- above 75% Recurring cash conversion rate on average over Fiscal 2024-2026 vs. above 70% previously

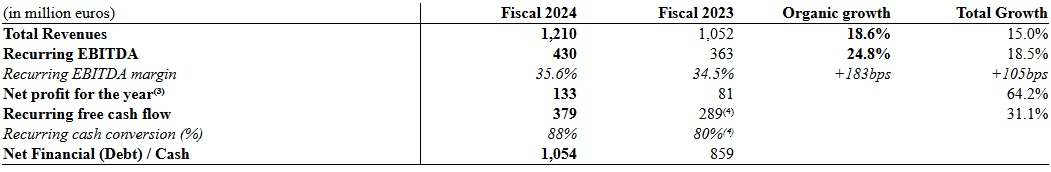

Fiscal 2024 key figures Aurélien Sonet, Chief Executive Officer of Pluxee, commented:"As we conclude our first fiscal year, I am proud to announce that we have exceeded all our business and financial objectives. Fiscal 2024 was marked by the significant transformation of the Group as a standalone and listed company and by the delivery of outstanding Organic revenue growth, strong Recurring EBITDA margin expansion and robust cash conversion. Demonstrating our commitment to a clear capital allocation framework, we have made significant strides on our M&A roadmap with the deployment of our partnership with Santander in Brazil and the successful acquisition of Cobee in Spain while pursuing our investments in growth and enhancing our shareholder distribution policy.These achievements reflect the remarkable efforts and unwavering commitment of all our employees and I would like to thank them for their contribution to this success. As we transition to Fiscal 2025, I am confident that Pluxee is well-positioned to deliver on its objectives going forward, continuing to generate sustainable low double-digit organic growth combined with steady margin expansion and strong cash flow generation. This is underpinned by the disciplined execution of our strategic roadmap, driven by product innovation, a powerful commercial engine, best-in-class tech capabilities and a targeted M&A strategy, creating value for all our shareholders, clients, consumers and merchant partners."

Aurélien Sonet, Chief Executive Officer of Pluxee, commented:"As we conclude our first fiscal year, I am proud to announce that we have exceeded all our business and financial objectives. Fiscal 2024 was marked by the significant transformation of the Group as a standalone and listed company and by the delivery of outstanding Organic revenue growth, strong Recurring EBITDA margin expansion and robust cash conversion. Demonstrating our commitment to a clear capital allocation framework, we have made significant strides on our M&A roadmap with the deployment of our partnership with Santander in Brazil and the successful acquisition of Cobee in Spain while pursuing our investments in growth and enhancing our shareholder distribution policy.These achievements reflect the remarkable efforts and unwavering commitment of all our employees and I would like to thank them for their contribution to this success. As we transition to Fiscal 2025, I am confident that Pluxee is well-positioned to deliver on its objectives going forward, continuing to generate sustainable low double-digit organic growth combined with steady margin expansion and strong cash flow generation. This is underpinned by the disciplined execution of our strategic roadmap, driven by product innovation, a powerful commercial engine, best-in-class tech capabilities and a targeted M&A strategy, creating value for all our shareholders, clients, consumers and merchant partners."¹ Adjusted net profit is defined in the section Alternative performance measures (APM) in the appendix.

² At Fiscal 2024 constant rates

³ Attributable to the equity holders of the parent

⁴ Excluding a positive impact from the evolution in regulation in Brazil (€191m)

Fiscal 2024 resultsThe Board of Directors of Pluxee N.V. prepared the financial statements for the full year Fiscal 2024. The Group's statutory auditor completed the audit of the full year consolidated financial statements.

