KUALA LUMPUR, Feb 8 (Bernama) -- Highlights of Quarter Four Performance

·

Revenue increased 7.1% to RM442.6 million from RM413.3 million and Profit Before Tax (PBT) saw significant growth to RM470.4 million from RM359.6 million in 2022 from strong performance in the retail and hotel segments ·

Retail segment saw its highest performance to-date with increase of 9.3% in revenue, from RM125.4 million to RM 137.1 million, from higher occupancy, retailers’ turnover and footfall ·

Hotel segment recorded a remarkable turnaround, with PBT of RM6.2 million on the back of revenue of RM65.2 million, propelled by improved occupancy from leisure tourist arrivals and demand from Marketing, Incentives, Convention and Exhibitions (MICE) events ·

Distribution of 14.40 sen per stapled security for the quarter, totalling 40.50 sen per stapled security for 2023, the highest since the listing of Stapled SecurityQuarter Four, 2023 vs Quarter Four, 2022 Performance

KLCCP Stapled Group delivered a strong growth performance in quarter four, 2023, backed by a resilient performance in the retail and hotel segments. The Group’s revenue grew from RM413.3 million to RM442.6 million while PBT rose to RM470.4 million from RM359.6 million for the quarter ended 31 December 2023.

The office segment, comprising the PETRONAS Twin Towers, Menara 3 PETRONAS and Menara ExxonMobil remained stable backed by the Triple Net Lease (TNL) and long-term leases. The segment’s revenue increased to RM146.5 million, while PBT showed a slight improvement to RM114.5 million.

The retail segment, represented by Suria KLCC and the retail podium of Menara 3 PETRONAS, delivered a stellar performance with a 9.3% increase in revenue to RM137.1 million and a 7.4% increase in PBT. This was mainly driven by the improvement in occupancy, footfall, hitting its highest ever MAT-tenant sales to-date, with a 12% growth compared to a year ago. Suria KLCC welcomed 10 new tenants during the quarter, demonstrating its commitment to its curated, diversified tenant profile.

Mandarin Oriental, Kuala Lumpur (MOKL Hotel) which represents the hotel segment, recorded a remarkable revenue increase of 32.8% to RM65.2 million from RM49.1 million in Q4, 2022 and PBT of RM6.2 million. This resilient performance was attributed to higher occupancy of 62% from 56% in Q4, 2022 and a 27% surge in Revenue Per Available Room (RevPAR), driven by group stays, and banqueting events, which marked the highest revenue in October 2023 since the hotel opening.

The management services segment, comprising facility management and car parking management services, saw higher revenue of RM113.8 million compared to RM112.1 million during the same quarter last year. PBT improved by 6.1% to RM22.8 million. This improved performance was contributed mainly by carpark income and expanded facilities management scope.

Year-to-Date, 2023 Performance

The Group closed 2023 with a commendable performance for the financial year ended 31 December 2023. It recorded a revenue growth of 11.0% from RM1.5 billion to RM1.6 billion, and PBT of RM1.2 billion. This marks an impressive increase of 16.5% compared to 2022, demonstrating excellent business growth momentum, underpinned by the resilience of the Group’s portfolio strength. The PBT improvement is further bolstered by a significant fair value gain of RM221.9 million, attributable to the overall improvement in the market value of the investment properties.

KLCCP Stapled Group declared a dividend of 40.50 sen per stapled security for the year, its highest since its listing as a stapled security in 2013. This is the Group’s commitment in delivering consistent distribution growth to its stapled security holders.

“Datuk Md. Shah Mahmood, Chief Executive Officer of KLCC Property Holdings Berhad said, “The Group’s solid growth momentum across all segments, coupled with our strategic actions have enabled us to deliver our strongest performance in 2023, marking the 10th anniversary since listing as a stapled security.” “We are optimistic that the upswing will continue, particularly in the retail and hotel segments. Our customer-focused strategy, together with the growth in tourism and MICE activities, will strategically position us to synergise efforts and enhance our competitive advantage towards future business sustainability”, he added.Prospects

The Group is optimistic that the growth trend for 2024 will remain positive as it continues to leverage its iconic assets, long-term and triple net lease arrangements, underpinned by the solid footing of its retail and hospitality segments.

