KUALA LUMPUR, May 30 (Bernama) -- KLCCP Stapled Group delivered an encouraging performance for the first quarter 2023, reporting an increase of 18.3% in revenue to RM380.7 million compared to the same quarter last year. Profit Before Tax (PBT) increased 16.9% to RM236.8 million, reflecting continued growth and recovery across all business segments.

The Group declared a dividend of 8.50 sen per stapled security, 6.3% higher than first quarter 2022, attributable to the Group’s resilient performance.

An encouraging start to the year

With the continued pick up in economic activities, the Group registered an improved Year-on-Year (YoY) performance, across all business segments, particularly the retail, hotel, and management services segments. "We are pleased that the positive start to the current financial year has set a strong growth momentum for the Group and we will remain focused to deliver on our expectations for the year’” said Datuk Md. Shah Mahmood, Chief Executive Officer of KLCC Property Holdings Berhad.

Suria KLCC and the retail podium of Menara 3 PETRONAS which represent the retail segment, recorded an increase in PBT of RM20.0 million on the back of revenue of RM129.8 million. This significant improvement was driven by robust tenant sales and increase in customer counts at the mall. Moving Annual Turnover (MAT)-tenant sales continued to surpass pre-Covid levels by 17%, mainly contributed by Fashion and Food and Beverage (F&B). The quarter also saw Suria KLCC welcoming onboard four new tenants including Nitori (Japan’s largest furniture and home furnishing brand) and Pak John Steamboat & BBQ.

Mandarin Oriental, Kuala Lumpur (MOKL Hotel), representing the hotel segment showed significant improvement compared to quarter one last year. The segment saw its revenue jump to RM46.1 million compared to RM20.0 million in the corresponding quarter further narrowing the loss to RM2.3 million. Revenue per available room (RevPar) increased twofold on the back of significant improvement in occupancy and pent-up demand from high-yielding rooms. This was further propelled by robust corporate demand and a resurgence of International Meetings, Incentives, Conference & Exhibitions (MICE) events. MOKL Hotel recorded an occupancy of 49.5% compared to 21.1% in the same quarter last year, supplemented by higher F&B covers.

The management services segment comprising the facilities management and the car parking management services saw a revenue increase of 21.3% to RM77.4 million whilst PBT rose by 13.2% to RM19.2 million. This was mainly due to the continuous improvement in car parking income and the ongoing reinstatement works for the “Workplace for Tomorrow” (WFT) and further contributed by the higher interest income derived from higher interest rate during the quarter. During the quarter, KLCC Parking Management Sdn Bhd (KPM) saw an increase in transient car count due to increase in exhibitions, concerts and events held within the KLCC precinct, throughout the school holiday season and long weekends. KPM also successfully secured 278 parking bays in Putrajaya, bringing its total car park bays under management to exceeding 15,000.

The office segment with solid leases in PETRONAS Twin Towers, Menara 3 PETRONAS, Menara ExxonMobil and Menara Dayabumi saw a marginal increase in revenue to RM146.3 million compared to RM145.3 million in quarter one last year and continued to provide a stable income to the Group. PBT increased to RM120.6 million compared to RM118.8 last year contributed by income from utility charges and higher interest income.

Datuk Md. Shah further commented, “While navigating through competitive market landscape and macroeconomic challenges that continue to pose challenges to the Group, we are confident that the Group’s encouraging performance and solid recovery momentum are showing positive signs that we are gaining our pace in business normalisation.”

Prospects

The Group remains positive and is optimistic that the economic and business indicators will continue to show positive recovery momentum with the return of MICE, events and tourism activities as well as rising domestic demand. However, the Group is cautious with the rising cost of living and inflationary pressure which may impact the consumers’ spending pattern and cost of business.

Suria KLCC will continue to drive sales through its strategic initiatives to enhance the vibrancy of the mall as it moves towards business normalisation.

Mandarin Oriental, Kuala Lumpur is expected to continue its positive performance and heighten marketing activities, leveraging on its strong brand value and innovative offerings.

Overall, the Group’s performance is expected to remain stable backed by the long-term leases and triple net lease agreement in the office segment.

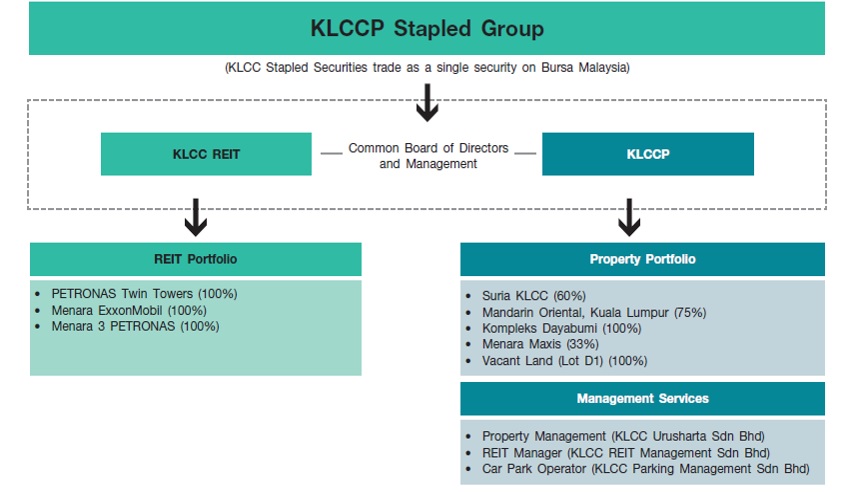

About KLCCP Stapled Group KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia’s largest self-managed stapled security that invests, develops, owns and manages a stable of iconic and quality assets.

KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013 and trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group’s core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP’s wholly owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCCP Stapled Group is continuously recognised for its excellence in the industry for demonstrating strong environmental, social and governance practices. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation‘s 2030 Agenda across four critical dimensions - Prosperity, Planet, People, Partnership and Peace, in line with its commitment to contribute towards the five prioritised United Nation’s Sustainable Development Goals. KLCCP Stapled Group is also a member of the United Nations Global Compact Malaysia (UNGCmy). For a better insight into the Group‘s ESG Profile and Disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.html.

Issued by:

Group Strategic Communications & Investor Relations29 May 2023

SOURCE: KLCC (Holdings) Sdn BhdFOR MORE INFORMATION, PLEASE CONTACT:Name: Yasmin Abdullah

Tel: 03 2783 7584

Email: yasmina@klcc.com.my

Name: Nur Diana Alia Othman

Email: nurdianaalia.othma@klcc.com.my

--BERNAMA