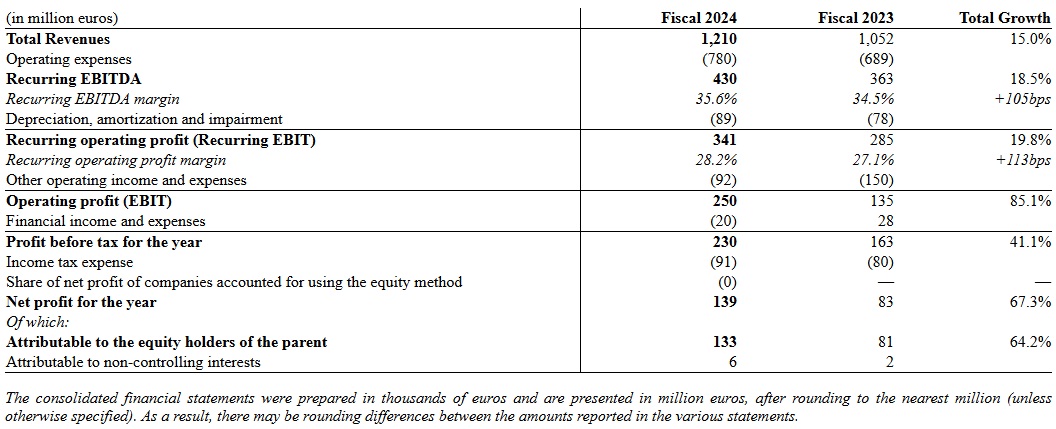

Fiscal 2024 Income statement Strong business momentum in Fiscal 2024Total Business volumes issued

Strong business momentum in Fiscal 2024Total Business volumes issued reached 24.0 billion euros in Fiscal 2024. Employee Benefits business volumes stood at 18.1 billion euros of which 4.4 billion euros in the fourth quarter, representing sustained organic growth of +11.5% over the fiscal year, including +11.1% in the fourth quarter.

The strong commercial dynamics across regions were driven by significant new client wins and strong net retention including a further significant increase in average face value and a growing portfolio contribution driven by cross-selling.

This robust performance was supported by the continuous enrichment of the Group's offering through further product innovation and complementary technological and data capabilities to continue improving the client and consumer experience. The Group has also consistently leveraged its powerful commercial engine and segmented sales and digital marketing strategy, along with its dedicated approach to the small and medium-sized enterprise (SME) segment.

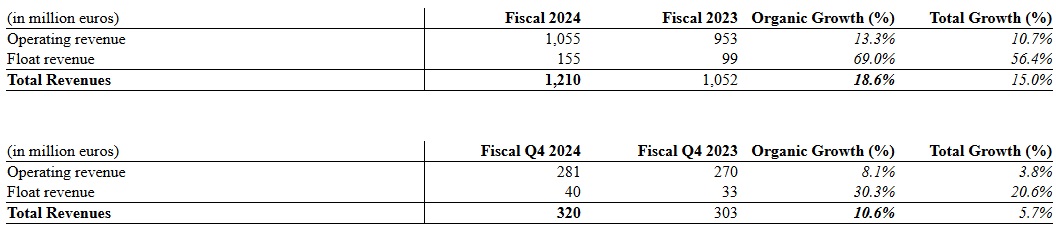

+18.6% Organic revenue growth in Fiscal 2024Total Revenues reached 1,210 million euros in Fiscal 2024, a +15.0% increase compared to Fiscal 2023. This amount includes a currency translation effect of -3.9% mainly due to operations in Türkiye and Brazil, particularly in Q4, and a positive scope effect of +0.4%, related to the integration of Santander Brazil's Employee Benefits activity following the closing of the strategic partnership in June 2024.

Organic growth was +18.6% in Fiscal 2024, significantly above the low double-digit Organic revenue growth objective communicated during the Capital Markets Day. This outstanding performance was primarily driven by positive business momentum in Employee Benefits and high float revenue.

In the fourth quarter, Total Revenues grew organically +10.6%, i.e. +5.7% total growth including a -6.1% currency impact.

