KUALA LUMPUR, Jan 31 (Bernama) -- Highlights of Quarter Four Performance •

Rebounds to a Profit Before Tax (PBT) position of RM64.0 million for the quarter ended 31 December 2021 from a loss before tax (LBT) of RM44.7 million in quarter four, 2020 •

Strong top-line growth of 14.3% compared to quarter four, 2020 to RM348.2 million, with recovery in retail and hotel segments •

Retail segment sees PBT accelerate by 34.4% on the back of increased revenue of 21.7%, spurred by reopening of economy and year-end festive season •

Hotel segment turns around with strong revenue growth to close the quarter at RM23.0 million •

Distribution of 12.60 sen per stapled security, amounting to a total of 33.60 sen per stapled security for 2021 Quarter Four, 2021 vs Quarter Four, 2020 Performance KLCCP Stapled Group finished the year with its best performance for the quarter which saw the Group’s retail and hotel segments rebound, following the transition to Phase 3 and subsequently Phase 4 of the National Recovery Plan in October 2021. The Group posted revenues of RM348.2 million, higher by 14.3% and PBT rose to RM64.0 million compared to a loss of RM44.7 million in the corresponding quarter of 2020.

The office segment anchored by its long-term Triple Net Lease agreements registered a revenue increase to RM145.4 million during the quarter while PBT soared to RM117.4 million from RM32.7 million compared to quarter four, 2020. This was mainly attributed to lower finance cost and minimal impairment recorded on the Phase 3 Redevelopment of Kompleks Dayabumi.

Suria KLCC and the retail podium of Menara 3 PETRONAS which represents the retail segment also saw a surge in revenue of 21.7% to RM120.0 million while PBT jumped 34.4% to RM87.2 million driven by improved footfall and tenant sales, coupled with higher advertising income. During the quarter, Suria KLCC welcomed seven new tenants, ranging from F&B outlets to fashion accessories namely Evisu, a Japanese fashion store and fashion accessories store, Amaris Beauty, Oakley and Charles & Keith. The mall saw encouraging recovery during the quarter supported by the year-end festive season and shoppers reward campaigns which drove footfall and significant direct sales for our retail partners.

In the hotel segment, Mandarin Oriental, Kuala Lumpur (MOKL Hotel) saw encouraging improvement with the highest revenue for the quarter performance, growing from RM9.7 million in quarter four, 2020, to RM23.0 million, from increased occupancy and improved Food & Beverage (F&B) performance. Occupancy for the month of December 2021, peaked to 36.2%, which saw significant take-up of high-yielding rooms. The F&B growth was mainly boosted by the reopening of its Mosaic, Mandarin Grill, banqueting events held and higher growth in Mandarin Online Shop due to its extended offerings. The Tatler House collaboration also contributed to the hotels’ performance with five high-end events held during the quarter.

Under the Management Services segment, revenue recorded an increase of 17.3% mainly from the additional services secured in facilities management and higher car park income in line with the reopening of economic activities. However, PBT decreased marginally by 5.4% due to the one-off adjustment made in a facility management work.

Year-to-Date, 2021 Performance With the strong performance in quarter four 2021, KLCCP Stapled Group closed the year ended 31 December 2021 with revenue of RM1.2 billion, lower by 5.5% and PBT of RM565.8 million, an increase of 3.5% YoY, despite operating in a full year impact of COVID-19 environment. The Group upheld its commitment to deliver sustainable returns to its shareholders with a 95% distribution of its distributable income, bringing the total distribution to 33.60 sen per stapled security for the year, a growth of 12% from 2020, which translates to a full year dividend payment of RM606.6 million.

Prospects Despite operating under a very challenging market landscape and the prolonged pandemic, the Group expects to continue the recovery momentum in its business segments, riding on the improved consumer confidence following the country’s high vaccination coverage and the on-going efforts in booster shot roll out.

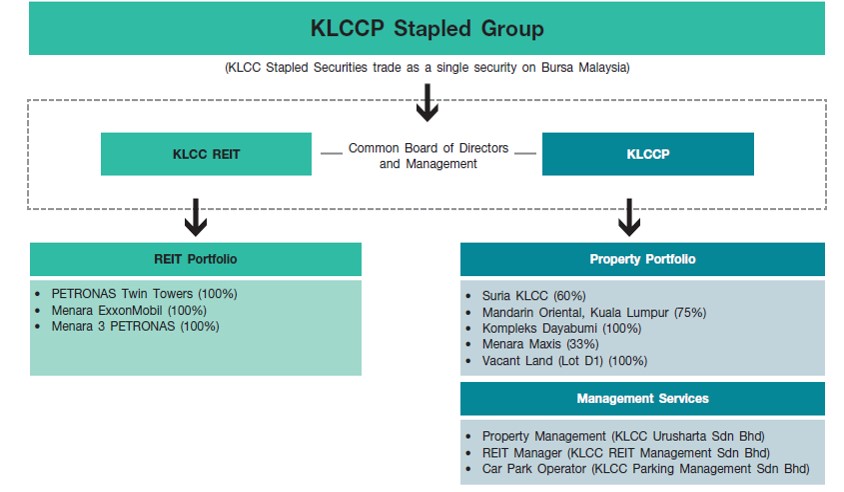

“The Group’s encouraging fourth quarter results reflect the strength of our resilient business, dedicated to creating long-term values for our shareholders. We are looking into resetting our priorities and positioning our growth trajectory, building on the positive outlook for REITs in the year ahead. Riding on this positive momentum, we will continue our recovery efforts and work collaboratively with our customers for mutually beneficial outcomes.” Md. Shah Mahmood, Chief Executive Officer, KLCC Property Holdings Berhad About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013 and trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCCP Stapled Group is continuously recognised for its excellence in the industry for demonstrating strong environmental, social and governance practices. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation‘s 2030 Agenda across five critical dimensions - Prosperity, Planet, People, Partnership and Peace, in line with its commitment to contribute towards the five prioritised United Nation’s Sustainable Development Goals. For a better insight into the Group‘s ESG Profile and Disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.html.

Issued by:

Corporate CommunicationsInvestor Relations and Business Development Department 28 January 2022

Source: KLCC Property Holdings Berhad

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Ms. Bindu Menon

Head, Investor Relations and

Business Development

KLCC Property Holdings Berhad

Tel: +603 2783 7291

Email: bindu@klcc.com.my

Name: Ms. Yasmin Abdullah

Corporate Communications

Investor Relations and

Business Development Department

KLCC Property Holdings Berhad

Tel: +603 2783 7584

Email: yasmina@klcc.com.my

--BERNAMA