• Fourth quarter operating income for North America was $122 million, an increase of $38 million from the year-ago period, and full-year operating income was $565 million, an increase of $78 million from the prior year. For both the quarter and full year, the increase was driven by favorable price mix and expanded raw material risk management.

Segment Operating Income

Segment Operating Income

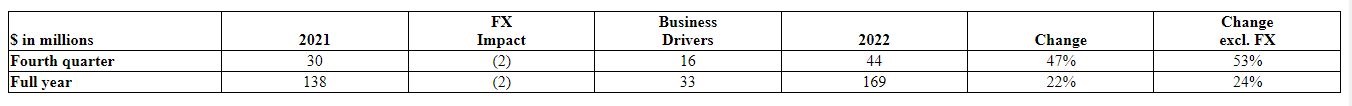

• Fourth quarter operating income for South America was $44 million, an increase of $14 million from the year-ago period, and full-year operating income was $169 million, an increase of $31 million from the prior year. For both the quarter and full year, the increases were driven by favorable price mix, partially offset by higher corn and input costs. Excluding foreign exchange impacts, segment operating income was up 53% and 24%, respectively, for the fourth quarter and full year.

Asia-PacificNet Sales Segment Operating Income

Segment Operating Income

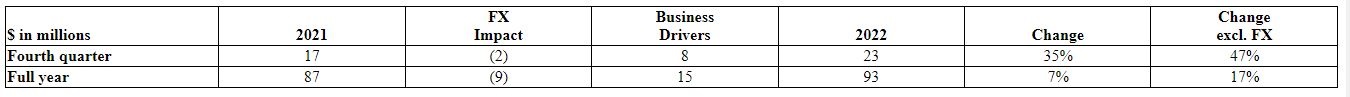

• Fourth quarter operating income for Asia-Pacific was $23 million, up $6 million from the year-ago period, and full-year operating income was $93 million, up $6 million compared to the prior year. For both the quarter and full year, the change was driven by favorable price mix that was partially offset by foreign exchange impacts. Excluding foreign exchange impacts, segment operating income was up 47% and 17%, respectively, for the fourth quarter and full year.