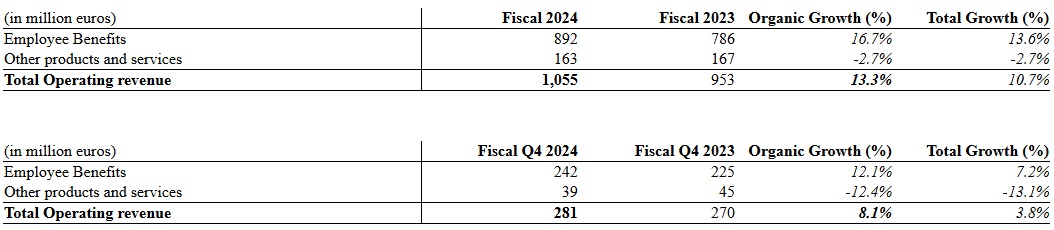

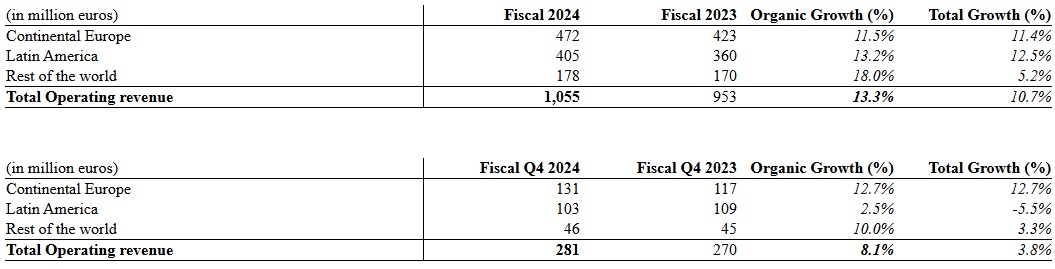

Total Revenues by nature Operating revenue

Operating revenue reached 1,055 million euros, representing +13.3% organic growth in Fiscal 2024 and +10.7% total growth including a -2.9% currency translation effect and a +0.3% scope effect. Pluxee sustained its double-digit growth trajectory in Operating revenue, driven by Employee Benefits.

Operating revenue organic growth amounted to +8.1% in the fourth quarter. The strong underlying business trends were partially offset by well-flagged base effects in Latin America that will fade in the course of First Half Fiscal 2025.

Float revenue rose to 155 million euros in Fiscal 2024, increasing +69.0% organically compared to the previous year, i.e. +56.4% total growth including a -14.0% currency translation effect. The increase was driven by the continuous positive momentum in business volumes issued expanding the Float base, coupled with high interest rates overall and the Group's ability to seize investment opportunities.

In the fourth quarter Fiscal 2024, Float revenue continued to grow +30.3% on an organic basis compared to fourth quarter Fiscal 2023, to reach 40 million euros.

Operating revenue by line of service Employee Benefits

Employee Benefits generated Operating revenue of 892 million euros in Fiscal 2024, growing +16.7% organically, i.e. +13.6% total growth including a -3.5% currency effect, and accounting for 85% of Total Operating revenue. This performance was propelled by strong commercial dynamics leading to double digit growth in business volumes issued supported by steady improvement of +22bps in the average take-up rate reaching 4.95% in Fiscal 2024.

In the fourth quarter Fiscal 2024, Employee Benefits generated Operating revenue of 242 million euros with organic growth of +12.1%, confirming the positive momentum.

Other Products and Services generated Operating revenue of 163 million euros in Fiscal 2024 compared to 167 million euros in Fiscal 2023 and representing 15% of Total Operating revenue. The performance of Other Products and Services reflected the base effects in some Public benefit contracts, including the discontinuation of a contract in Chile and large programs issued in Fiscal 2023 in Continental Europe. The Group has also initiated a portfolio rationalization in the UK and U.S. to focus on digital Employee Engagement offerings. Except in Chile, all significant Public benefit contracts have been successfully renewed paving the way for a progressive return to growth in Fiscal 2025.

In the fourth quarter Fiscal 2024, Other Products and Services generated Operating revenue of 39 million euros compared to 45 million euros in Fiscal 2023.

Operating revenue by region In Continental Europe

In Continental Europe, Operating revenue reached 472 million euros in Fiscal 2024, representing organic growth of +11.5% and total growth of +11.4%. This performance was driven by strong commercial momentum in Western European countries, especially Belgium and France, while facing higher comparison bases in Central and Eastern Europe, especially over the second half of Fiscal 2024. As an example, the French security forces entrusted Pluxee with ensuring meal benefits for more than 90,000 civil servants and military personnel during the Paris 2024 Olympics. Positive momentum was also fueled by the continuous increase in average face value to progressively reach the legal face value cap as raised by Public Authorities. Cross-selling across Pluxee's product range also significantly contributed to the steady performance delivered over the year in the region. In Belgium, the Group leveraged a non-recurring government measure supporting purchasing power by deploying a one-off benefit program, notably to existing clients, driving up cross-selling.

In the fourth quarter Fiscal 2024, Operating revenue in Continental Europe grew +12.7% organically, returning to an improved growth profile.

In Latin America, Operating revenue reached 405 million euros in Fiscal 2024, growing +13.2% organically, i.e. +12.5% total growth including a -1.5% currency impact related mainly to Brazil and Mexico especially over the fourth quarter. Solid performance in the region resulted from strong new development, driven notably by the growing penetration of small and medium enterprises. In Brazil and Mexico, small and medium enterprises represented around 35% of business volume growth over the fiscal year. Pluxee continued to pro-actively manage its portfolio, constantly leveraging analytics to advise clients in upgrading face values.

