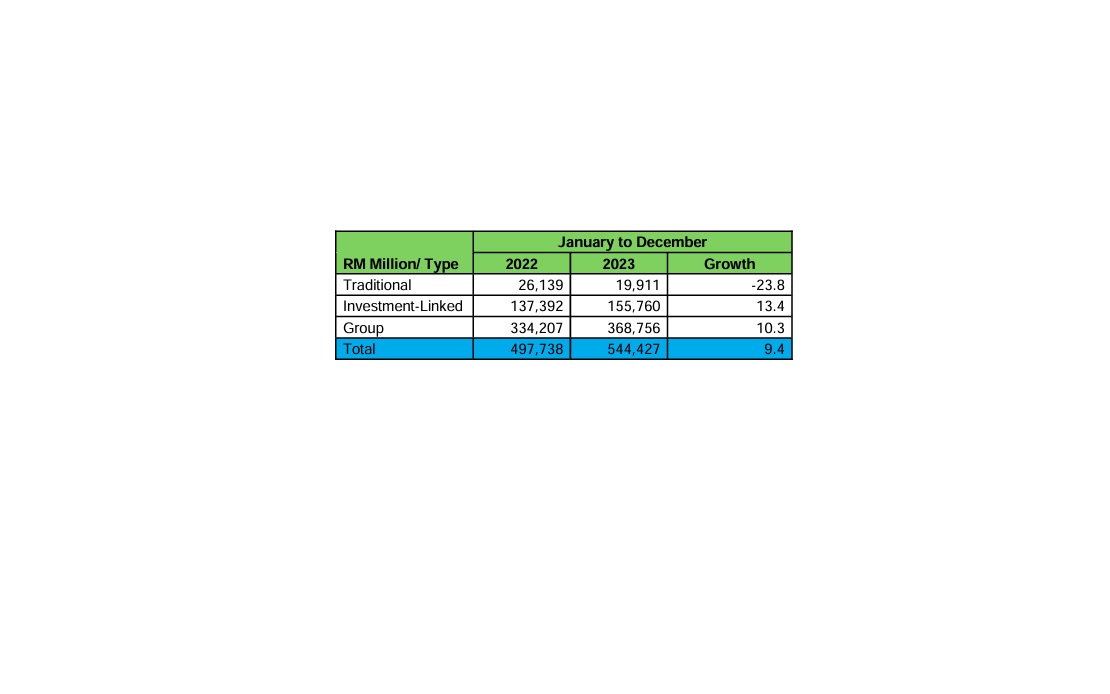

The overall new business sum assured recorded 9.4% growth to RM544.4 billion in 2023 as compared to RM497.7 billion in the previous year. The new business sum assured of investment-linked policies and group policies recorded a double-digit growth of 13.4% to RM155.8 billion and 10.3% to RM368.8 billion, respectively, in 2023.