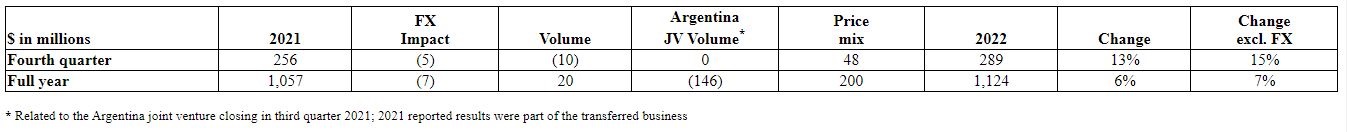

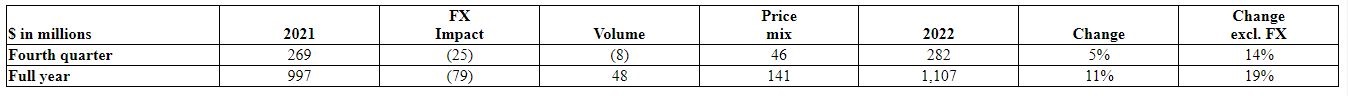

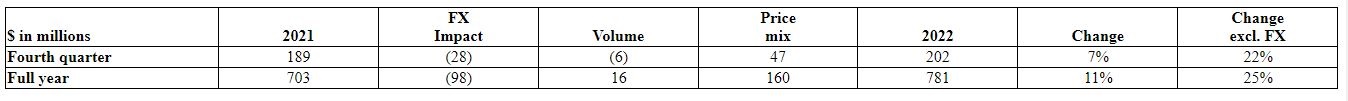

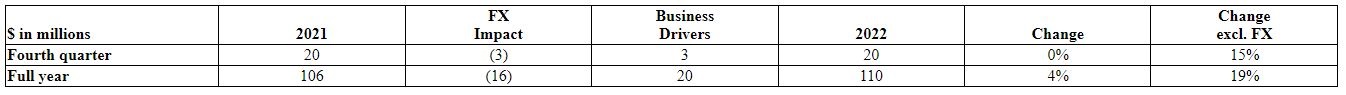

Europe, Middle East, and Africa (EMEA)Net Sales Segment Operating Income

Segment Operating Income

• Fourth quarter operating income for EMEA was $20 million, flat with the year-ago period, and full-year operating income was $110 million, up $4 million from the prior year. For both the quarter and full year, favorability in Europe was partially offset by conditions in Pakistan and foreign exchange impacts across the region. Excluding foreign exchange impacts, fourth quarter and full-year segment operating income were up 15% and 19%, respectively.

Dividends and Share RepurchasesFor the full year of 2022, the Company paid total dividends of $181 million, and in the fourth quarter declared a quarterly dividend of $0.71 per share payable in the first quarter of 2023. During 2022, the Company repurchased $112 million of outstanding shares of common stock, for a total of 1.3 million shares. Ingredion considers return of value to shareholders through cash dividends and share repurchases as part of its capital allocation strategy to support total shareholder return.

2023 Full-Year OutlookThe Company expects its outlook for full-year 2023 reported and adjusted EPS to be in the range of $7.70 to $8.40. This expectation excludes acquisition-related integration and restructuring costs, as well as any potential impairment costs.

The Company expects full-year 2023 net sales to be up mid-double-digits and adjusted operating income to be up high single-digits to low double-digits.

Compared to last year, the 2023 full-year outlook assumes the following: North America operating income is expected to be up low double-digits, driven by favorable price mix partially offset by higher input costs; South America operating income is expected to be up low single-digits, with favorable price mix mostly offsetting higher input costs; Asia-Pacific operating income is expected to be up mid-double-digits, driven by favorable price mix and PureCircle growth, partially offset by higher input costs; and EMEA operating income is expected to be up mid-single-digits as we navigate foreign exchange impacts. Corporate costs are expected to be up low single-digits.

For full-year 2023, the Company expects a reported and adjusted effective tax rate of 26.5 percent to 28.5 percent.

Cash from operations for full-year 2023 is expected to be in the range of $550 million to $650 million, which reflects an anticipated increase in our working capital balances. Capital expenditures for the full year are expected to be approximately $300 million.

Conference Call and Webcast DetailsIngredion will host a conference call on Wednesday, February 8, 2023, at 8 a.m. Central Time / 9 a.m. Eastern Time, hosted by Jim Zallie, president and chief executive officer, and Jim Gray, executive vice president and chief financial officer. The call will be webcast in real time and can be accessed at

https://ir.ingredionincorporated.com/events-and-presentations. A

presentation containing additional financial and operating information will be accessible through the Company’s website, and available to download a few hours prior to the start of the call. A replay will be available for a limited time at

https://ir.ingredionincorporated.com/financial-information/quarterly-results.

About the CompanyIngredion Incorporated (NYSE: INGR) headquartered in the suburbs of Chicago, is a leading global ingredient solutions provider serving customers in more than 120 countries. With 2022 annual net sales of $7.9 billion, the Company turns grains, fruits, vegetables and other plant-based materials into value-added ingredient solutions for the food, beverage, animal nutrition, and industrial markets. With Ingredion’s Idea Labs

® innovation centers around the world and approximately 12,000 employees, the Company co-creates with customers and fulfills its purpose of bringing the potential of people, nature and technology together to make life better. Visit

ingredion.com for more information and the latest Company news.

Forward-Looking StatementsThis news release contains or may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends these forward-looking statements to be covered by the safe harbor provisions for such statements.

Forward-looking statements include, among others, any statements regarding the Company’s expectations for full-year 2023 net sales, adjusted operating income, reported and adjusted EPS, segment operating income, reported and adjusted effective tax rates, cash flow from operations, and capital expenditures, and any other statements regarding the Company’s prospects and its future operations, financial condition, net sales, operating income, volumes, corporate costs, tax rates, capital expenditures, cash flows, expenses or other financial items, including management’s plans or strategies and objectives for any of the foregoing, and any assumptions, expectations or beliefs underlying any of the foregoing.