The performance in the region in the second half of Fiscal 2024 reflected the base effects related to the change in regulation in Brazil in May 2023 as well as the discontinuation of a Public benefit contract in Chile. Both effects will fade in the course of First Half Fiscal 2025.

In Rest of the world, Operating revenue amounted to 178 million euros in Fiscal 2024, showing +18.0% Organic growth excluding a -12.8% currency impact mostly related to the evolution of the Turkish Lira. Organic growth was driven in the region by increasing adoption and usage of Pluxee solutions across countries. In Türkiye’s hyperinflationary environment, the Group managed to generate an additional increase in average face value within the existing client portfolio and further penetrated the meal benefit segment by signing new client contracts.. Development was also particularly strong in India across the full Employee benefit products range.

In the fourth quarter Fiscal 2024, Operating revenue came in at 46 million euros, up +10.0% organically and total growth of +3.3% including currency impacts. Positive business dynamics translated into solid double-digit organic growth in most of the countries, especially in Türkiye and India, while the UK and the U.S. underwent the rationalization of their portfolio to focus on digital Employee Engagement offerings.

Recurring EBITDA margin up +183bps on an organic basisRecurring EBITDA reached 430 million euros in Fiscal 2024, up +24.8% organically and +18.5% year-on-year including a +0.5% scope effect and a -6.8% currency effect. Recurring EBITDA margin increased by +183bps on an organic basis while absorbing standalone costs, reaching 36.4%, well above the Group's objective of at least 34.5% at constant rates, subsequently increased to at least 35%. On a reported basis, Recurring EBITDA margin stood at 35.6%, representing a +105bps increase including currency impacts.

The increase in Recurring EBITDA, absorbing the new standalone costs, was driven by steady growth in business volumes, fueling the increase in Operating revenue in all regions, a positive contribution of Float revenue as well as the preliminary effects of the operating leverage and efficiency gains. This improvement became more apparent in the second half of Fiscal 2024, while the First Half reflected one-off effects related to the spin-off such as management fees still invoiced by Sodexo. All the regions contributed to this substantial increase in Recurring EBITDA.

Recurring operating profit (Recurring EBIT) was 341 million euros, up +19.8% year-on-year. This includes -89 million euros of Depreciation and amortization charges for the year, compared to -78 million euros in Fiscal 2023.

Other operating income and expenses amounted to -92 million euros in Fiscal 2024, compared to -150 million euros in Fiscal 2023 which incorporated the provision of -127 million euros related to the competition proceedings in Francel. For the fiscal year, Other operating expenses included the one-off charges related to (i) the Spin‑off and listing, including the rebranding that introduced the new identity of the Group, for a total amount of -62 million euros, (ii) the write-off of specific digital assets related to the Zeta platform now limited to two countries for a total amount of -16 million euros, (iii) restructuring and rationalization costs of -8 million euros as well as (iv) M&A costs related to business combinations for -7 million euros. Other operating income encompassed a capital gain of 6 million euros on disposal of investments in equity-accounted companies.

Operating profit (EBIT) in Fiscal 2024 was 250 million euros compared to 135 million euros in Fiscal 2023.

Increase in Net profit by +€56mFinancial income and expenses came in at -20 million euros in Fiscal 2024, compared to 28 million euros in Fiscal 2023. The Group recorded -52 million euros of gross borrowing costs in Fiscal 2024 in connection with the new capital structure established as part of the Spin-off compared to -20 million euros in Fiscal 2023. It also included 44 million euros of interest income generated from the non-Float-related cash position and -12 million euros of Other financial income and expenses comprising the effects of hyperinflation in Türkiye and the net gains and losses from foreign exchange fluctuations.

Income tax expense was -91 million euros in Fiscal 2024. The Effective tax rate decreased from 49.1% in Fiscal 2023 including the impacts of the competition proceedings in France, to 39.5% in Fiscal 2024, reflecting the effect of one-off costs related to the Spin-off.

