|

|

|

|

November 25, 2024 -Monday |

|

|

|

|

|

|

|

|

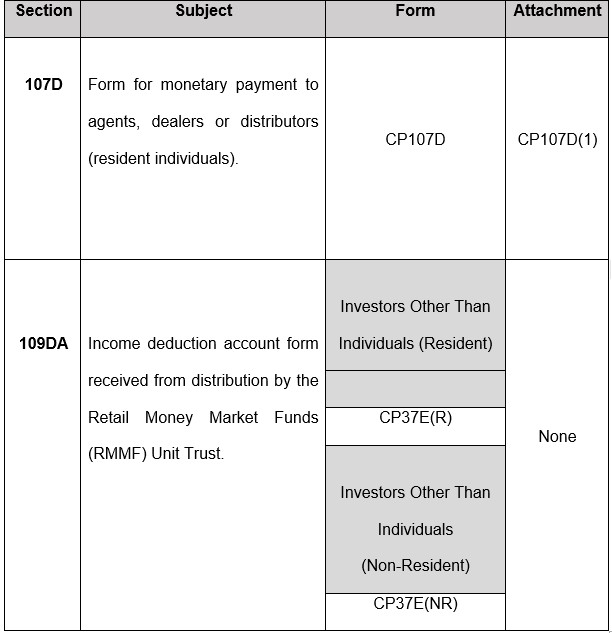

WITHHOLDING TAX PAYMENT FORMS UNDER SECTION 107D AND SECTION 109DA OF INCOME TAX ACT 1967 (ITA) NOW AVAILABLE ON THE OFFICIAL PORTAL OF INLAND REVENUE BOARD OF MALAYSIA (IRBM)

Wednesday 09/03/2022

KUALA LUMPUR, March 9 (Bernama) -- The Inland Revenue Board of Malaysia (HASiL) would like to inform that the Withholding Tax Payment Forms under Section 107D and Section 109DA of ITA have been uploaded to the HASiL’s Official Portal.

1. The abovementioned forms are as below:

2. The documents can be accessed and downloaded as follows:

i. Visit HASiL’s Official Portal at www.hasil.gov.my

ii. Click the Form menu> Download Form> Withholding Tax.

3. Before filling in Form CP107D, the payer must ensure that the recipient (agent, dealer or distributor) has an income tax number. If the recipient does not have an income tax number, registration can be made online via e-Daftar at https://edaftar.hasil.gov.my/

4. For income deduction accounts received from distribution by Retail Money Market Funds (RMMF) Unit Trusts under Section 109DA of the ITA, the payer only needs to fill in Form CP37E (R) or CP37E (NR). Payer does not have to submit any attachments with Form CP37E (R) or CP37E (NR).

For further enquiries, please do not hesitate to contact us through:

a) Hasil Care Line at 03-8911 1000 / 603-8911 1100 (Overseas);

b) HASiL Live Chat; and

c) Feedback Form on HASiL Official Portal at

https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/ms-my/.

Issued by:

Communications Division | Chief Executive Officer Office

Inland Revenue Board of Malaysia

Date: 09 March 2022

Source: Inland Revenue Board of Malaysia

FOR MORE INFORMATION, PLEASE CONTACT:

Communications Division | Chief Executive Officer Office

Inland Revenue Board of Malaysia

Hasil Care Line : 03-8911 1000 / 603-8911 1100 (overseas)

Hasil Recovery Call Centre: 03-8751 1000

Official Portal : www.hasil.gov.my

Official FB: facebook.com/LHDNM

Official IG: instagram.com/lhdnm

Official Twitter: @LHDNMofficial

--BERNAMA |

|

|

|

|

|