These statements can sometimes be identified by the use of forward-looking words such as “may,” “will,” “should,” “anticipate,” “assume,” “believe,” “plan,” “project,” “estimate,” “expect,” “intend,” “continue,” “pro forma,” “forecast,” “outlook,” “propels,” “opportunities,” “potential,” “provisional,” or other similar expressions or the negative thereof. All statements other than statements of historical facts in this news release or referred to in this news release are “forward-looking statements.”

These statements are based on current circumstances or expectations, but are subject to certain inherent risks and uncertainties, many of which are difficult to predict and beyond our control. Although we believe our expectations expressed or implied in these forward-looking statements are based on reasonable assumptions, investors are cautioned that no assurance can be given that our expectations will prove correct.

Actual results and developments may differ materially from the expectations expressed in or implied by these statements, based on various risks and uncertainties, including the impact of COVID-19 on the demand for our products and our financial results; changing consumption preferences relating to high fructose corn syrup and other products we make; the effects of global economic conditions and the general political, economic, business, and market conditions that affect customers and consumers in the various geographic regions and countries in which we buy our raw materials or manufacture or sell our products, including, particularly, economic, currency, and political conditions in South America and economic and political conditions in Europe, and the impact these factors may have on our sales volumes, the pricing of our products and our ability to collect our receivables from customers; future purchases of our products by major industries which we serve and from which we derive a significant portion of our sales, including, without limitation, the food, beverage, and animal nutrition, the uncertainty of acceptance of products developed through genetic modification and biotechnology; our ability to develop or acquire new products and services at rates or of qualities sufficient to gain market acceptance; increased competitive and/or customer pressure in the corn-refining industry and related industries, including with respect to the markets and prices for our primary products and our co-products, particularly corn oil; the availability of raw materials, including potato starch, tapioca, gum Arabic, and the specific varieties of corn upon which some of our products are based, and our ability to pass along potential increases in the cost of corn or other raw materials to customers; energy costs and availability, including energy issues in Pakistan; our ability to contain costs, achieve budgets, and realize expected synergies, including with respect to our ability to complete planned maintenance and investment projects on time and on budget as well as with respect to freight and shipping costs; the effects of climate change and legal, regulatory, and market measures to address climate change; our ability to successfully identify and complete acquisitions or strategic alliances on favorable terms as well as our ability to successfully integrate acquired businesses or implement and maintain strategic alliances and achieve anticipated synergies with respect to all of the foregoing; operating difficulties at our manufacturing facilities; the behavior of financial and capital markets, including with respect to foreign currency fluctuations, fluctuations in interest and exchange rates and market volatility and the associated risks of hedging against such fluctuations; effects of the conflict between Russia and Ukraine, including impacts on the availability and prices of raw materials and energy supplies and volatility in exchange and interest rates; our ability to attract, develop, motivate, and maintain good relationships with our workforce; the impact on our business of natural disasters, war, threats or acts of terrorism, the outbreak or continuation of pandemics such as COVID-19, or the occurrence of other significant events beyond our control; the impact of impairment charges on our goodwill or long-lived assets; changes in government policy, law, or regulation and costs of legal compliance, including compliance with environmental regulation; changes in our tax rates or exposure to additional income tax liability; increases in our borrowing costs that could result from increased interest rates; our ability to raise funds at reasonable rates and other factors affecting our access to sufficient funds for future growth and expansion; security breaches with respect to information technology systems, processes, and sites; volatility in the stock market and other factors that could adversely affect our stock price; risks affecting the continuation of our dividend policy; and our ability to maintain effective internal control over financial reporting.

Our forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement as a result of new information or future events or developments. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections. For a further description of these and other risks, see “Risk Factors” and other information included in our Annual Report on Form 10-K for the year ended December 31, 2021, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, and our subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission.

Ingredion Incorporated

Condensed Consolidated Statements of Income

(Unaudited)CONTACTS:Investors: Noah Weiss, 773-896-5242

Media: Becca Hary, 708-551-2602

SOURCE: Ingredion Incorporated

--BERNAMA