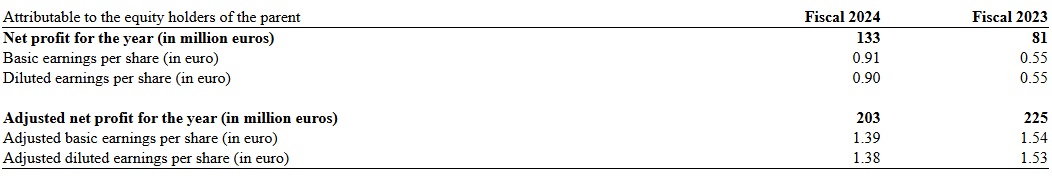

Net profit for the year was 139 million euros in Fiscal 2024, compared to 83 million euros in Fiscal 2023, reflecting the significant increase in Total Revenues and Recurring EBITDA, the new capital structure of the Group as well as Other operating expenses and Income tax expense specifically related to Fiscal 2024.

Net profit attributable to equity holders of the parent was 133 million euros compared to 81 million euros in the previous fiscal year and Basic Earnings Per Share attributable to equity holders of the parent was 0.91 euro in Fiscal 2024 compared to 0.55 euro in Fiscal 2023.

Adjusted Net profit standing at €203m

Adjusted net profit attributable to the equity holders of the parent was 203 million euros in Fiscal 2024, compared to 225 million euros in Fiscal 2023 reflecting the new capital structure of the Group following the Spin-off. Adjusted net profit excludes Other operating income and expenses net of related income tax and related non-controlling interests shares.

Adjusted basic earnings per share came in at 1.39 euro in Fiscal 2024.

Enhanced shareholder distribution policyConsistently with the capital allocation framework presented at the Capital Markets Day,

the Group has enhanced its distribution policy with 25% payout now based on Adjusted net profit (attributable to the equity holders of the parent) representing an expanded basis of 203 million euros.

As such, it is proposed that the General Meeting adopt, with due observance of the Group's articles of association and dividend policy, a dividend of €0.35 per ordinary share. This proposal would represent a total dividend payment of 51 million euros. On approval, Pluxee ordinary shares will trade ex-dividend as from December 20, 2024, the dividend record date will be on December 23, 2024, and payment of the dividend will take place on December 24, 2024.

Strong Recurring free cash flow at €379m and Recurring Cash conversion rate at 88%Recurring free cash flow was 379 million euros in Fiscal 2024, compared to 289 million euros in Fiscal 2023 excluding the one-off impact in Change in working capital related to the evolution in regulation in Brazil in May 2023, i.e. 480 million euros reported.

Capital Expenditures were 116 million euros in Fiscal 2024, representing 9.6% of Total Revenues, compared to the objective of c. 10% of Total Revenues. It reflected the Group's commitment to leveraging the positive revenue growth momentum to invest further, especially in IT infrastructure following the spin-off as well as in technology and data, paving the way for the future growth.

Change in Working capital excluding Restricted cash stood at 168 million euros compared to 92 million euros in Fiscal 2023 excluding the one-off impact of the evolution in regulation in Brazil. Positive evolution in Change in Working capital reflected strong volume growth in Fiscal 2024.

Recurring cash conversion rate came in at 88% in Fiscal 2024 compared to 80% in Fiscal 2023 adjusted from the positive impact from the evolution in regulation in Brazil mentioned above (i.e. 132% reported), substantially exceeding the average 70% financial objective for Fiscal 2024-2026.

Increased Net financial cash position at €1,054mCash and cash equivalents reached 1,421 million euros as of August 31, 2024 compared to 1,625 million euros as of August 31, 2023.

Current financial assets stood at 814 million euros as of August 31, 2024 compared to 542 million euros as of August 31, 2023. This increase is mainly driven by the gradual diversification of the Group's investment policy, which included an extension of investment maturity to further optimize returns in an expected decreasing rate environment. Cash and cash equivalents were mostly invested in (i) interest-bearing current accounts and (ii) short-term deposits with banks as well as other deposit products such as money market funds.

The cumulated amount of liquidity, including 973 million euros of Restricted cash related to the Float, reached 3,208 million euros as of August 31, 2024.

Gross debt amounted to 1,181 million euros

1 in Fiscal 2024, mainly corresponding to the issuance of bonds. On February 27, 2024, Pluxee successfully placed two inaugural bonds totaling 1,100 million euros consisting of (i) a 550 million euro bond issue with a 4.5-year maturity and a coupon of 3.50% and (ii) a 550 million euro bond issue with a 8.5-year maturity and a coupon of 3.75%. This allowed to fully repay the bridge loan on March 4, 2024. To secure its liquidity, the Group has a revolving credit facility amounting to 650 million euros, now maturing in October 2029, after having obtained bank approval on October 2, 2024, to extend the original termination date by an additional year.