New Business – Sum Assured

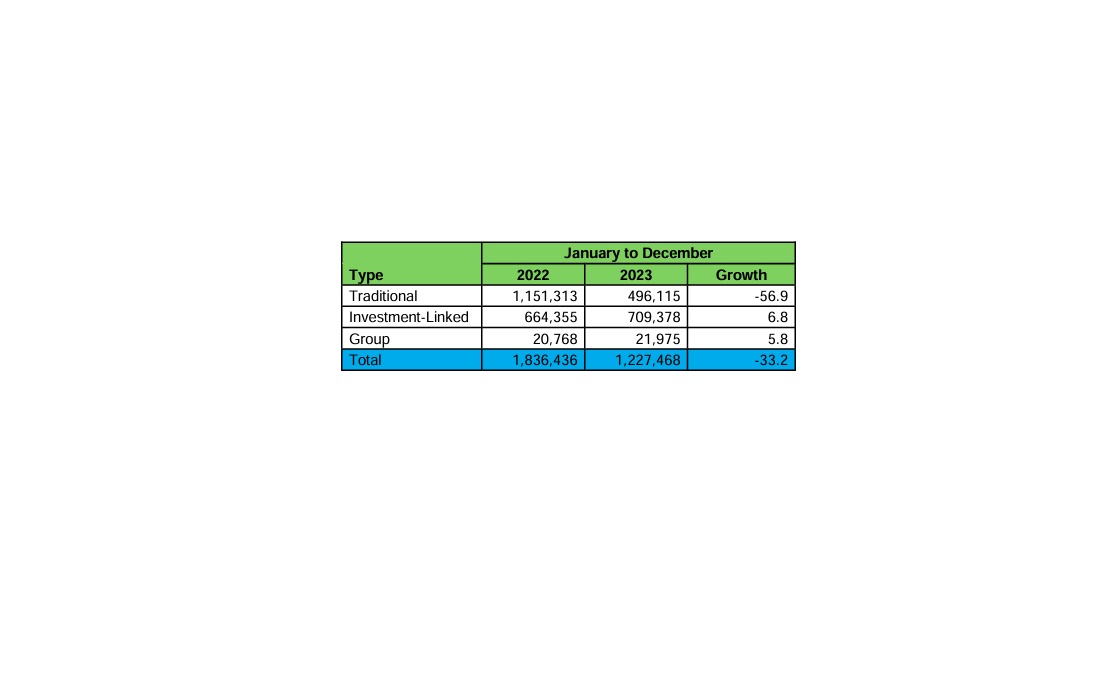

Meanwhile, the number of new investment-linked policies grew by 6.8% to 709,378 and new group policies increased by 5.8% to 21,975 in 2023. However, new traditional policies recorded a decline of 56.9% from 1.2 million in 2022 to 496,115 in 2023, resulting in the overall number of policies falling 33.2% to 1.2 million in 2023 compared to 1.8 million in 2022. The drop in the new traditional policies was compounded by the absence of policies issued in 2023 under the Perlindungan Tenang Voucher Scheme which ended in November 2022. Some 437,024 policies were issued in 2022 under the Perlindungan Tenang Voucher Scheme.

New Business – New Policies

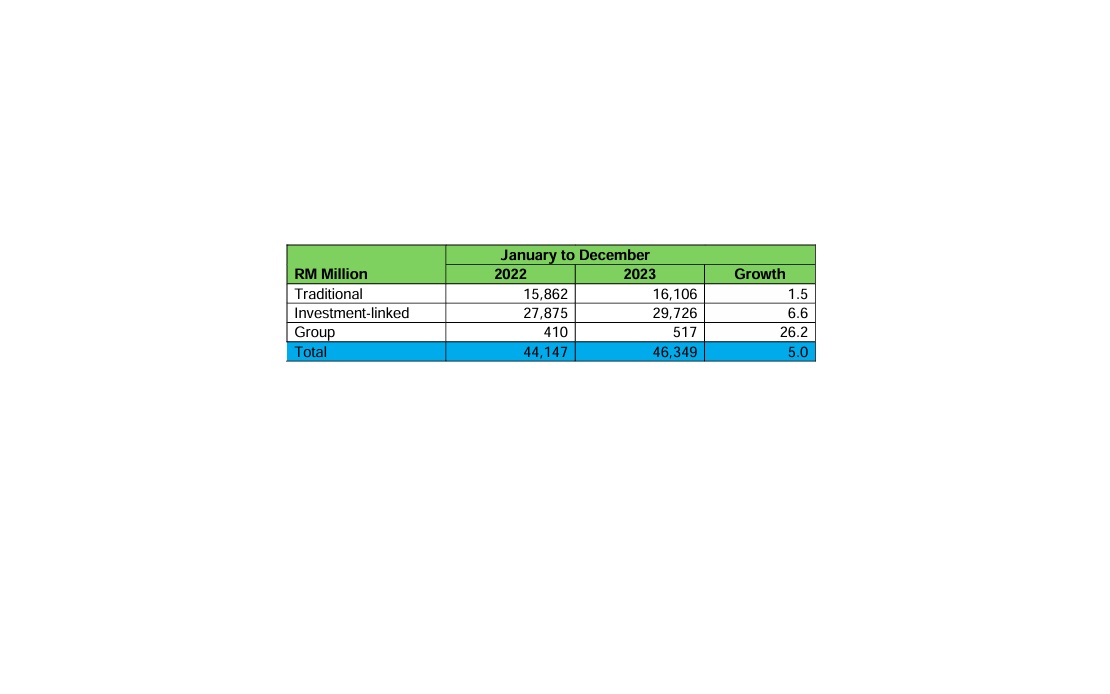

The total premium in force grew by 5% to RM46.3 billion in 2023 compared to RM44.1 billion in 2022. Group policies in force premium registered a leap of 26.2% from RM410 million in 2022 to RM517 million in 2023. Investment-linked policies in force premium rose by 6.6% while traditional policies grew by 1.5%.