MOKL Hotel’s improved performance is set to continue with anticipated growth in tourist arrivals, supported by its partnership in the KLCC Precinct and promotional initiatives, reinforcing its market leadership.

Meanwhile, Suria KLCC remains committed to tenants' sustainability, operational efficiency, tailored marketing initiatives and customer loyalty programmes, to attract foot traffic and boost tenants’ sales.

This optimistic trajectory will be further supported by resilient consumer demand and moderating of inflationary pressure, anticipated for the year.

About KLCCP Stapled Group

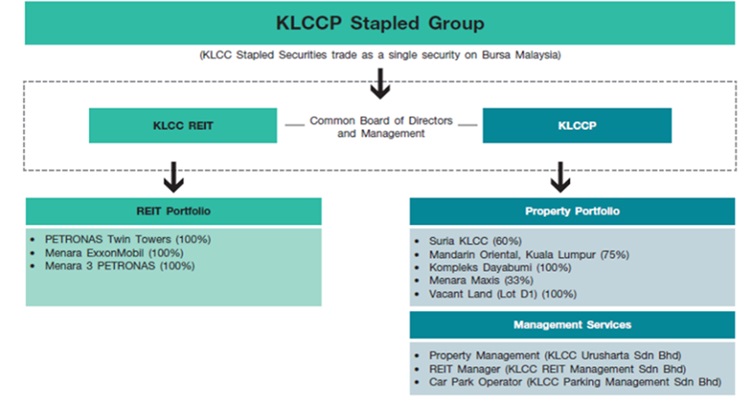

KLCC Property Holdings Berhad (KLCCP) and KLCC REIT, collectively known as KLCCP Stapled Group is Malaysia's largest self-managed stapled security that invests, develops, owns, and manages a stable of iconic and quality assets. KLCCP Stapled Group became the first ever Shariah compliant stapled structure in Malaysia upon the listing of KLCC Stapled Securities (KLCCSS) on 9 May 2013 and trades under the REIT sector of the Index as a single price quotation.

With KLCCP Stapled Group's core business in property investment and development, the Group has a diverse property portfolio largely located within the Kuala Lumpur City Centre comprising prime Grade A office buildings, a premier retail mall and a luxury hotel. The stabilised and wholly owned assets namely PETRONAS Twin Towers, Menara ExxonMobil and Menara 3 PETRONAS are under KLCC REIT and the non-wholly owned assets and assets with development and redevelopment potential, Suria KLCC, Mandarin Oriental, Kuala Lumpur hotel and a vacant land (Lot D1) are in KLCCP. KLCCP also has a 33% stake in Menara Maxis.

Two of KLCCP's wholly owned subsidiaries, namely KLCC Urusharta Sdn Bhd and KLCC Parking Management Sdn Bhd, are engaged in providing facility management services and car parking management services respectively. The REIT Manager who is engaged to manage and administer KLCC REIT is internal and resides within KLCCP as a 100% owned subsidiary.

KLCCP Stapled Group is continuously recognised for its excellence in the industry for demonstrating strong environmental, social and governance practices. In pursuing its sustainability journey, the Group aligns its reporting to the United Nation's 2030 Agenda across five critical dimensions - People, Planet, Prosperity, Peace & Partnership, in line with its commitment to contribute towards the United Nation's Sustainable Development Goals. For a better insight into the Group's ESG Profile and Disclosures, please visit ESG World at

https://www.klcc.com.my/sustainability.php.

Issued by:

Group Strategic Communications and Investor Relations7 February 2024SOURCE: KLCC (Holdings) Sdn Bhd

FOR MORE INFORMATION, PLEASE CONTACT:Name: Yasmin Abdullah

Head, Corporate Communications

Group Strategic Communications and Investor Relations

KLCC (Holdings) Sdn Bhd

Tel: +60 2783 7584

Email: yasmina@klcc.com.my

--BERNAMA