Net Financial (Debt) / Cash at August 31, 2024, stood at 1,054 million euros compared to 859 million euros at August 31, 2023, representing a significant increase of +195 million euros in Fiscal 2024. This improvement was primarily driven by an inflow of 379 million euros coming from Recurring free cash flow and to a lesser extent, by the disposal of non-consolidated investments and a positive cash position resulting from the consolidation of Santander Brazil's employee benefit activity. Further, it also reflects the cash impact of the currency fluctuations and the Other operating income and expenses incurred in Fiscal 2024.

Pluxee's strong financial cash position and cash generation is reflected in the BBB+ rating and stable outlook from Standard & Poor's.

A year of continued progress on Pluxee's ESG journeyIn Fiscal 2024, along with the completion of

the double materiality assessment in anticipation of CSRD obligations and

the validation of the 2035 Net-Zero trajectory by the Science Based Targets initiative (SBTi), Pluxee also took an active part in international partnerships and conducted ESG assessments. The Group received

a bronze medal from EcoVadis based on the results of its first sustainability performance assessment, and joined

the United Nations Global Compact at the Group level as well as in Brazil and United Kingdom.

Pluxee has also continued to deliver on its ESG targets with focus on four areas:

- On business integrity and transparency, the Group made significant progress on its commitment to be a trusted partner with 99.6% of employees being trained in Responsible Business Conduct and acknowledging the Group’s Ethics Charter.

- The Group has also made progress promoting women in leadership positions, reaching 39.9% this year.

- Business volume reimbursed to small and medium enterprise merchants grew by +9% in comparison to last year, reaching 6.2 billion euros. This was made possible thanks to local partnerships and initiatives that helped integrate new and diverse merchants into the Group's network.

- In terms of environment, the Group expects to meet its carbon emission reduction objective within the planned timeframe. In Fiscal 2024, Pluxee decreased its Scope 1 & 2 carbon emissions by -11% compared to Fiscal 2023 and by -50% compared to a Fiscal 2017 baseline. Such reduction resulted from country-led initiatives such as optimizing office space and improving energy efficiency. Pluxee improved sourcing of renewable electricity by about +3,000bps reaching 56% in Fiscal 2024. Indirect carbon emissions relative to Scope 3, however, registered an exceptional increase in comparison to Fiscal 2023, explained by the impact of the Spin-off and rebranding efforts.

The Group is moving forward to identify complementary commitments and targets in preparation for CSRD alignment in Fiscal 2025.

1 Including -6 million euros of Bank overdrafts as of August 31, 2024

Upgraded Fiscal 2025 and 2026 financial objectivesDuring its Capital Markets Day, the Group set out medium-term

financial objectives focusing on delivering sustainable Organic revenue growth, improving Recurring EBITDA margin and maintaining strong Recurring cash conversion.

Based on the strong financial performance delivered in Fiscal 2024, Pluxee has revised its financial objectives upward for Fiscal 2025 and Fiscal 2026:

- Low double-digit Organic revenue growth confirmed for both Fiscal 2025 and 2026, based on a higher Fiscal 2024 revenue basis;

- +75bps Recurring EBITDA margin expansion expected in each of Fiscal 2025 and 2026, leading to delivery of the initial 3-year target of +250bps organic increase one year ahead of plan;

- Above 75% Recurring cash conversion on average over Fiscal 2024 to Fiscal 2026 compared to above 70% previously.

Fiscal 2025 and 2026 financial objectives include:

- a slight organic growth in Float revenue year on year, based on current forward curves, and driven by the expansion of the Float and the optimization of the Group's investments compensating for the expected evolution in interest rates;

- the synergies to be generated through the deployment of the partnership with Santander and the integration of Cobee; and

- the possible regulatory change in Italy with a potential 5% cap on merchant commissions for meal & food benefits in the private sector, noting that meal & food solutions in Italy contribute to less than 3% of the Group’s financial aggregates.

Significant events in Fiscal 2024Successful spin-off and listing on Euronext ParisOn February 1, 2024, Pluxee successfully completed

its spin-off and listing on Euronext Paris with a technical reference price of 26 euros per share. Pluxee's shares were distributed to Sodexo shareholders on a one-for-one basis. Bellon S.A. remains a committed long-term shareholder to Pluxee with approximately 42.8% of the outstanding ordinary shares and nearly 60.0% of the voting rights in the Company.