In Force Premium

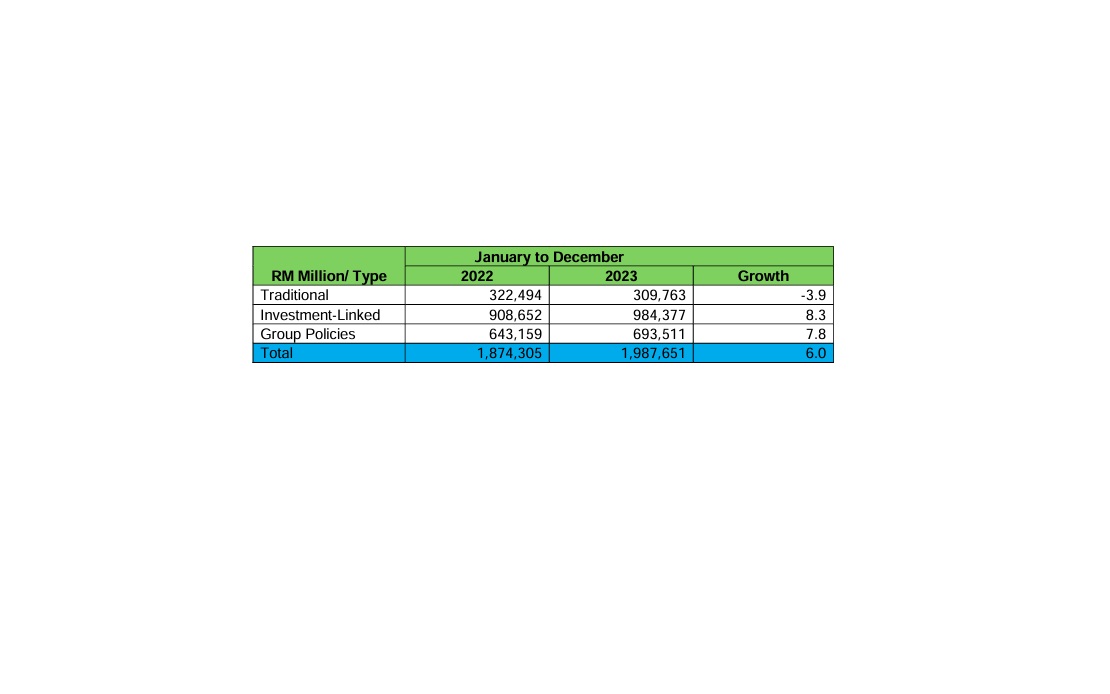

The sums assured in force rose to RM2 trillion in 2023 compared to RM1.9 trillion in 2022, registering a rise of 6%. Investment-linked policies sums assured in force recorded a strong growth of 8.3% to RM984.4 billion in 2023 compared to RM908.7 billion in 2022. The sums assured in force of group policies also increased by 7.8% whereas traditional policies fell 3.9%.

