KUALA LUMPUR, Dec 29 (Bernama) -- The Life Insurance Association of Malaysia (LIAM) and Malaysian Takaful Association (MTA) announced a pack of relief measures to alleviate the hardship caused by the current floods’ catastrophe in the country.

Thousands of people have been displaced from their homes by the severe floods and may face difficulties in paying their premiums/contributions on time. Life Insurers and Family Takaful Operators have collectively come together to provide a range of support and relief measures* which include:

1. Granting extra timeline of a few months for payment of premiums/contributions;

2. Restructuring of premium/contribution paying modes, from annual to monthly basis;

3. Extending the grace period (usually 30 days) to a longer timeframe for payment of premiums/contributions;

4. Reducing or waiving the interest charges for policy/certificate loan and policies/certificates under the Automatic Premium Loan (APL) option.

5. Waiver of printing cost for insurance policy/takaful certificate/medical card replacement.

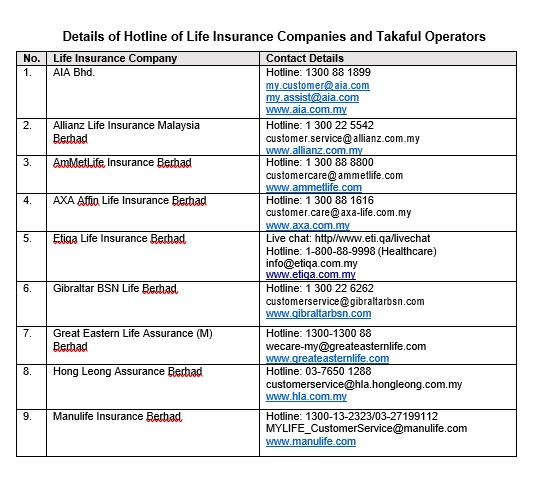

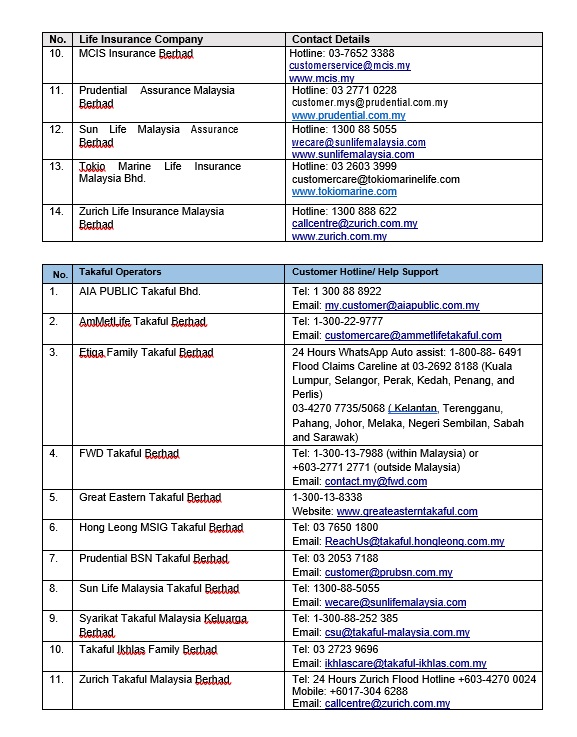

* subject to Insurers and Takaful Operators’ terms and conditions.“We would like to extend our deepest sympathies to the families and victims that had their homes damaged and livelihoods disrupted by the floods. Our member companies are committed in providing the necessary support to affected families, so that they can have the peace of mind to know that their insurance needs are taken care of. We would like to advise policy/certificate holders to contact their insurance/takaful companies to find out the details of the relief measures offered by their life insurers” said Loh Guat Lan, President of LIAM.

Encik Elmie Aman Najas, Chairman of MTA said that the insurance and takaful industry is focused to help the victims in their times of need. The flood has taken its toll on the family, business, and the wellbeing of the victims and the necessary relief measures will help ease their burden during this difficult time. “The floods have resulted in the evacuation of many victims from flooded areas to safer grounds mainly causing the family to lose contact with their family members, losing business and some even lost their loved ones in the floods and it is timely for the industry to play their role and responsibility in helping the victims” he added.

As circumstances of each case/claim may differ, policy/certificate holders who are affected and unsure of their coverage are advised to contact the respective insurers/takaful operators for more information and clarification.

About LIAM

About LIAMFormed in 1974, the Life Insurance Association of Malaysia (LIAM) is a trade association registered under the Societies Act 1966. LIAM has a total of 16 members, of which 14 are life insurance companies and 2 life reinsurance companies.

LIAM’s objectives are to promote a progressive life insurance industry; to enhance public understanding and appreciation for life insurance; to upgrade the image and professionalism of the life insurance industry and to support the regulatory authorities in developing a strong industry.

About Malaysian Takaful AssociationMalaysian Takaful Association (MTA) was established on November 2002 under the Societies Act 1966. It is a trade association representing all 18 licensed Takaful and Retakaful operators in the country. The objectives and the powers of MTA are to promote the interests of its members and to lead and supervise the exercise of self-regulation within the Takaful industry.

SOURCE : Life Insurance Association of Malaysia (LIAM)FORE MORE INFORMATION, PLEASE CONTACT:

Name: Ms Nancy TanExecutive Secretary

Life Insurance Association of Malaysia Tel: 03 –2691 6628/ 6168

Email: liaminfo@liam.org.my

Website: www.liam.org.my

Facebook: LIAM – Life Insurance Association of MalaysiaName: Puan Siti Nor Kamariah Ishak

Head of Corporate Communications Malaysian Takaful Association

Tel: +603-2031 8160

Fax: +603-2031 8170

E-mail: mtasecretariat@malaysiantakaful.com.my

--BERNAMA