Refinancing and inaugural bond issueOn March 4, 2024, Pluxee successfully completed

the placing of two inaugural bonds for an aggregate amount of 1.1 billion euros, consisting of a 550 million euro bond issue with a 4.5-year maturity and a coupon of 3.50% and a 550 million euro bond issue with a 8.5-year maturity and a coupon of 3.75%. The net proceeds were used to repay the 1.1 billion euro portion drawn down from the bridge loan secured in October 2023 as part of the spin-off project.

Strengthened Executive CommitteeThe Group has strengthened its Executive Committee and enhanced its geographic governance to accelerate the execution of its strategic plan and the delivery of its objectives.

Alexandre Cotarmanac'h was appointed Chief Product Officer to drive further enhancement of the product offering globally.

Thierry Guihard, Managing Director of Pluxee Brazil, and Malena Gufflet, Managing Director of Pluxee France, joined the Executive Committee to ensure alignment and strategic decision-making in the Group's two largest markets.

Sébastien Godet, previously President of Asia, Middle East, Türkiye and Africa, was named Chief Revenue Growth Officer for Asia, Middle East, Africa and Continental Europe excluding France. Manuel Fernandez Amezaga, previously Managing Director of Romania and Bulgaria, was appointed Chief Revenue Growth Officer for Hispanic Latin America. Viktoria Otero del Val, Group Chief Strategy, Marketing and Sales Officer, was also appointed Chief Revenue Growth Officer for the UK and the U.S. All three Executive Committee members will support country teams in setting, enabling and tracking growth plans, and ensuring best in class execution.

Completion of the strategic partnership with Santander in BrazilIn July 2023, Pluxee signed a strategic partnership with Santander in Brazil, one of the largest private banks in the country, to reinforce Pluxee's market leadership in Brazil. The transaction was completed on June 27, 2024 following approval from the Administrative Council for Economic Defense (CADE) and the Central Bank of Brazil. This strategic partnership reinforces Pluxee's market positioning in Brazil through (i) a 25-year exclusive distribution agreement of Pluxee's Employee benefit solutions in the Santander network and (ii) the integration of Ben's business volume and expertise (Santander Brazil's Employee Benefits activity). It enables Pluxee to significantly enhance the distribution of its products through the wide national network of Santander agencies and bankers, creating synergies to capture market potential. Through this operation, Banco Santander (Brazil) S.A. now holds 20% of Pluxee Brazil, the Group subsidiary operating the Employee Benefits business in Brazil. The transaction is expected to positively contribute to Organic revenue growth and Recurring EBITDA margin from Fiscal 2025.

Acquisition of CobeeIn June 2024, Pluxee entered into an agreement to acquire 100% of Cobee, an Employee Benefits digital-native player operating in Spain, Portugal and Mexico, and serving more than 1,500 clients and 100,000 employee consumers with a broad multi-benefit offering. On September 26, 2024, the Group announced the successful completion of the acquisition, following the approval by Spanish regulatory authorities (see section Subsequent Events). The acquisition of Cobee strengthens Pluxee's position in the growing and under-penetrated Spanish Employee Benefits market. The combination of Pluxee and Cobee's respective talent pools, capabilities, and technology will create a complete, competitive, and attractive solution in Spain, Portugal, and Mexico, broadening the Group's existing benefit offering and enhancing its tech capabilities at global scale. The transaction is expected to be neutral in terms of Pluxee's Recurring EBITDA and Recurring free cash flow in Fiscal 2025 and accretive to Recurring EBITDA margin and Net income from Fiscal 2026.

Subsequent EventsCompletion of Cobee acquisitionOn September 25, 2024, the Group completed the 100% acquisition of Cobee after receiving clearance from the Spanish regulatory authorities. The majority of the transaction price was paid on the closing date, while the agreement also provides for two earn-outs, subject to the achievement of defined milestones that have been designed to align all stakeholders' interests and representing, if achieved, less than 50% of the fixed base price paid on the closing date. The acquisition will be fully funded from existing cash resources with limited impact on Group leverage.

Extension of the revolving credit facilityOn October 2, 2024, the Group obtained bank approval to extend the original maturity of the 650 million euro revolving credit facility by an additional year, for a new maturity date of October 2029.