Sums Assured in Force

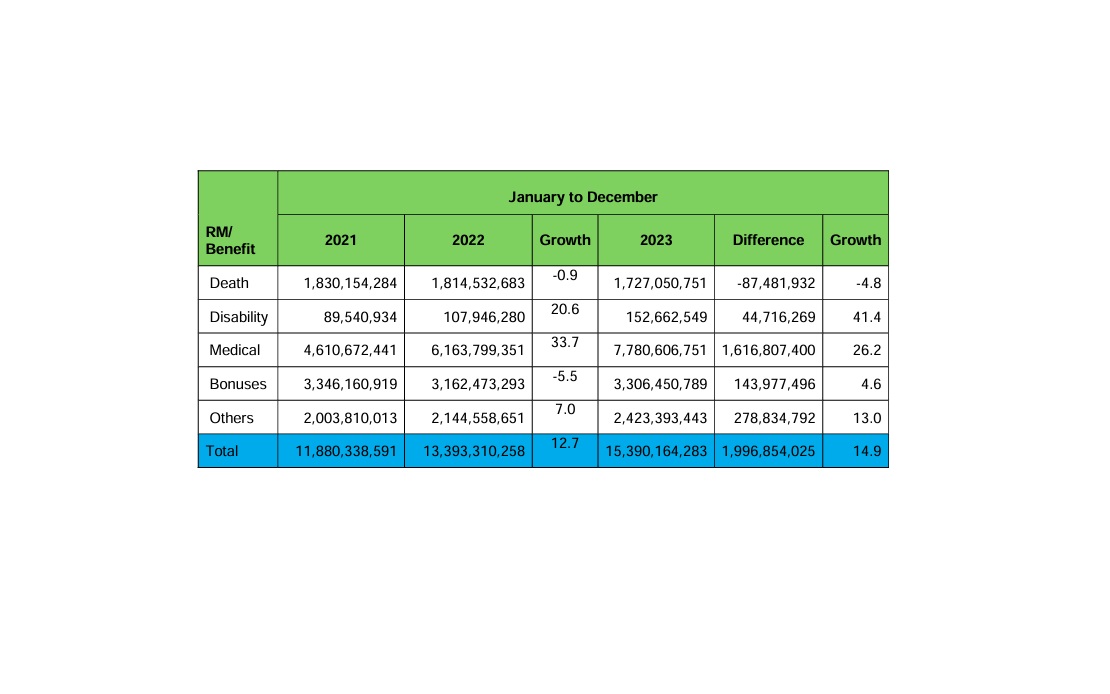

CLAIMS PAYOUT The total claims payout in 2023 surged by 14.9% to RM15.4 billion in 2023 compared to RM13.4 billion in 2022. The increase was primarily driven by the hike of 41.4% in disability payment and 26.2% in medical claims.

SURGING MEDICAL CLAIMSThe surge in medical claims has been a challenge for the industry since 2019 (pre-pandemic) as policyholders resumed healthcare treatments which were deferred earlier due to COVID 19 pandemic. The highest increase observed since 2019 was 34% recorded in 2022 as compared to 2021. 2023 claims increase of 26.2% is also one of the highest ever observed.

The increase in medical claims payout is attributed to higher costs in medical treatments, hospitalization and the cost of drugs and medical equipment. A rise in admissions is also a major driver of claims increase. Claims data in 2018 shows that hospital supplies and services accounted for 60-70% of claimable surgical and non-surgical treatment costs respectively in Malaysia.

The high claims payout is also caused by the high medical inflation rate in Malaysia. According to the 2024 Global Medical Trend Rates Report published by Aon-Hewitt, the global average medical trend rate for 2024 is expected to be 10.1 percent, up from 9.2 percent in 2023 and the highest it has been since 2015. In the same report, Malaysia’s medical inflation rate is projected to reach 15% in 2024, similar to 2023.

It is expected that the higher medical claims will add pressure on premium increases going forward. Repricing of premium is a standard feature of medical reimbursement covers to ensure the sustainability of the medical insurance policy. Medical insurance policies become unsustainable when the premiums collected are insufficient to cover the expected claims expenses. The industry continues to engage with our regulator, Bank Negara Malaysia (BNM), and other stakeholders on finding ways to assist policyholders in managing their medical policy amidst rising premiums.

In this regard, the industry would like to urge all stakeholders including healthcare providers, private hospitals, doctors, regulators, and policyholders to work together with the insurance industry to address the challenges contributing to rising in medical costs and to curb medical claims inflation in the country.

Policyholders are urged to educate themselves on their medical policies, explore alternative treatments, question unreasonable billing and consider optimal medical treatment for cost effectiveness and sustainability.

Moving forward, BNM with insurers and takaful operators will promote new insurance plans with cost-sharing provisions, which have been proven to lower overall claims costs and premiums.

Outlook Looking ahead to 2024, the industry is poised to maintain its growth momentum and resilience amidst evolving market dynamics. Various efforts outlined under the Financial Sector Blueprint 2022-2026 are being carried out to strengthen and to push the development to a higher level, to deliver better products and services to the consumers.

As LIAM is celebrating its 50th Anniversary in 2024, we continue to engage closely with stakeholders as we brace ourselves to achieve the financial inclusion agenda and continue to serve the rakyat with insurance and protection needs.

Source:Bank Negara Malaysia Monthly Highlights and Statistics January 2024 - (New Business and Total Business in Force)

Life Insurance Association of Malaysia (LIAM) – (Claims Payout) About LIAM Formed in 1974, the Life Insurance Association of Malaysia (LIAM) is a trade association registered under the Societies Act 1966. LIAM has a total of 16 members, of which 14 are life insurance companies and 2 life reinsurance companies. LIAM’s objectives are to promote a progressive life insurance industry; to enhance public understanding and appreciation for life insurance; to upgrade the image and professionalism of the life insurance industry and to support the regulatory authorities in developing a strong industry.

SOURCE: Life Insurance Association of Malaysia

FOR MORE INFORMATION, PLEASE CONTACT:

Name: Puan Norizan Hassan

Head of Corporate Communications

Tel: 603-2691 6168 / 6628 / 8068Email: liaminfo@liam.org.my

Website: www.liam.org.my

Facebook: LIAM – Life Insurance Association of Malaysia

Instagram: @liamalaysia

--BERNAMA