisure and Jewellery. The month of September also saw an increase in Food and Beverage (F&B) sales with the resumption of dine-in services for fully vaccinated customers.

The hotel segment represented by Mandarin Oriental, Kuala Lumpur (MOKL Hotel) recorded a loss of RM20.0 million for the quarter with reduced occupancy and lower performance in the F&B due to restricted operations during the period. The transition to NRP Phase 2 saw stronger pick-up in pace, with room occupancy hitting 30% during weekends. Significant improved performance was also seen in F&B compared to the previous month following the resumption of dine-in services at Lai Po Heen restaurant and Lounge on the Park with stringent Standard Operating Procedures (SOPs) in place. This encouraging performance was also contributed by the Mandarin Online Shop which saw the successful Moon Cake promotion, the highest revenue generator for the period.

In the management services segment, which comprises facility management and car parking management services, revenue and PBT for the quarter declined 7.9% and 3.9% respectively mainly due to lower revenue from transient car park income during the movement restrictions. More recently, the car park management services added an additional 177 car parking bays at Lot 2C3 in Putrajaya under its management which commenced operations on 1

st November 2021.

Prospects

Amidst the ongoing challenges, the Group remains cautious on the recovery post the pandemic for the rest of the year. The transition into Phase 4 of the NRP in October and the opening of all economic sectors and offices at full capacity is expected to lead to the gradual recovery of the retail and hotel segments as well as the returning of the surrounding office tenants.

The Group expects the office segment to remain stable supported by the triple net lease agreements and long-term leases. As the Covid-19 pandemic still lingers, Suria KLCC continues to prioritise the well-being of customers on top of the continuous effort to ensure tenants’ sustainability. Suria KLCC will capitalize on the year end festivities, driving sales through their reward driven campaigns. Mandarin Oriental, Kuala Lumpur reopens and ready to serve guests with various promotional packages tailoring to its guests’ profile. The weekend crowd has been encouraging however, pace of economic recovery towards the end of the year is anticipated to be slow.

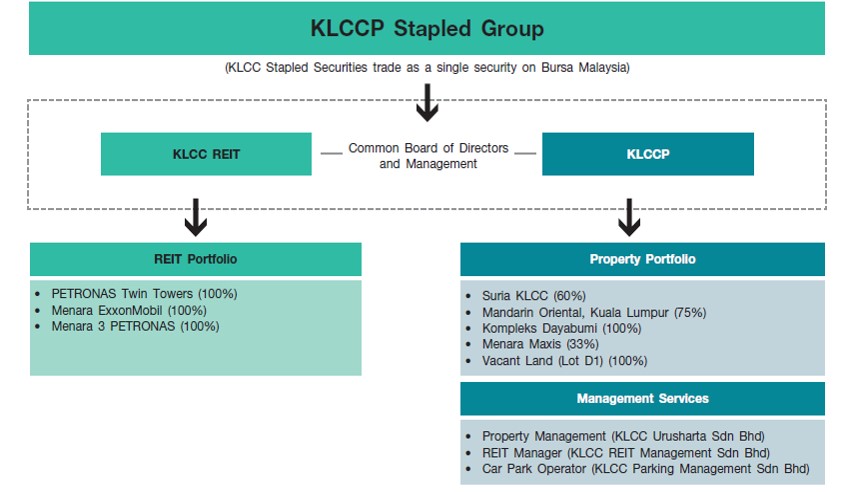

“In an economy that is still showing the effects of the health crisis, we will continue to focus on managing our assets and supporting our tenants in making our place more sustainable. Covid-19 has clearly impacted our performance, but we remain focused on our business recovery priorities and in re-positioning ourselves in facing the new normal. With over 95% of the adult population in the country now fully vaccinated, restrictions are further relaxed and the pick-up in economic activities are showing optimism that recovery is under way”.“While we focus on recovery, we will continue to prioritise the health and safety of our people, tenants, shoppers, hotel guests and the surrounding community as we welcome them back to our premises’.Md. Shah Mahmood, Chief Executive OfficerAbout KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013 and trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly owned subsidiaries, namely KLCC Urusharta Sdn. Bhd. and KLCC Parking Management Sdn. Bhd., are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCC Stapled Group is continuously recognised for its excellence in the industry for demonstrating strong environmental, social and governance practices. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation’s 2030 Agenda across five critical dimensions - Prosperity, Planet, People, Partnership and Peace, in line with its commitment to contribute towards the five prioritised United Nation’s Sustainable Development Goals. For a better insight into the Group’s ESG Profile and Disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.php.

Issued by:

Corporate CommunicationsInvestor Relations and Business Development Department 8 November 2021

Source: KLCC Property Holdings Berhad

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Ms. Bindu Menon

Head, Investor Relations and

Business Development

Tel: +603 2783 7291

Email: bindu@klcc.com.my

Name: Ms Yasmin Abdullah

Corporate Communications