Conference call for investors and analystsPluxee will hold a

conference call in English on October 31, 2024, at 8:30 a.m. CET to comment on its

Fiscal 2024 Results.

To connect:

- from France: +33 1 70 91 87 04; or

- from the UK: +44 121 281 8004; or

- from the U.S.: +1 718 705 8796,

followed by the access code 07 26 76.

The live audio webcast will be accessible on

www.pluxeegroup.com The press release, presentation and webcast are available on the Group website

www.pluxeegroup.com in the section "Investors – Financial results and publications".

Annual Report and Annual General MeetingPluxee filed its Fiscal 2024 Annual Report which includes the consolidated and company financial statements, the auditor's report and the responsibility statement of the Board of Directors for this report with the Dutch Authority for the Financial Markets (

Autoriteit Financiële Markten, “AFM”) and the French

Autorité des Marchés Financiers.

The Annual Report is available on the Group website www.pluxeegroup.com in the "Investors – Financial results and publications" section.

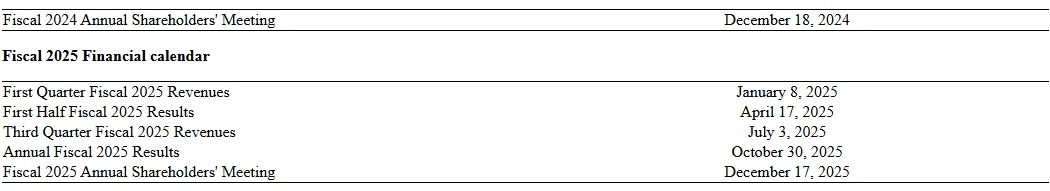

Pluxee will hold its Annual General Meeting in Amsterdam-Schiphol, the Netherlands on December 18, 2024. The convening notice, agenda and all related documents will be available at

https://www.pluxeegroup.com/shareholder-meeting by November 6, 2024.

Financial calendar

These dates are indicative and may be subject to change without notice.

Regular updates are available in the calendar on our website

www.pluxeegroup.com About PluxeePluxee is a global player in employee benefits and engagement that operates in 29

1 countries. Pluxee helps companies attract, engage, and retain talent thanks to a broad range of solutions across Meal & Food, Wellbeing, Lifestyle, Reward & Recognition, and Public Benefits. Powered by leading technology and more than 5,000 engaged team members, Pluxee acts as a trusted partner within a highly interconnected B2B2C ecosystem made up of more than 500,000 clients, 37 million+ consumers and 1.7 million+ merchants. Conducting business for more than 45 years, Pluxee is committed to creating a positive impact on local communities, supporting well being at work for employees and protecting the planet. For more information:

www.pluxeegroup.com.

Contacts

Media

Cecilia de Pierrebourg

+33 6 03 30 46 98

cecilia.depierrebourg@pluxeegroup.com

Analysts and Investors

Pauline Bireaud

+33 6 22 58 83 51

pauline.bireaud@pluxeegroup.com

1 As part of its portfolio rationalization efforts, Pluxee exited two non-core countries in Fiscal 2024.

Appendices

Total RevenuesClick hereForward-looking statementsThis press release contains forward-looking statements. These forward-looking statements reflect the Group's intentions, current beliefs, expectations and assumptions, including, without limitation, assumptions regarding the Group's future business strategies and the environment in which the Group operates, and involve known and unknown risks, uncertainties and other important factors beyond the Group's control, which may cause the Group's actual results, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include those discussed in Pluxee's Fiscal 2024 Annual Report, filed on October 31, 2024 with the Dutch Authority for the Financial Markets (

Autoriteit Financiële Markten, “AFM”) and the French

Autorité des Marchés Financiers, and available in the 'Investors – Financial Results and Publications' section of the Group website:

www.pluxeegroup.com. Accordingly, readers of this press release are cautioned on relying on these forward-looking statements. These forward-looking statements are made as of the date of this press release and Pluxee Group expressly disclaims any obligation or undertaking to release any updates or revisions to any forward-looking statements included in this press release to reflect any change in expectations or any change in events, conditions or circumstances on which these forward-looking statements are based.

DisclaimerThis press release does not contain or constitute an offer of securities for sale or an invitation or inducement to invest in securities in France, the United States, or any other jurisdiction.

Attachment• PR Pluxee Fiscal 2024 Results EN.pdfSource: Pluxee N.V.

--BERNAMA