KUALA LUMPUR, Nov 11 (Bernama) -- KLCCP Stapled Group delivered a resilient performance in quarter three, 2022 which saw its Profit Before Tax (PBT) surge to RM237.6 million, compared RM154.0 million in third quarter last year. Revenue grew 43.7% from RM260.3 million to 374.0 million, underpinned by the steady growth in the retail and hotel segments.

For the cumulative nine months, the Group recorded PBT of RM659.3 million from RM501.8 million while revenue increased to RM1.046.0 billion from RM822.9 million compared to cumulative nine months in 2021.

The Group declared a dividend of 8.00 sen per stapled security, bringing the total to 24.00 sen for the cumulative nine months of 2022.

Solid Recovery as Businesses Return to Normalcy Suria KLCC and the retail podium of Menara 3 PETRONAS which represent the retail segment, saw an increase in revenue of 96.1% to RM133.6 million. PBT tripled to RM107.8 million, from improved tenant sales, resulting in higher percentage rent as business regained normalcy. During the quarter, Suria KLCC welcomed four new tenants namely Burger & Lobster, the first downtown Kuala Lumpur restaurant,

Mee Tarik Warisan Asli, Babyshop, and Aveda, the vegan haircare and beauty store.

Suria KLCC was awarded the Gold Winner for Best Experiential Marketing Awards 2020-2022 by the Malaysia Shopping Malls Association (PPKM) for its CSR initiative - We Are With You – A Mental Health Awareness Campaign. This initiative was Suria KLCC's commitment to educate the public about mental health, by setting aside a Safe Space in Suria KLCC for dialogues about mental health, in a welcoming atmosphere. During the quarter, Suria KLCC brought mental health to the forefront yet again, through its #YouMatter 2022 campaign with various activities at its Safe Space to destigmatize mental health and bring continued awareness to the community.

The hotel segment represented by Mandarin Oriental, Kuala Lumpur (MOKL Hotel) recorded an impressive performance as revenue rose to RM45.8 million compared to RM5.9 million in third quarter 2021. MOKL Hotel’s resilient performance was backed by higher average occupancy at 55% compared to 7% in third quarter 2021, higher F&B covers supported by the return of international travellers.

“The encouraging performance, particularly from the retail and hotel segments gives the Group the confidence that we are on track towards recovery. The various initiatives and efforts in enlivening and rejuvenating the KLCC Precinct have brought about higher footfall to Suria KLCC and increased patronage to MOKL Hotel as we continued to focus on delivering values and creating unique experiences for our customers, guests, and tenants”, said Md. Shah Mahmood, Chief Executive Officer, KLCC Property Holdings Berhad.The office segment comprising the PETRONAS Twin Towers, Menara 3 PETRONAS, Menara Exxonmobil, and Menara Dayabumi, remain the major contributor to the Group’s revenue, with high-quality offices, backed by the long-term tenancies and the Triple Net Lease (TNL) of PETRONAS Twin Towers and Menara 3 PETRONAS. The segment recorded a marginal increase in revenue to RM145.2 million. PBT, however saw a slight decrease of 1.1% mainly due to a one-off expense at Kompleks Dayabumi incurred during the quarter.

The management services segment comprising the Group’s facilities and car parking management recorded an increase in revenue and PBT by 17.8% and 7.2% compared to third quarter 2021, due to an increase in car parking revenue as economic activities continued to peak and more events were held within the KLCC Precinct.

KLCC Parking Management (KPM) continued to elevate its customer service and experience while promoting the use of clean energy with the installation of Electric Vehicle (EV) chargers at carparks under its operations. In collaboration with Gentari Sdn Bhd (GENTARI), the clean energy solutions provider, KPM recently installed another 27 EV chargers at the Northwest Development carpark, bringing the total number to 47 and making it the carpark with the largest number of EV charging points in the country. Another two units were installed at the KLCC open car park and six at the Kuala Lumpur Convention Centre car park. KPM will extend this initiative to other carparks under its operation, namely in Alamanda, Putrajaya, Herriot-Watt University, Putrajaya and Menara Dayabumi.

ProspectsThe Group remains cautiously optimistic that it is on the path to recovery and anticipates stronger performance, particularly from the retail and hotel segments. The retail and hotel segments are expected to recover progressively towards the pre-Covid levels boosted by the upcoming festive and holiday seasons coupled with the increase in international travellers’ confidence. However, the recovery may be encumbered by the increasing business and labour costs, rising interest rates and the uncertainty in Covid-19 cases.

The office segment is expected to remain stable with full occupancy and long-term leases which will continue to stable cash flows of the Group.

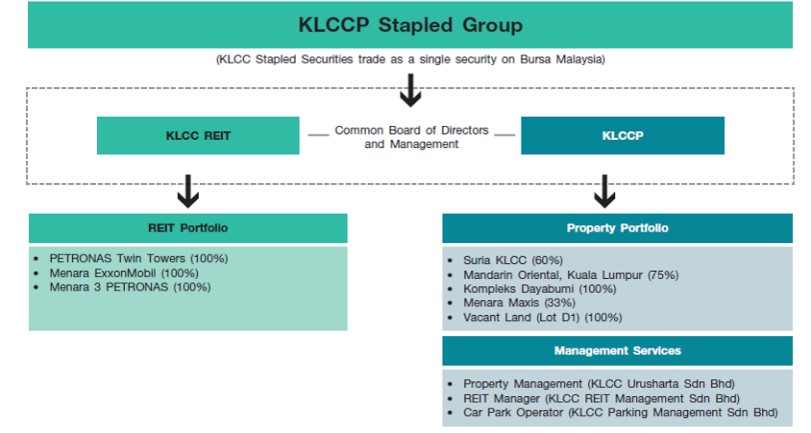

About KLCCP Stapled GroupKLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia's largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets. KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013 and trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group's core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP's wholly owned subsidiaries, namely KLCC Urusharta Sdn. Bhd. and KLCC Parking Management Sdn. Bhd. are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCCP Stapled Group is continuously recognised for its excellence in the industry for demonstrating strong environmental, social and governance practices. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation's 2030 Agenda across five critical dimensions - Prosperity, Planet, People, Partnership and Peace, in line with its commitment to contribute towards the five prioritised United Nation's Sustainable Development Goals. For a better insight into the Group's ESG Profile and Disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.php.

Issued by:

Group Strategic Communications and Investor Relations Source: KLCC Property Holdings Berhad

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Yasmin Abdullah

Head, Corporate Communications

Group Strategic Communications and Investor Relations

KLCC (Holdings) Sdn Bhd

Tel: +603 2783 7584

Email: yasmina@klcc.com.my

--BERNAMA